I did a little research today, and I think Doc may

Post# of 87963

Here is my logic:

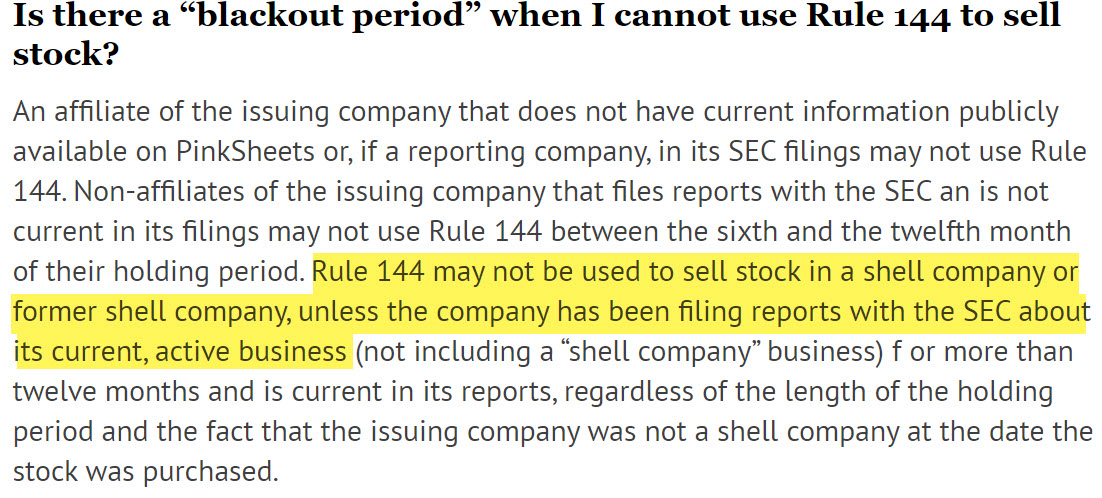

1) "Rule 144 may not be used to sell stock in a shell company."

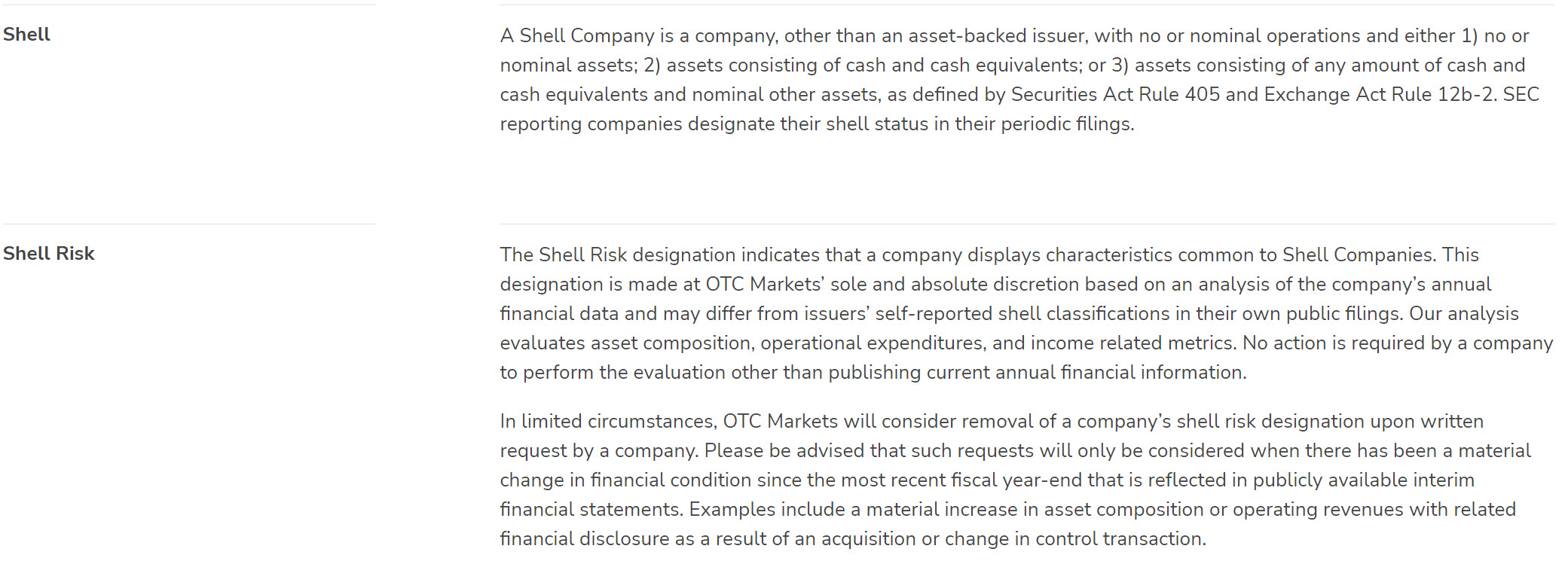

2) OTC defines a shell company as "a company...with no or nominal operations and ...no or nominal assets."

This describes UNVC as we currently know it (Doc may have already rolled in the companies and is about to release that information with the Q3 financials imminently, but we do not know for sure...so just going by what is publicly available at this moment). Furthermore, OTC labels us as a "Shell Risk", so if an affiliate (someone who owns more than 10% of the company) is selling over a million dollars with of stock (at current PPS), you can bet the SEC will take notice.

IMHO, Doc is required to wait until the companies are rolled in to sell those nearly 23 million shares indicated on Form 144 from last week.

(23)

(23) (0)

(0)