Home prices may 'see big declines in coming years,

Post# of 128767

Despite four straight months of record-breaking increases, home prices could end up reversing course in the next few years, according to one expert.

“There is a chance that we will see big declines in coming years,” Yale Professor of Economics Robert J. Shiller said on Yahoo Finance Live. “I think people are anxious about that at this point in history.”

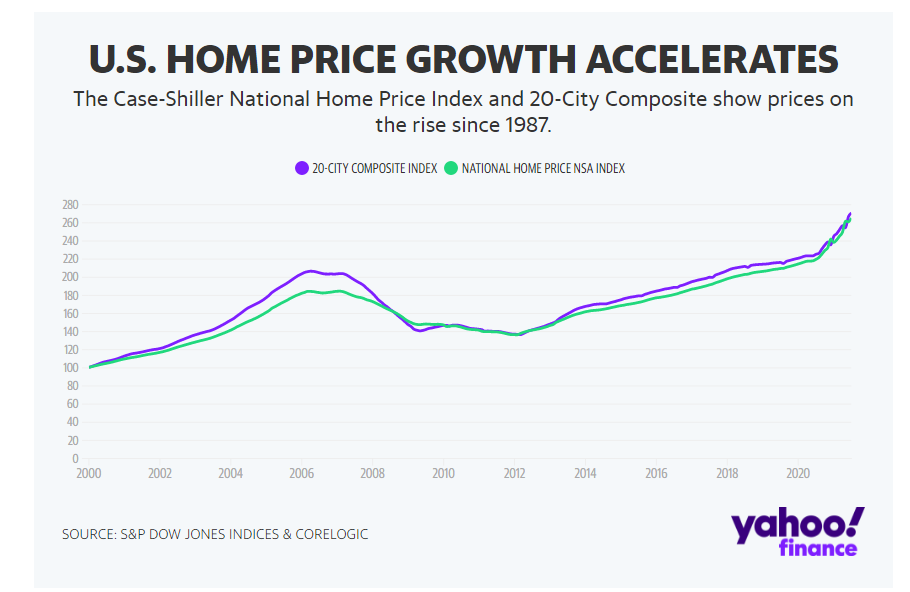

In July, housing values jumped 19.7% year over year, up from 18.7% in June and the fourth month in a row setting record high growth, according to the S&P CoreLogic Case-Shiller national home price index. The 20-City Composite grew 19.9% in July, up from 19.1% a month earlier and just shy of analysts’ expectations of a 20% annual gain, according to Bloomberg consensus estimates.

"It's surprising the timing of this," Shiller said. "It came starting in a recession. We're supposed to be depressed and yet we seem to be exuberant in the market."

The three drivers of home prices

Shiller keyed on several factors driving the recent surge in home prices. First, mortgage rates are near historic lows and have been during the span of the pandemic.

Most recently, the rate on the 30-year fixed mortgage — the most common among homebuyers — was 2.88% last week, according to Freddie Mac. The rate hit an all-time low of 2.65% in January of this year.

"It is partly due to low interest rates, of course, and Fed policy," he said. "But it's so pervasive ... I think it has something do with our psychology at this point in history, maybe emerging from a COVID-19 pandemic."

He noted that many people may be feeling frustrated during the pandemic, forced to work and learn from home, and buying a house is akin to taking action.

"We want to do something," he said. "So that seems to be 'let's upgrade our house.'"

Last, Shiller said that FOMO — or fear of missing out — could be behind many decisions by homebuyers to jump in the market as they watch anxiously as prices accelerate.

"And so, eventually, people cave in and buy and that's what drives it," he said. "It's an unstable situation."

Source:

https://www.aol.com/finance/home-prices-see-b...57569.html

(1)

(1) (0)

(0)