Introduction to Aben Resources ...................

Post# of 1088

Aben Resources Ltd. is a publicly traded Canadian GOLD exploration company with significant projects in BRITISH COLUMBIA and the YUKON TERRITORY.

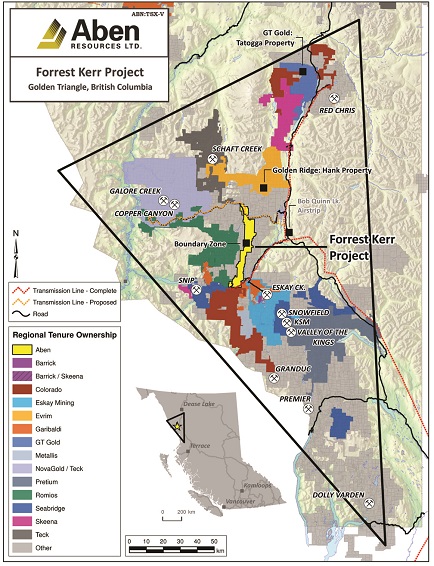

The Company's 100% owned flagship 23,000 hectares FORREST KERR GOLD PROJECT is located in the heart of a region called the GOLDEN TRIANGLE in northwestern British Columbia. This region has hosted significant mineral deposits including: Pretium (Brucejack), Eskay Creek, Snip, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc, Red Chris and more.

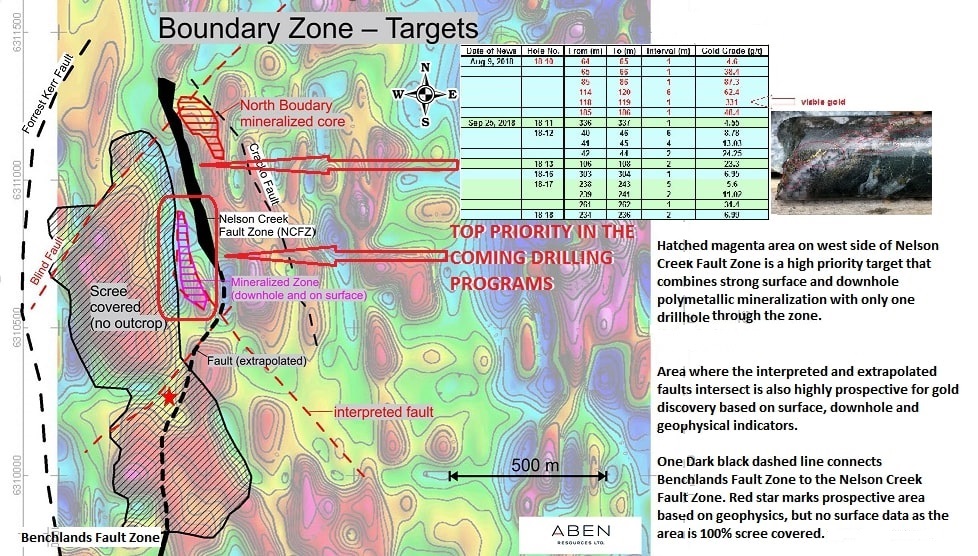

The first drill hole of 2018 at the Forrest Kerr Project discovered multiple high-grade zones including 62.4 g/t Gold over 6.0 meters within 38.7 g/t Gold over 10.0 meters starting at 114 meters downhole at the North Boundary Zone.

Aben also holds a 100% interest in the 7,411 hectares JUSTIN GOLD PROJECT located in the southeast Yukon. The Justin property is located on the Tintina Gold Belt to the immediate southeast of Golden Predator's 3 Aces gold project. Previous drilling by Aben intercepted 60 meters of 1.19 g/t Gold including 21 meters of 2.47 g/t Gold in the POW Zone. The geochemical signature of the mineralized zone is characterized by elevated Au, Bi, Cu, Mo and W supporting an Intrusion Related Gold System (IRGS).

Recent exploration at the Justin Project discovered the Lost Ace Zone located within 2 km of the POW Zone and bears striking similarities to Golden Predators adjacent 3 Aces project. 2018 trenching at the Lost Ace Zone returned values ranging from trace to 20.8 g/t Gold over 4.4 meters including 88.2 g/t Gold over 1.0 meter. Lost Ace is interpreted to be orogenic-style quartz-gold veins pointing towards the existence of a multi-phase hydrothermal system with the potential for overprinting mineralizing with the POW Zone.

===============

Stock Information

===============

Share Outstanding: 128 million

Ticker Symbols

TSX Venture, Canada: ABN.V

United States of America: OTCQB Market: ABNAF

Frankfurt Exchange, Germany: E2L2

==================

Outstanding Shares

==================

Click for enlarged view

https://investorshangout.com/images/MYImages/...1,2021.gif

March 1, 2021- Management Discussion and Analysis for Calendar Q4, 2020

https://sedar.com/GetFile.do?lang=EN&docC...Id=4898750

===========

Recent News

===========

November 24, 2020

Aben Resources to Extend Term of Share Purchase Warrants

https://www.abenresources.com/news/aben-resou...-warrants/

October 30, 2020

Aben Resources Provides Results and Summary of 2020 Drill Program at the Forrest Kerr Gold Project in BC’s Golden Triangle

https://www.abenresources.com/news/aben-resou...-triangle/

August 21, 2020

Eric Sprott Clarifies Holdings in Aben Resources Ltd.

https://www.newsfilecorp.com/release/62323/Er...on%20share.

https://sedar.com/GetFile.do?lang=EN&docC...Id=4764154

=================================

Financial filing and official news release

=================================

https://sedar.com/DisplayCompanyDocuments.do?...o=00005652

=====================

Website and Presentation

=====================

Company website and Corporate Presentation

https://www.abenresources.com/

========================================================

Video presentation - Golden Triangle and Forrest Kerr mining property

========================================================

Introduction to The Golden Triangle of British Columbia

https://www.youtube.com/watch?v=rBY6t3FHu7I

Overview of Aben's Forrest Kerr property

https://www.youtube.com/watch?v=egG5OWpTq0s

Aben Resources - gold contents in drill cores

https://www.youtube.com/watch?v=rUuDeaYt5ew

Gold resources in Aben's neighbors

https://www.youtube.com/watch?v=eQpWgPJKln0&a...e=youtu.be

=========================

Mining properties Information

=========================

Justin Property, Yukon

https://www.abenresources.com/projects/justin/

Flagship Forrest Kerr property in the Golden Triangle of British Columbia

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

=====================================

Track record of past and current explorations

=====================================

Forrest Kerr is a pristine territory with many unexplored area, Aben will likely encounter Measured and Indicated Resources leading to Proven and Probable Reserves. Gold producers are eagerly looking for properties with Proven Reserves to replenish their dwindling mineral reserves, when bonanza gold deposits are discovered in Forrest Kerr the company will be sold for $$ a share.

5 gold/copper mines (Eskay Creek mine, Snip mine, Burns Block mine and Copper Canyon mine in the Golden Triangle, Gualcamay mine in Argentina) were discovered by the 3 experienced, subtle and strategic geologists affiliated with Aben Resources with the corresponding companies sold to other mining companies.

CEO James Pettit sold Bayfield Ventures to New Gold Inc.

https://m.marketscreener.com/quote/stock/BAYF...-19365314/

Geologists:

Ron Netolitzky

https://www.mininghalloffame.ca/ronald-k-netolitzky

Timothy Termuende sold Copper Canyon Resources to NovaGold Resources

https://www.northernminer.com/news/copper-can...000404723/

Cornell McDowell

Interview with Aben VP Exploration Cornell McDowell at Forrest Kerr, Golden Triangle, BC, Gold Project

https://www.facebook.com/abenresources/videos...392516340/

=============================================

Media commentary and interview with CEO James Pettit

=============================================

Equity.Guru video: Aben Resources' (ABN.V) golden triangle opportunity explained by Fabiana Lara

https://www.youtube.com/watch?v=-Mj2R4jvb0A

2018 - Silver and Gold Summit - High grade gold and copper discovery in Forrest Kerr

https://cambridgehouse.com/video/8213/highgra...ources-ltd

2019 - Massive gold nuggets found in outcrop of Aben's Justin property in Yukon

https://www.youtube.com/watch?v=13goOuptl_w

2020 - CEO James Pettit's update on the company's exploration and drilling in Forrest Kerr

https://www.facebook.com/abenresources/videos...326774690/

==========

Media News

==========

The Resource Maven on Aben Resources

http://www.321gold.com/editorials/preston/preston111418.html

https://www.miningfeeds.com/2018/11/07/aben-r...le-winner/

https://investingnews.com/company-profiles/ab...-triangle/

https://www.miningnewsnorth.com/story/2018/10.../5372.html

http://energyandgold.com/2018/05/08/aben-reso...-triangle/

https://www.investorideas.com/news/2019/main/...ources.asp

=============================

Aben Resources in the social media

=============================

https://ca.linkedin.com/company/aben-resources-tsx-v-abn-

https://twitter.com/Aben_ABN/

======================

Insider Trading Information

======================

Canadian Insider

https://www.canadianinsider.com/company?ticker=ABN

How Many Aben Resources Ltd. (CVE:ABN) Shares Did Insiders Buy, In The Last Year?

https://simplywall.st/stocks/ca/materials/tsx...-last-year

==================================================================

Aben Resources - The potential of bonanza precious metal and base metal discovery

==================================================================

Great Bear Resources's long intervals of high grade gold is contributed by bonanza gold deposits along the LP fault zone in its Dixie property in Red Lake, Ontario.

https://greatbearresources.ca/news/great-bear...-step-out/

GBR.V weekly chart

https://stockcharts.com/h-sc/ui?s=GBR.V&p...5415822585

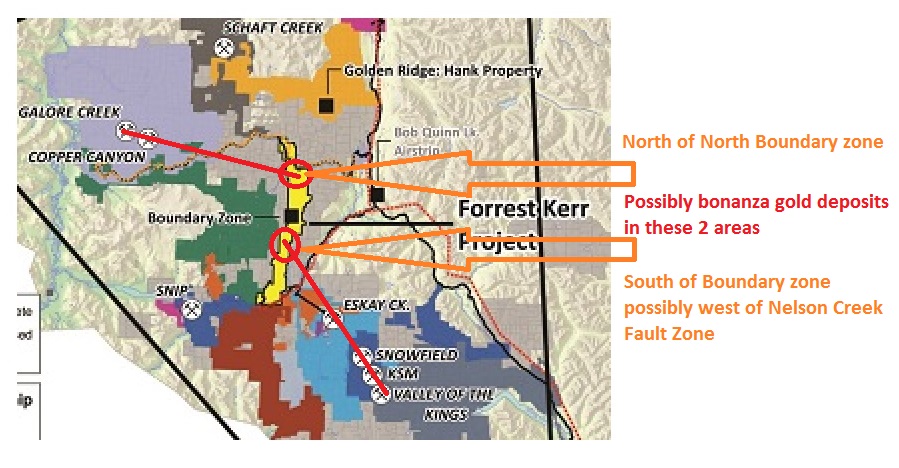

What do Aben Resources and Great Bear Resources have in common? They both have fault lines in their property where most of massive gold deposits are found. Aben has even longer fault lines which traverse the entire property of Forrest Kerr in the North-South direction. CEO James Pettit likes Forrest Kerr because of presence of the fault lines. The moderately long intervals of high grade gold in the North Boundary Zone is a sign of existence of bonanza gold deposits somewhere in Forrest Kerr. Being in between the Eskay Creek mine and Snip mine, the prospect of bonanza gold deposits in Forrest Kerr is very promising due to similar geology in the area. Constructive share price chart pattern stands out among its peers, reflecting investors' strong confidence in the company's bonanza gold discovery as some experienced investors are super keen in their clairvoyance, they believe bonanza gold deposits are there just as in the neighboring mines, it is only a matter of time the geologists will find them. North Boundary zone hosts high grade gold, the South Boundary zone hosts massive tonnage of average grade gold, but coming drilling programs could lead to a gold vein with massive long intervals of high grade gold too as the geology of the area is similar to that of Eskay Creek to the southeast.

A famous idiom states that Rome is not built in one day, it took early explorers in Eskay Creek 50 years to trace the sporadic high grade gold to its source - a massive gold vein. Backward mining technology and arduous exploration conditions in lack of basic infrastructure like roads and power line culminated hiatus in exploration leading to a lengthy period of discovery.

History of Eskay Creek mine, the world's massive high grade gold mine

In 1932 a prospector named Tom Mackay of Consolidated Stikine Resources was the first to recognize the area's unique geological setting after spotting an alluring rock outcrop from his single-engine bush plane. After staking the property he discovered a boulder broken free from its source higher up on the mountain, rolling several dozen meters downslope, assays from the boulder returned a spectacular five ounces of gold per tonne. Mackay explored the property for over 50 years but bonanza gold deposit was never found. In 1988 after investing in Consolidated Stikine Resources which held rights to Eskay Creek, geologist Ron Netolitzky became Stikine’s technical person and one of five controlling shareholders. He teamed up with Murray Pezim of Calpine Resources to raise $900,000 for a drill program and started exploring the area in the summer of 1990. After drilling 108 holes and with momentum building, they hit a fault. Chet Idziszek, Pezim’s geologist with a M.Sc. degree from McGill University observed gradually increasing gold grade and increasing interval length in the assays, he had an intuition that he must be very close to the main gold vein, he studied the maps and analysed the terrain then he ragged the drill rig to a spot 350 meters from the last hole drilled and drilled hole #109. Bingo, assays from hole 109 returned spectacular 27.2 g/t gold, 30.2 g/t silver over 208 meters (682 feet). In 1994 Eskay Creek went into production that lasted 14 years, finally ended in 2008. Eskay Creek had the highest grade gold on the planet and produced 3.3 million ounces of gold at a breathtaking 45 g/t Au, also 160 million ounces of silver at 2,224 g/t. Stikine Resources was acquired by Placer Dome and International Corona for $67 per share. Ron Netolitzky has had a very successful career in mining and mineral exploration with decades of experience and having been directly associated with three major mineral discoveries in Canada that have subsequently been put into production: Eskay Creek, Snip and Brewery Creek. Ron Netolitzky was inducted into the Canadian Mining Hall of Fame in 2014.

Several gold mines lining up in the Eskay Creek area because fault line occurs in a straight line underground and can run for hundreds or thousands of meters. Corroborated by James Pettit's encouraging intuition that the area west of the Nelson Creek Fault Zone and the area north of the North Boundary Zone are top priority drilling targets, possible locations of bonanza gold deposits in Forrest Kerr through extrapolation is as follow:

For enlarged view

https://investorshangout.com/images/MYImages/...posits.jpg

======================================

Drilling targets in the coming drilling programs

======================================

Page 17 of Presentation

Click for enlarged view

https://investorshangout.com/images/MYImages/...argets.jpg

==================

Outlook for gold price

==================

https://youtu.be/d0ZBpZV4EIs

https://www.youtube.com/watch?v=l8RauDwklyY

====================================

Outlook for commodiities prices and inflation

====================================

Continuous economic stimulus and weak US Dollar are needed amid weak economic growth. Strong bond prices reflects that interest rate will remain low. The US Dollar Index will likely decline to level 80 in the coming months followed by a side way consolidation. Gold and mining stocks will strive as the economy improves with rising inflation expectation.

US Dollar Index is in a long term down trend towards level 80, commodities prices are inversely related to the strength of U.S. Dollar

https://bigcharts.marketwatch.com/advchart/fr...60&y=5

Organization for Economic Co-operation and Development - Inflation forecast 2021 - 2022

https://data.oecd.org/price/inflation-forecast.htm

Goldman Sach - The outlook for commodities bull market in 2021

https://www.youtube.com/watch?v=y9yuyAAn5Dc

Potential supercycle bodes well for precious metals in 2021, says analyst

https://www.cnbc.com/video/2020/12/18/potenti...alyst.html

Economic boom in China will lead to another commodities supercycle similar to that between the year 2000 to 2008.

https://www.theguardian.com/business/2021/jan...supercycle

Here's Why Commodities are Worth Investing in Right Now

https://www.nasdaq.com/articles/heres-why-com...2021-01-19

Scotiabank’s Marc Desormeaux looks at 2021 and the continuing impact of Covid-19 on metals markets

https://www.northernminer.com/commodities-mar...003825843/

Personal Blog

Just as share consolidation happens when outstanding share becomes too diluted, coming currency consolidation is inevitable as stream of paper money or digital currency floods the financial market around the world. During the Great Depression of 1930's in China, inflation was so rampant that prices changed by the week than by the day then by the hour, 300 old Yuan was replaced by a New Yuan, but shortly afterward, 200 former New Yuan was replaced by another New Yuan, forcing majority of the population into poverty except those who bought gold which is a good inflation hedger as gold price in Yuan skyrocketed. With American national debt over 106% GDP and rising and with continuous currency dilution, it will be alarming to look towards the future. One can imagine the only solution for the government is to inflate itself out of debt then what happened in China will happen in America. Global mounting debts is a time bomb waiting to set off with apocalyptic consequence. Gold and potential mining stocks will be the only safe haven in time of financial crisis and economic uncertainty, those not preparing for the inevitable will be forced into poverty as they struggle to survive amid erosion of purchasing power of paper money.

The economic boom of past 100 years was fueled by continuous emergence of new technology and new innovative products amid strong demands from the world's "have not", but those "have not" not only are well-fed and well dressed, they have become sellers, vying with the world's biggest economy. Nature is cyclical: Big economic cycle enveloping small economic cycles is the law of the Universe, the 100 year economic boom will not go on forever, another prolonged economic depression is inevitable. Amid global economic and technological saturation and trade war, aggravated by the Pandemic, the global economies are struggling without upward wage pressure, may be the world is already in an economic depression. We are living in the similar situation as in the 1930's but with less severity and austerity because in the 1930's there were less than 100 big American public companies having revenue under $1/2 billion except 7 companies in the oil, automobile and steel industry with revenue between $1 billion and $1.5 billion supported by 121 million American customers. Dow Jones Industrial Average peaked out at 5,726 in 1929 before market crash. Now there are over 17 million American companies with the top 500 biggest companies having revenue between $5 billion and $600 billion supported by 328 million American customers while global customers had increased from 2 billion in 1929 to current 7.8 billion. Economic diversification has resulted in security and stability and prevented the 1930's style economic Great Depression. But In an economic slump, the only economic stimulus is printing money which is inflationary. With astronomical amount of currency dilution globally and domestically chasing finite natural resources amid increasing demands for natural resources from astronomical number of industries, do expect skyrocketing and sustainable high commodities prices in the years ahead with the ramification of runaway inflation.

Gold, the first financial commodity ever traded in human history will be the last financial security and safe haven the world will be seeking for.

The Rush is on, in the apocalypse when paper money becomes worthless, any mining company with big proven gold reserves may see its share price emulating that of bitcoin, potential mining stocks will be a safe haven in time of runaway inflation. When the baseless bitcoin price bubble bursts, money will flow out of bitcoin into gold, sending gold price to the stratosphere.

========================

M1 money supply (in millions)

========================

US (currently at 6.7 trillion US Dollar)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

CANADA (currently at 1.4 trillion Canadian Dollar)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

CHINA (currently at 62 trillion Yuan)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

Germany (currently at 2.6 trillion Euro)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

France (currently at 1.7 trillion Euro)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

UK (currently at 2.1 trillion Pound Sterling - GBP)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

BRAZIL (currently at 580 billion Brazilian Real - BRL)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

Russia (currently at 31 trillion Russian Ruble - RUB)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

INDIA (currently at 43 trillion Indian Rupee - INR)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

South Africa (currently at 2.1 trillion South Africa Rand - ZAR)

https://d3fy651gv2fhd3.cloudfront.net/charts/...1=19210323

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Commodities prices are surging, global inflation rate will soon rise. It will take a few months for inflationary pressure to propagate from deliveries of commodities through manufacturing of products and through distribution of products to the consumer level then manifesting in consumer price index and inflation figure. The long term commodities price charts reveal a going-up-stair pattern: Every 30 years prices surge up one step, culminated by 30 years' accumulated inflation which is driven by increasing money supply amid increasing population. Global debts are mounting, eventually as world governments chose the last resort of inflating itself out of debt, exponential increase in money supply will trigger a global runaway inflation, those not prepared for the inevitable will be forced into poverty amid constant erosion of purchasing power of paper money. Commodities prices are responding to global currency dilution, expect sustainable high commodities prices in the years ahead.

Lumber price

https://mrci.com/pdf/lb.pdf

Soybean

https://mrci.com/pdf/s.pdf

Soybean meal

https://www.mrci.com/pdf/sm.pdf

Corn

https://www.mrci.com/pdf/c.pdf

Canola

https://www.mrci.com/pdf/rs.pdf

Sugar

https://mrci.com/pdf/sb.pdf

Wheat

https://mrci.com/pdf/w.pdf

Crude oil

https://mrci.com/pdf/cl.pdf

Palladium

https://www.mrci.com/pdf/pa.pdf

https://www.bbc.com/news/business-51171391#:~...ime%20soon

Gold

https://mrci.com/pdf/gc.pdf

Silver

https://mrci.com/pdf/si.pdf

Copper

https://www.mrci.com/pdf/hg.pdf

============================================

Price chart for Gold, Silver, Copper, XAU Mining Index

============================================

Gold Price

https://stockcharts.com/h-sc/ui?s=%24GOLD&...9325303251

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=%24SILVER&a...5832796445

https://mrci.com/pdf/si.pdf

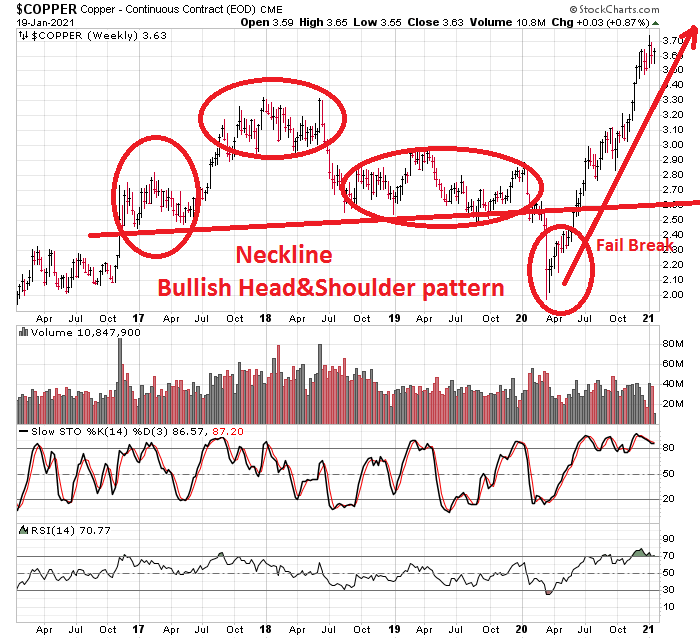

Copper Price

https://stockcharts.com/h-sc/ui?s=%24COPPER&a...7009666446

https://www.mrci.com/pdf/hg.pdf

XAU Mining Index

https://stockcharts.com/h-sc/ui?s=%24XAU&...0985509425

XAU mining stock Index monthly chart (The 15-year Head-And-Shoulder pattern formed between year 2000 and 2015 signals a prolonged up trend in mining stocks to possibly new record high)

https://bigcharts.marketwatch.com/advchart/fr...62&y=4

Global mining stock Index

https://stockcharts.com/h-sc/ui?s=%24SPTGM&am...5126536165

ABN.V

https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

==========================================================

Mining companies operating in the Golden Triangle of British Columbia

==========================================================

Aben Resources is a new comer to the Golden Triangle while most of the explorers have been

operating there for decades, delineating their resources and reserves to enhance shareholder

value. CEO James Pettit optioned Forrest Kerr in 2016, in the subsequent 3 years he drilled

and incurred exploration expenses to meet the option agreement, completed the Earn-In in

November 2019 and now owns 100% of Forrest Kerr property.

Mining explorers operating in the prolific Golden Triangle of British Columbia and their share

price as of Friday, February 26, 2021:

1 RG Romios Gold Resources $0.045

https://stockcharts.com/h-sc/ui?s=RG.V&p=...3258189645

2 ABN Aben Resources $0.070

https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

3 DEC Decade Resources $0.070

https://stockcharts.com/h-sc/ui?s=DEC.V&p...1633995508

4 MRO Millrock Resources Inc. $0.090

https://stockcharts.com/h-sc/ui?s=MRO.V&p...6836544963

5 SKYG Sky Gold Corp $0.140

https://stockcharts.com/h-sc/ui?s=SKYG.V&...4081325604

6 ENDR Enduro Metals Corporation $0.180

https://stockcharts.com/h-sc/ui?s=ENDR.V&...0889726269

7 AMK American Creek Resources Ltd $0.320

https://stockcharts.com/h-sc/ui?s=AMK.V&p...4902895968

8 BBB Brixton Metals Corporation $0.250

https://stockcharts.com/h-sc/ui?s=BBB.V&p...4146375562

9 EVER Evergold Corp $0.230

https://stockcharts.com/h-sc/ui?s=EVER.V&...9306455150

10 MTS Metallis Resources $0.380

https://stockcharts.com/h-sc/ui?s=MTS.V&p...3708570676

11 MTB Mountain Boy Minerals $0.190

https://stockcharts.com/h-sc/ui?s=MTB.V&p...5090334703

12 GGI Garibaldi Resources Corp $0.470

https://stockcharts.com/h-sc/ui?s=GGI.V&p...6339012581

13 QEX QuestEx Gold & Copper Ltd $0.570

https://stockcharts.com/h-sc/ui?s=CXO.V&p...3543151089

14 DV Dolly Varden Silver Corp $0.740

https://stockcharts.com/h-sc/ui?s=DV.V&p=...0211663558

15 BNCH Benchmark Metals Inc. $1.050

https://stockcharts.com/h-sc/ui?s=BNCH.V&...8185217032

16 AOT.TO Ascot Resources Ltd. $1.080

https://stockcharts.com/h-sc/ui?s=AOT.TO&...1773813526

17 ESK Eskay Mining Corp $2.410

https://stockcharts.com/h-sc/ui?s=ESK.V&p...2221768177

18 TUD Tudor Gold Corp $2.990

https://stockcharts.com/h-sc/ui?s=TUD.V&p...7186783346

19 GTT GT Gold Corp $2.250

https://stockcharts.com/h-sc/ui?s=GTT.V&p...1772760930

20 TUO Teuton Resources Corp $2.780

https://stockcharts.com/h-sc/ui?s=TUO.V&p...1926720407

21 SKE.TO Skeena Resources Ltd. $3.150

https://stockcharts.com/h-sc/ui?s=SKE.TO&...2377942100

22 III.TO Imperial Metals Corp $4.630

https://stockcharts.com/h-sc/ui?s=III.TO&...2125642263

23 PVG.TO Pretium Resources Inc. $12.520

https://stockcharts.com/h-sc/ui?s=PVG.TO&...0112557228

24 ELD.TO Eldorado Gold Corp $13.360

https://stockcharts.com/h-sc/ui?s=ELD.TO&...0529029750

25 SEA.TO Seabridge Gold Inc. $21.700

https://stockcharts.com/h-sc/ui?s=SEA.TO&...9592454206

https://www.seabridgegold.com/company/overview

Due to lack of basic infrastructure like power line and accessible roads, exploration and discoveries have been arduous in the Golden Triangle in the past decades, it took Seabridge Gold 41 years to achieve its current mineral reserves and resources since its formation in 1979. Thanks to Imperial Metals, its desire to construct a copper mine at Red Chris prompted the government to construct highway and roads and install power line through the Golden Triangle since 2012, with the basic infrastructure in place and with the progress in modern day mineral detection technology, potential rapid discovery of bonanza gold deposits in the Forrest Kerr fault zone and accurate resources estimate through 3-D imaging can be achieved.

=====================

Share price weekly charts

=====================

Canadian Venture Exchange: ABN.V (in Canadian Dollar)

https://stockcharts.com/h-sc/ui?s=ABN.V&p...3381419340

America OTCQB:ABNAF (in US Dollar)

https://stockcharts.com/h-sc/ui?s=ABNAF&p...5868384830

Germany Frankfurt Exchange: E2L2 (in € Euro)

https://bigcharts.marketwatch.com/advchart/fr...p;state=10

===============

Chart Technicality

===============

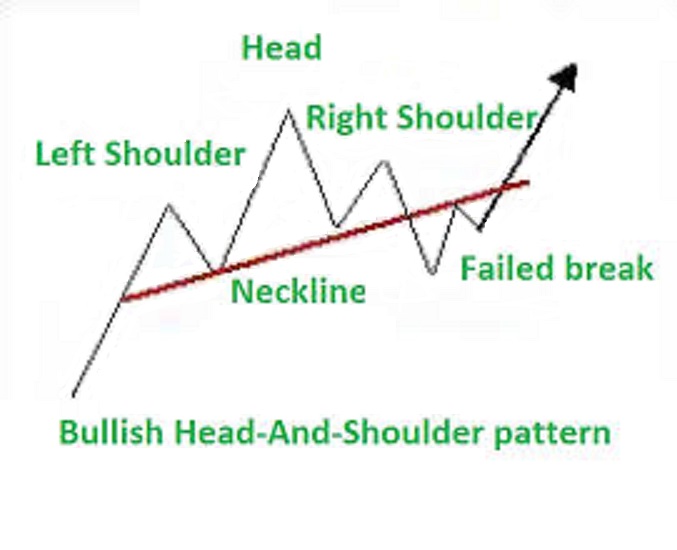

Chart is not only a historical record, quite often it can predict the future, it is an important trading tool, no investor can be successful without referring to charts. Trading without charts is like an airplane pilot flying without any navigation instrument but only by hunch and guessing, chances are he will end up in crash-and-burn. Head-And-Shoulder is a natural chart formation in Nature, it is the most liable and predictable chart pattern among all chart formations.

Bullish and bearish Head-And-Shoulder patterns

https://encrypted-tbn0.gstatic.com/images?q=t...p;usqp=CAU

Bullish Head-And-Shoulder pattern - fail break pattern

Bullish Head-And-Shoulder pattern in copper

Bullish Head-And-Shoulder pattern in XAU mining index

Future scenario

Click for enlarged view

https://investorshangout.com/images/MYImages/...M-SOLD.gif

Counter down

Click for enlarged view

https://investorshangout.com/images/MYImages/...04_ABN.jpg

===================================

Testament for the Golden Triangle potential

===================================

In the year 2000 I scanned long term weekly charts of some 1,000 mining stock charts in my search for mining companies with promising future as I believe in charts. One chart with a bullish Head-And_Shoulder pattern immediately caught my special interest, upon doing research I found out that mining company had 6 billion pound of commercially viable copper resources in its Red Chris project in the Golden Triangle of British Columbia, so I bought 200,000 shares of American Bullion Minerals at 5 cents for long term investment. In the year 2011 the company was bought out by Imperial Metals at $2 a share, the sale offered me an early retirement. Recently I again scanned some 1,000 mining stock charts and again one chart stood out among others like a star shining brightly among dark matters of the Universe and has the potential of exploding into a supernova. I have strong confidence that lightning will strike twice for me. It is truism that one picture is worth a thousand words.

Red Chris Mine (at the top right corner of the Golden Triangle)

https://investorshangout.com/images/MYImages/...ABNmap.jpg

==================================

Aben Resources - Potential gold resources

==================================

The significance of long intervals of consistent low grade gold

https://investorshangout.com/images/MYImages/...degold.jpg

https://youtu.be/hFVxJI6PQJI

(0)

(0) (0)

(0)