Introduction to Aben Resources ...................

Post# of 1088

===============

Stock Information

===============

Share Outstanding: 128 million

Ticker Symbols

TSX Venture, Canada: ABN.V

United States of America: OTCQB Market: ABNAF

Frankfurt Exchange, Germany: E2L2

==================

Outstanding Warrants

==================

Click for enlarged view

https://investorshangout.com/images/MYImages/...rrants.gif

===========

Recent News

===========

November 24, 2020

Aben Resources to Extend Term of Share Purchase Warrants

https://www.abenresources.com/news/aben-resou...-warrants/

October 30, 2020

Aben Resources Provides Results and Summary of 2020 Drill Program at the Forrest Kerr Gold Project in BC’s Golden Triangle

https://www.abenresources.com/news/aben-resou...-triangle/

August 21, 2020

Eric Sprott Clarifies Holdings in Aben Resources Ltd.

https://www.newsfilecorp.com/release/62323/Er...on%20share.

https://sedar.com/GetFile.do?lang=EN&docC...Id=4764154

=================================

Financial filing and official news release

=================================

https://sedar.com/DisplayCompanyDocuments.do?...o=00005652

=====================

Website and Presentation

=====================

Aben Resources company website

https://www.abenresources.com/

Presentation (Check for new Update each month in the company website above)

https://www.abenresources.com/site/assets/fil...b_2021.pdf

========================================================

Video presentation - Golden Triangle and Forrest Kerr mining property

========================================================

The Golden Triangle of British Columbia

https://www.youtube.com/watch?v=rBY6t3FHu7I

July 15, 2016

https://www.youtube.com/watch?v=egG5OWpTq0s

Aug 10, 2018

https://www.youtube.com/watch?v=rUuDeaYt5ew

Aug 20, 2018

https://www.youtube.com/watch?v=eQpWgPJKln0&a...e=youtu.be

=========================

Mining properties Information

=========================

Justin Property, Yukon

https://www.abenresources.com/projects/justin/

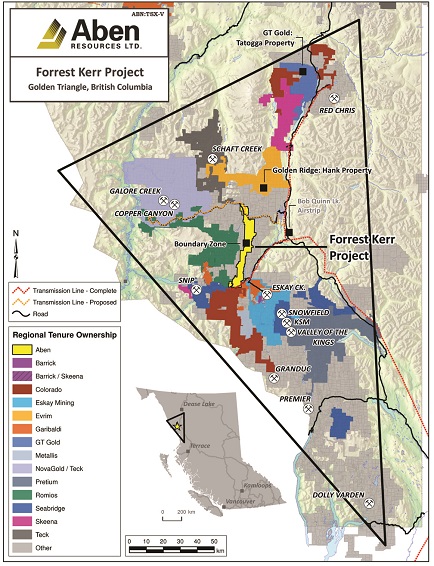

Flagship Forrest Kerr property in the Golden Triangle of British Columbia

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

=====================================

Track record of past and current explorations

=====================================

Forrest Kerr is a pristine territory with many unexplored area, Aben will likely encounter Measured and Indicated Resources leading to Proven and Probable Reserves. Gold producers are eagerly looking for properties with Proven Reserves to replenish their dwindling mineral reserves, when a gold mine is discovered in Forrest Kerr the company will be sold for $$ a share.

5 gold/copper mines (Eskay Creek mine, Snip mine, Burns Block mine and Copper Canyon mine in the Golden Triangle, Gualcamay mine in Argentina) were discovered by the 3 experienced, subtle and strategic geologists affiliated with Aben Resources with the corresponding companies sold to other mining companies.

CEO James Pettit sold Bayfield Ventures to New Gold Inc.

https://m.marketscreener.com/quote/stock/BAYF...-19365314/

Geologists:

Ron Netolitzky

https://www.mininghalloffame.ca/ronald-k-netolitzky

Timothy Termuende sold Copper Canyon Resources to NovaGold Resources

https://www.northernminer.com/news/copper-can...000404723/

Cornell McDowell

Interview with Aben VP Exploration Cornell McDowell at Forrest Kerr, Golden Triangle, BC, Gold Project

https://www.facebook.com/abenresources/videos...392516340/

=======================================================

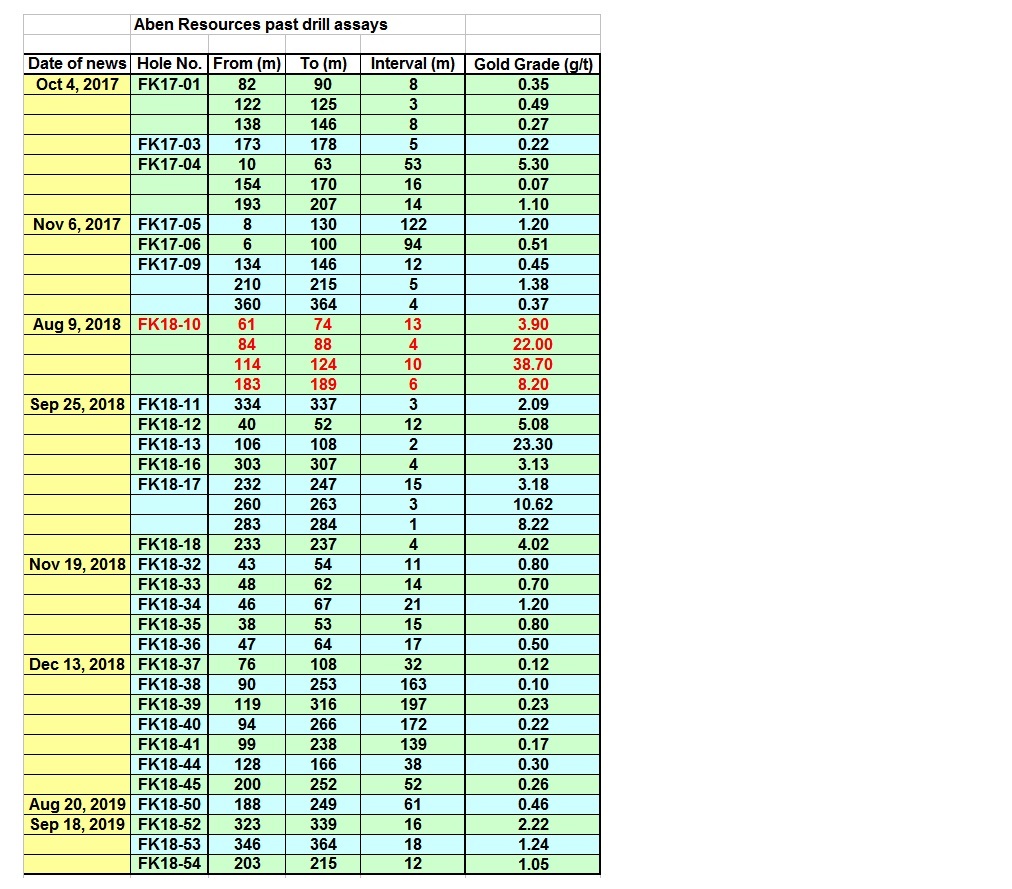

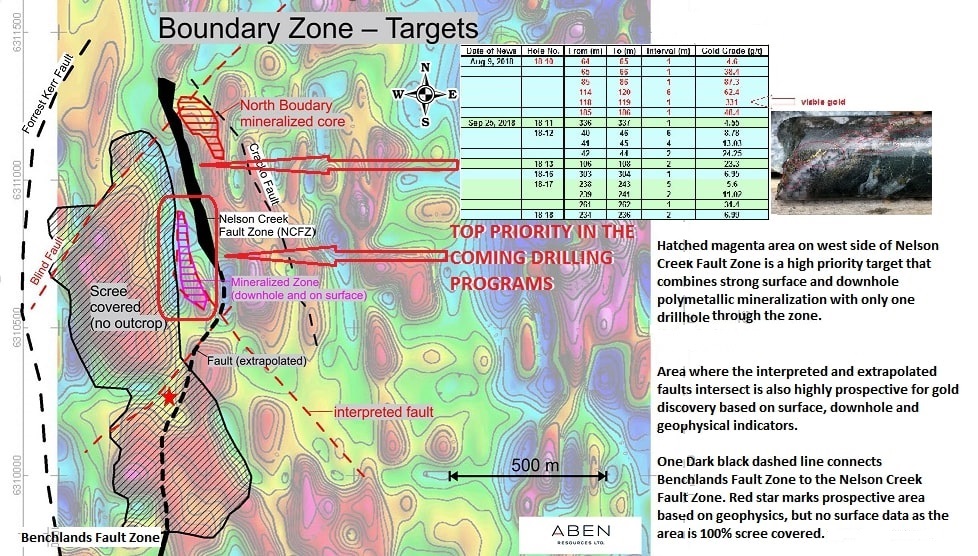

Aben Resources's Forrest Kerr drill core assays in the Boundary zone

=======================================================

Click for enlarged view

https://investorshangout.com/images/MYImages/...assays.jpg

=============================================

Media commentary and interview with CEO James Pettit

=============================================

Equity.Guru video: Aben Resources' (ABN.V) golden triangle opportunity explained by Fabiana Lara

https://www.youtube.com/watch?v=-Mj2R4jvb0A

2018 - Silver and Gold Summit - High grade gold and copper discovery in Forrest Kerr

https://cambridgehouse.com/video/8213/highgra...ources-ltd

2019 - Massive gold nuggets found in outcrop of Aben's Justin property in Yukon

https://www.youtube.com/watch?v=13goOuptl_w

2020 - CEO James Pettit's update on the company's exploration and drilling in Forrest Kerr

https://www.facebook.com/abenresources/videos...326774690/

==========

Media News

==========

The Resource Maven on Aben Resources

http://www.321gold.com/editorials/preston/preston111418.html

https://www.miningfeeds.com/2018/11/07/aben-r...le-winner/

https://investingnews.com/company-profiles/ab...-triangle/

https://www.miningnewsnorth.com/story/2018/10.../5372.html

http://energyandgold.com/2018/05/08/aben-reso...-triangle/

https://www.investorideas.com/news/2019/main/...ources.asp

=============================

Aben Resources in the social media

=============================

https://ca.linkedin.com/company/aben-resources-tsx-v-abn-

https://twitter.com/Aben_ABN/

======================

Insider Trading Information

======================

Canadian Insider

https://www.canadianinsider.com/company?ticker=ABN

How Many Aben Resources Ltd. (CVE:ABN) Shares Did Insiders Buy, In The Last Year?

https://simplywall.st/stocks/ca/materials/tsx...-last-year

==================================================================

Aben Resources - The potential of bonanza precious metal and base metal discovery

==================================================================

Great Bear Resources's long intervals of high grade gold is contributed by bonanza gold deposits along the LP fault zone in its Dixie property in Red Lake, Ontario.

https://greatbearresources.ca/news/great-bear...-step-out/

GBR.V weekly chart

https://stockcharts.com/h-sc/ui?s=GBR.V&p...5415822585

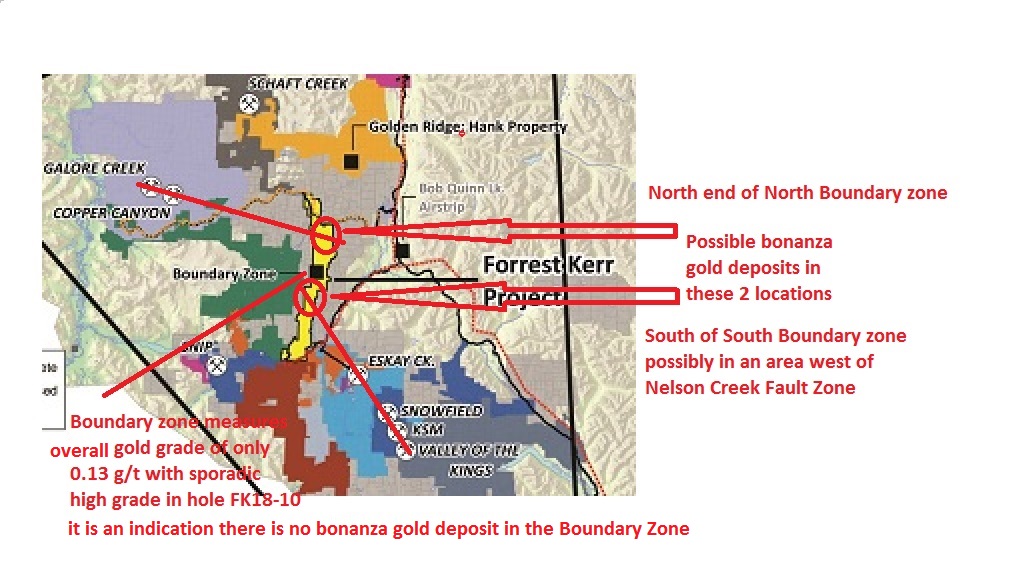

What do Aben Resources and Great Bear Resources have in common? They both have fault lines in their property where most of massive gold deposits are found. Aben has even longer fault lines which traverse the entire property of Forrest Kerr in the North-South direction. CEO James Pettit likes Forrest Kerr because of the presence of the fault lines. Aben geologists traced the source of the visible gold in the North Boundary zone to an area west of Nelson Creek fault zone and have outlined drilling targets for the coming drilling programs. With high grade gold in its past assays and long intervals of consistent gold mineralization in the drill holes and with the property situated between the prolific Eskay Creek mine and Snip mine, the prospect of bonanza gold deposits in Forrest Kerr is very promising due to similar geology in the area. Constructive share price chart pattern stands out among its peers, reflecting investors' strong confidence in the company's future significant discovery as some experienced investors are super keen in their clairvoyance, they believe bonanza gold deposits are there just as in the neighboring mines, it is only a matter of time the geologist will find them. Looking for bonanza gold deposit in the huge 234 square kilometer area is like looking for a pin in a haystack, time, patience and endurance are needed but drilling close to the fault line greatly increases the chance of discovery just as Great Bear Resources did. While the North Boundary zone hosts super high grade gold, the South Boundary zone hosts massive tonnage of average grade gold, but there could be massive tonnage of high grade gold at great depth too.

Searching for bonanza gold deposits is like striving to win a lottery jackpot. While some lucky gamblers do win jackpot on their first time playing the lottery game, most gamblers have drilled hundreds if not thousands of holes in their pockets over years with a few lucky ones finally winning big prizes. While experience, expertise, insight, continuous financing are needed among brilliant geologists, they still need the help of luck. The chance of hitting bonanza gold deposit in a land good only for raising chicken is zero while drilling at the earth's fault lines greatly enhance success as that is where most of the high grade gold originates and where bonanza gold deposits occur. Aben's spectacular gold grades and visible gold in hole FK18-10 is an indication that a bonanza deposit is nearby but not necessarily in the Boundary Zone. Most explorers started drilling in the wrong place and find only sporadic high grade gold in one or two holes but with low grade gold in the rest. Working stoically and relentlessly over years, through analysis, testing and tracing, they will move closer and closer to the source of the high grade / visible gold, then with persistent long intervals of super high grade gold in the assays, they hit the jackpot just as early explorers did in hole 109 of Eskay Creek.

History of Eskay Creek mine, the world's massive high grade gold mine

In 1932 a prospector named Tom Mackay of Consolidated Stikine Resources was the first to recognize the area's unique geological setting after spotting an alluring rock outcrop from his single-engine bush plane. After staking the property he discovered a boulder broken free from its source higher up on the mountain, rolling several dozen meters downslope, assays from the boulder returned a spectacular five ounces of gold per tonne. Mackay explored the property for over 50 years but bonanza gold deposit was never found. In 1988 after investing in Consolidated Stikine Resources which held rights to Eskay Creek, geologist Ron Netolitzky became Stikine’s technical person and one of five controlling shareholders. He teamed up with Murray Pezim of Calpine Resources to raise $900,000 for a drill program and started exploring the area in the summer of 1990. After drilling 108 holes and with momentum building, they hit a fault. Chet Idziszek, Pezim’s geologist with a M.Sc. degree from McGill University observed gradually increasing gold grade and increasing interval length in the assays, he had an intuition that he must be very close to the main gold vein, he studied the maps and analysed the terrain then he ragged the drill rig to a spot 350 meters from the last hole drilled and drilled hole #109. Assays from hole 109 returned spectacular 27.2 g/t gold, 30.2 g/t silver over 208 meters (682 feet). Later rivals Placer Dome and International Corona launched takeovers for Stikine and Stikine's shareholders accepted Corona’s $67-per-share bid and the company was sold. In 1994 Eskay Creek went into production that lasted 14 years and finally ended in 2008. Eskay Creek had the highest grade gold on the planet and produced 3.3 million ounces of gold at a breathtaking 45 g/t Au, also 160 million ounces of silver at 2224 g/t.

Mr. Netolitzky has had a very successful career in mining and mineral exploration with decades of experience and having been directly associated with three major mineral discoveries in Canada that have subsequently been put into production: Eskay Creek, Snip and Brewery Creek. At Eskay Creek, Mr. Netolitzky’s Consolidated Stikine Resources was acquired by Placer Dome and International Corona for $67 per share in what was one of the more famous transactions in Western Canadian mining history. Mr. Netolitzky was inducted into the Canadian Mining Hall of Fame in 2014.

Since fault lines travel in a straight line underground and can run for thousands of meters and bonanza gold deposits are found at the fault lines, several gold mines all line up in the Eskay Creek area. Corroborated by James Pettit's encouraging intuition that the area west of the Nelson Creek Fault Zone and the area north of the North Boundary Zone are top priority drilling targets, possible locations of bonanza gold deposits in Forrest Kerr through extrapolation is as follow:

For enlarged view

https://investorshangout.com/images/MYImages/...stKerr.jpg

======================================

Drilling targets in the coming drilling programs

======================================

Page 17 of Presentation

Click for enlarged view

https://investorshangout.com/images/MYImages/...argets.jpg

==========================

Outlook for the Resource Sector

==========================

Continuous economic stimulus and weak US Dollar are needed in the weak economic growth. The US Dollar Index will likely decline to level 80 in the coming years followed by a side way consolidating. Gold and mining stocks will strive as the economy improves with rising inflation expectation.

US Dollar Index is in a long term down trend towards level 80, commodities prices will strive as they are inversely related to the strength of U.S. Dollar

https://bigcharts.marketwatch.com/advchart/fr...60&y=5

Goldman Sach - The outlook for commodities bull market in 2021

https://www.youtube.com/watch?v=y9yuyAAn5Dc

Potential supercycle bodes well for precious metals in 2021, says analyst

https://www.cnbc.com/video/2020/12/18/potenti...alyst.html

Economic boom in China will lead to another commodities supercycle similar to that between the year 2000 to 2008.

https://www.theguardian.com/business/2021/jan...supercycle

Here's Why Commodities are Worth Investing in Right Now

https://www.nasdaq.com/articles/heres-why-com...2021-01-19

Could 2021 be the start of a new super-cycle?

https://www.woodmac.com/news/the-edge/could-2...per-cycle/

Personal Blog

Just as share consolidation happens when outstanding share becomes too diluted, coming currency consolidation is inevitable as stream of paper money or digital currency floods the financial market around the world. During the Great Depression of 1930's in China, inflation was so rampant that prices changed by the week than by the day then by the hour, 300 old Yuan was replaced by a New Yuan, but shortly afterward, 200 former New Yuan was replaced by another New Yuan, forcing majority of the population into poverty except those who bought gold which is a good inflation hedger as gold price in Yuan skyrocketed. With American national debt over 106% GDP and rising and with continuous currency dilution, it will be alarming to look towards the future. One can imagine the only solution for the government is to inflate itself out of debt then what happened in China will happen in America. Global mounting debts is a time bomb waiting to set off with apocalyptic consequence. Gold and potential mining stocks will be the only safe haven in time of financial crisis and economic uncertainty, those not preparing for the inevitable will be forced into poverty as they struggle to survive amid erosion of purchasing power of paper money.

The economic boom of past 100 years was fueled by continuous emergence of new technology and new innovative products amid strong demands from the world's "have nots", but those "have nots" not only are well-fed and well dressed, they have become sellers, vying with the world's biggest economy. Nature is cyclical: Big economic cycle enveloping small economic cycles is the law of the Universe, the 100 year economic boom will not go on forever, another prolonged economic depression is inevitable. Amid global economic and technological saturation and trade war, aggravated by the Pandemic, the global economies are struggling without upward wage pressure, may be the world is already in an economic depression. We are living in the similar situation as in the 1930's but with less severity and austerity because in the 1930's there were less than 100 big American public companies having revenue under $1/2 billion except 7 companies in the oil, automobile and steel industry with revenue between $1 billion and $1.5 billion supported by 121 million American customers. Dow Jones Industrial Average peaked out at 5,726 in 1929 before market crash. Now there are over 17 million American companies with the top 500 biggest companies having revenue between $5 billion and $600 billion supported by 328 million American customers while global customers had increased from 2 billion in 1929 to current 7.8 billion. Economic diversification has resulted in security and stability and prevented the 1930's style economic Great Depression. But In an economic slump, the only economic stimulus is printing money which is inflationary. With astronomical amount of currency dilution globally and domestically chasing finite natural resources amid increasing demands for natural resources from astronomical number of industries, do expect skyrocketing and sustainable high commodities prices in the years ahead with the ramification of runaway inflation.

Gold, the first financial commodity ever traded in human history will be the last financial security and safe haven the world will be seeking for.

============================================

Price chart for Gold, Silver, Copper, XAU Mining Index

============================================

Gold Price

https://stockcharts.com/h-sc/ui?s=%24GOLD&...9325303251

https://mrci.com/pdf/gc.pdf

Silver Price

https://stockcharts.com/h-sc/ui?s=%24SILVER&a...5832796445

https://mrci.com/pdf/si.pdf

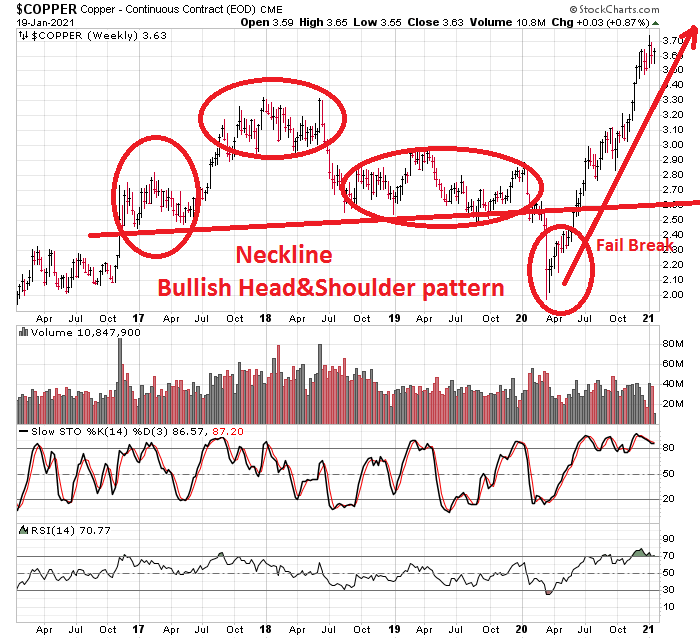

Copper Price

https://stockcharts.com/h-sc/ui?s=%24COPPER&a...7009666446

https://www.mrci.com/pdf/hg.pdf

XAU Mining Index

https://stockcharts.com/h-sc/ui?s=%24XAU&...0985509425

XAU mining stock Index monthly chart (The 15-year Head-And-Shoulder pattern formed between year 2000 and 2015 signals a prolonged up trend in mining stocks to possibly new record high)

https://bigcharts.marketwatch.com/advchart/fr...62&y=4

Global mining stock Index

https://stockcharts.com/h-sc/ui?s=%24SPTGM&am...5126536165

ABN.V

https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

==========================================================

Mining companies operating in the Golden Triangle of British Columbia

==========================================================

Aben Resources is a new comer to the Golden Triangle while most of the explorers have been operating there for decades, delineating their resources and reserves to enhance shareholder value. CEO James Pettit optioned Forrest Kerr in 2016, in the subsequent 3 years he drilled and incurred exploration expenses to meet the option agreement, completed the Earn-In in November 2019 and now owns 100% of Forrest Kerr property.

Mining explorers operating in the prolific Golden Triangle of British Columbia and their share price as of Friday, February 12, 2021:

1) RG Romios Gold Resources $0.05 https://stockcharts.com/h-sc/ui?s=RG.V&p=...3258189645

2) ABN Aben Resources $0.07 https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

3) DEC Decade Resources $0.09 https://stockcharts.com/h-sc/ui?s=DEC.V&p...1633995508

4) MRO Millrock Resources Inc. $0.12 https://stockcharts.com/h-sc/ui?s=MRO.V&p...6836544963

5) SKYG Sky Gold Corp $0.14 https://stockcharts.com/h-sc/ui?s=SKYG.V&...4081325604

6) ENDR Enduro Metals Corporation $0.20 https://stockcharts.com/h-sc/ui?s=ENDR.V&...0889726269

7) AMK American Creek Resources Ltd $0.39 https://stockcharts.com/h-sc/ui?s=AMK.V&p...4902895968

BBB Brixton Metals Corporation $0.26 https://stockcharts.com/h-sc/ui?s=BBB.V&p...4146375562

BBB Brixton Metals Corporation $0.26 https://stockcharts.com/h-sc/ui?s=BBB.V&p...4146375562 9) EVER Evergold Corp $0.25 https://stockcharts.com/h-sc/ui?s=EVER.V&...9306455150

10) MTS Metallis Resources $0.43 https://stockcharts.com/h-sc/ui?s=MTS.V&p...3708570676

11) MTB Mountain Boy Minerals $0.46 https://stockcharts.com/h-sc/ui?s=MTB.V&p...5090334703

12) GGI Garibaldi Resources Corp $0.55 https://stockcharts.com/h-sc/ui?s=GGI.V&p...6339012581

13) QEX QuestEx Gold & Copper Ltd $0.58 https://stockcharts.com/h-sc/ui?s=CXO.V&p...3543151089

14) DV Dolly Varden Silver Corp $0.69 https://stockcharts.com/h-sc/ui?s=DV.V&p=...0211663558

15) BNCH Benchmark Metals Inc. $1.18 https://stockcharts.com/h-sc/ui?s=BNCH.V&...8185217032

16) AOT.TO Ascot Resources Ltd. $1.12 https://stockcharts.com/h-sc/ui?s=AOT.TO&...1773813526

17) ESK Eskay Mining Corp $2.45 https://stockcharts.com/h-sc/ui?s=ESK.V&p...2221768177

18) TUD Tudor Gold Corp $3.39 https://stockcharts.com/h-sc/ui?s=TUD.V&p...7186783346

19) GTT GT Gold Corp $2.55 https://stockcharts.com/h-sc/ui?s=GTT.V&p...1772760930

20) TUO Teuton Resources Corp $2.75 https://stockcharts.com/h-sc/ui?s=TUO.V&p...1926720407

21) SKE.TO Skeena Resources Ltd. $3.91 https://stockcharts.com/h-sc/ui?s=SKE.TO&...2377942100

22) III.TO Imperial Metals Corp $4.73 https://stockcharts.com/h-sc/ui?s=III.TO&...2125642263

23) PVG.TO Pretium Resources Inc. $13.81 https://stockcharts.com/h-sc/ui?s=PVG.TO&...0112557228

24) ELD.TO Eldorado Gold Corp $16.55 https://stockcharts.com/h-sc/ui?s=ELD.TO&...0529029750

25) SEA.TO Seabridge Gold Inc. $23.54 https://stockcharts.com/h-sc/ui?s=SEA.TO&...9592454206

https://www.seabridgegold.com/company/overview

Due to lack of basic infrastructure like powerline and accessible roads, exploration and discoveries have been arduous in the Golden Triangle in the past decades, it took Seabridge Gold 41 years to achieve its current mineral reserves and resources since its formation in 1979. Thanks to Imperial Metals, its desire to construct a copper mine at Red Chris prompted the government to construct highway and roads and install powerline through the Golden Triangle since 2012, with the basic infrastructure in place and with the progress in modern day mineral detection technology, potential rapid discovery of bonanza gold deposits in the Forrest Kerr fault zone and accurate resources estimate through 3-D imaging can be achieved.

===============

Chart Technicality

===============

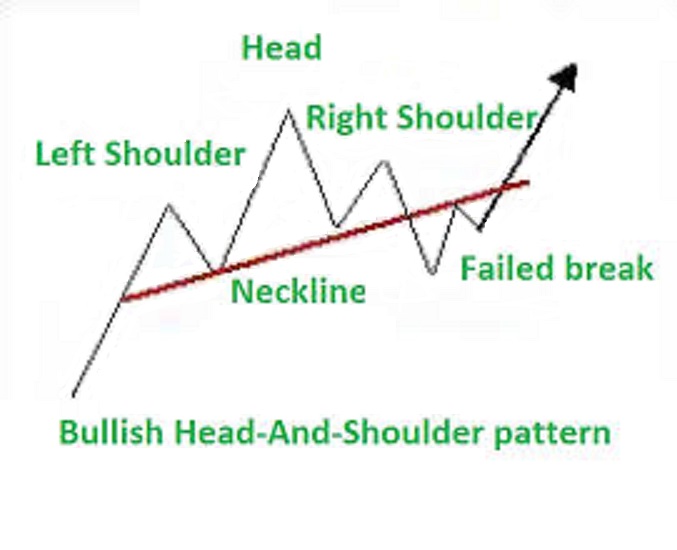

Chart is not only a historical record, quite often it can predict the future, it is an important trading tool, no investor can be successful without referring to charts. Trading without charts is like an airplane pilot flying without any navigation instrument but purely by guessing and hunch, chances are he will end up in crash-and-burn. Head-And-Shoulder is a natural chart formation in Nature, it is the most liable and predictable chart pattern among all chart formations.

Bullish and bearish Head-And-Shoulder patterns

https://encrypted-tbn0.gstatic.com/images?q=t...p;usqp=CAU

Bullish Head-And-Shoulder pattern - fail break pattern

Bullish Head-And-Shoulder pattern in copper

Bullish Head-And-Shoulder pattern in XAU mining index

Bullish Head-And-Shoulder pattern in Gold

.gif)

Click for enlarged view

https://investorshangout.com/images/MYImages/...04_ABN.jpg

Click for enlarged view

https://investorshangout.com/images/MYImages/...M-SOLD.gif

===================================

Testament for the Golden Triangle potential

===================================

In the year 2000 I bought 200,000 shares of American Bullion Minerals at 5 cents. The company owned the Red Chris copper mine with 6 billion pounds of copper reserves. The company was bought out by Imperial Metals in 2011 at $2 a share, the sale offered me $400K for my early retirement. Hope lightning will strike twice.

Red Chris Mine (at the top right corner of the Golden Triangle)

https://investorshangout.com/images/MYImages/...ABNmap.jpg

I always remind myself that Rome is not built in one day, big fortune can only be made in long term holding of stocks with promising future and that patience and endurance will pay off. No short term gamblers ever came out of a casino alive in the long run.

News Flashback - Will history repeat itself? Certainly, CEO James Pettit said in the interview videos that virtually every hole they drilled encountered gold mineralization and with the presence of visible gold and extension of the mineralization to the west of the Nelson Creek Fault Zone, it is a good indication of the existence of bonanza gold deposit along the fault line. Rome is not built in one day but they are getting there, wait till they get closer to the hot spots, 37 meters of 0.46 g/t in each of the 2 test holes in 2000 could turn into 37 meters of over 10 g/t and share price under 15 cents will be history.

June 21, 2018

Aben Mobilizes to Forrest Kerr Gold Project in BC’s Golden Triangle Region

https://sedar.com/GetFile.do?lang=EN&docC...Id=4343523

August 9, 2018

Aben’s First Drill Hole Discovers Multiple High-Grade Zones Including 62.4 g/t Gold over 6.0m within 38.7 g/t Gold over 10.0m at Forrest Kerr Project in BC’s Golden Triangle

https://sedar.com/GetFile.do?lang=EN&docC...Id=4366630

Aben Resources's gold resources potential:

https://www.youtube.com/watch?v=PLokNqo0j4A&a...e=youtu.be

(0)

(0) (0)

(0)