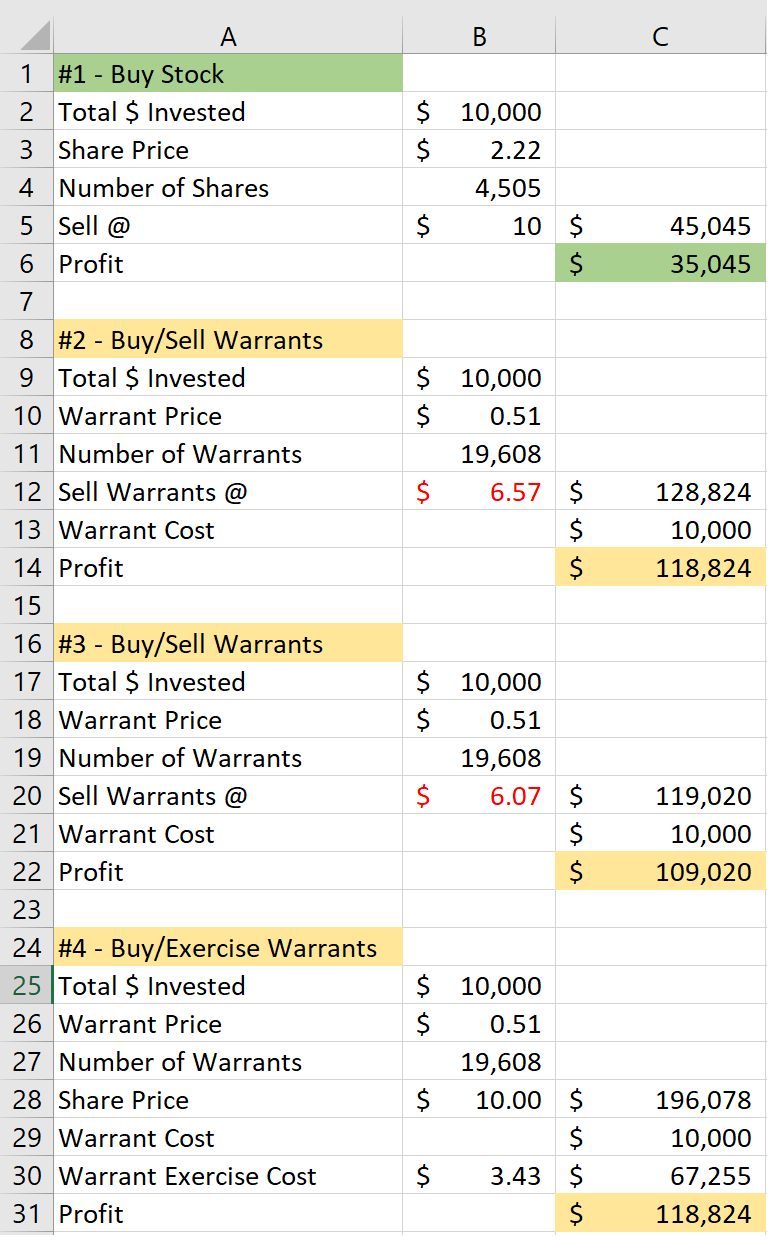

In examples #2 & #3 your stock would be worth $10,

Post# of 33162

The warrant price, when in the money wouldn't' be exactly the sp - the strike price, but if you say it's a few percentage off, that makes sense. I don't know how fast you can exercise them but if it's same day then it would be close.

In the update example #2 is no difference and #3 is .50 so it would be somewhere in-between.

Now who wants to put together a model is you bought only stock investing $10K and borrowing the rest to get the me kind of return as warrants and then articulate the risk of each?

Remember, this is IF the stock is $10. For extra credit, do the same calculations when the stock is at $3, $4, $5.

(12)

(12) (0)

(0)