I and others have posted about this and included t

Post# of 33181

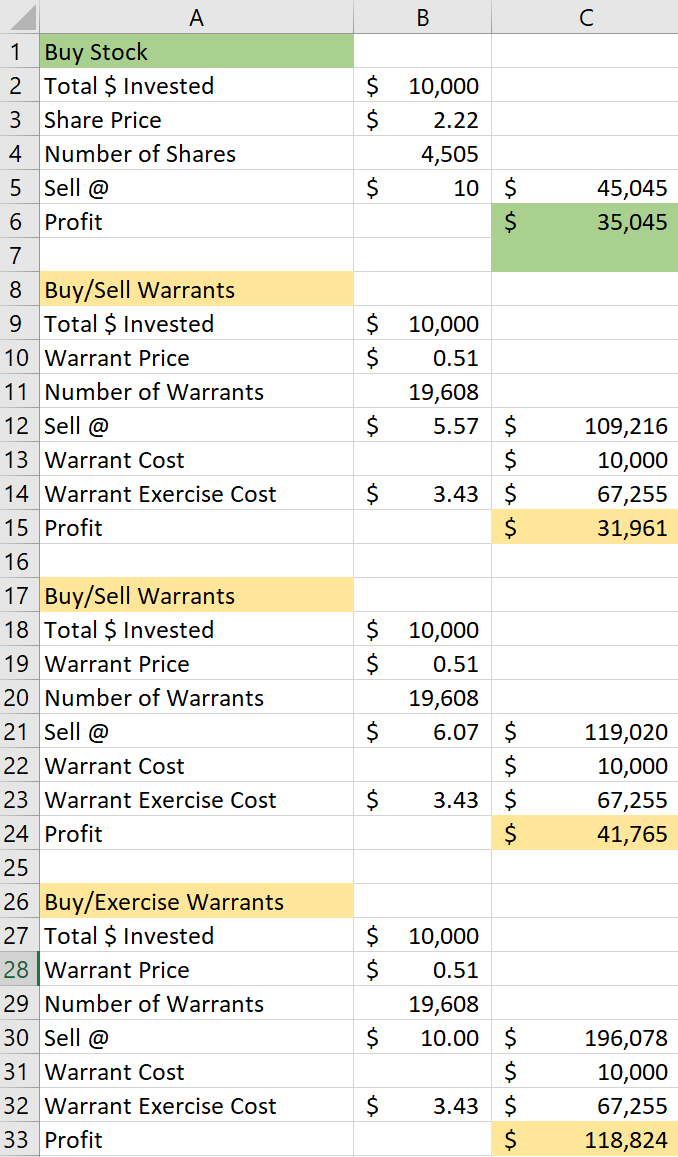

Let's say someone has $10K to invest and are trying to decide whether to buy shares or warrants. Let's also say they don't care about factoring in risk for some odd reason, but it's a big factor in warrants. But to make it simple, they don't.

Let's say Verb hits $10 and someone wants to sell. If they wanted to sell the warrants without exercising them to make it easy, they would be lower than the current share price minus the strike price. How much lower, I don't know but it's a factor. I show it as .50 lower and then a $1 lower. Could be between there are maybe only .10.

Now one might ask, why wouldn't they just exercise the warrants if they could make more money? People sell warrants that are in the green at a discount.

If my number are right, you could make 3-4 times more if one accepts the risk. But as I said, this is complicated. You could also get leverage other ways with less risk or maybe different risk and this is where more complicated Black Scholes formula come into play.

What if you could make 3-4 times as much or maybe more, if you just borrowed money? Black Scholes factors in the cost of borrowing money or at least last time I used it, I thought it did. If you can borrow money cheaply, then the math can work in your favor. What is a cheap interest rate? That is just factor. When I was playing around with the formula, it seemed like if you could borrow at less then 12%, 10%, 8%, (I forget), the buying shares can work in your favor but clearly risk there as well.

The other avenue with stocks is to look at options.

Now back to warrant risk. If a stock doesn't go above the strike price plus your cost basis, and the clock runs out, you lose it all. With the stock you don't.

Everyone please feel free to correct my numbers if I am off or my comments. It's a complicated subject and everyone should consider all factors before investing in any stock.

(16)

(16) (0)

(0)