Introduction to Aben Resources ...................

Post# of 1088

===============

Stock Information

===============

Share Outstanding: 128 million

Ticker Symbols

TSX Venture, Canada: ABN.V

United States of America: OTCQB Market: ABNAF

Frankfurt Exchange, Germany: E2L2

===========

Recent News

===========

November 24, 2020

Aben Resources to Extend Term of Share Purchase Warrants

https://www.abenresources.com/news/aben-resou...-warrants/

October 30, 2020

Aben Resources Provides Results and Summary of 2020 Drill Program at the Forrest Kerr Gold Project in BC’s Golden Triangle

https://www.abenresources.com/news/aben-resou...-triangle/

August 21, 2020

Eric Sprott Clarifies Holdings in Aben Resources Ltd.

https://www.newsfilecorp.com/release/62323/Er...on%20share.

https://sedar.com/GetFile.do?lang=EN&docC...Id=4764154

=================================

Financial filing and official news release

=================================

https://sedar.com/DisplayCompanyDocuments.do?...o=00005652

=====================

Website and Presentation

=====================

Aben Resources company website

https://www.abenresources.com/

Presentation (Updated each month) (Updated on February 1, 2021)

https://www.abenresources.com/site/assets/fil...b_2021.pdf

=========================

Mining properties Information

=========================

Justin Property, Yukon

https://www.abenresources.com/projects/justin/

Flagship Forrest Kerr property in the Golden Triangle of British Columbia

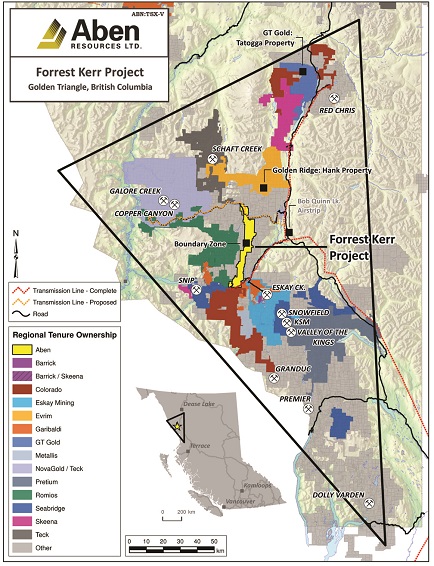

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

=====================================

Track record of past and current explorations

=====================================

5 gold/copper mines (Eskay Creek mine, Snip mine, Burns Block mine and Copper Canyon mine in the Golden Triangle, Gualcamay mine in Argentina) were discovered by the 4 experienced, subtle and strategic geologists affiliated with Aben Resources with the corresponding companies sold to other mining companies.

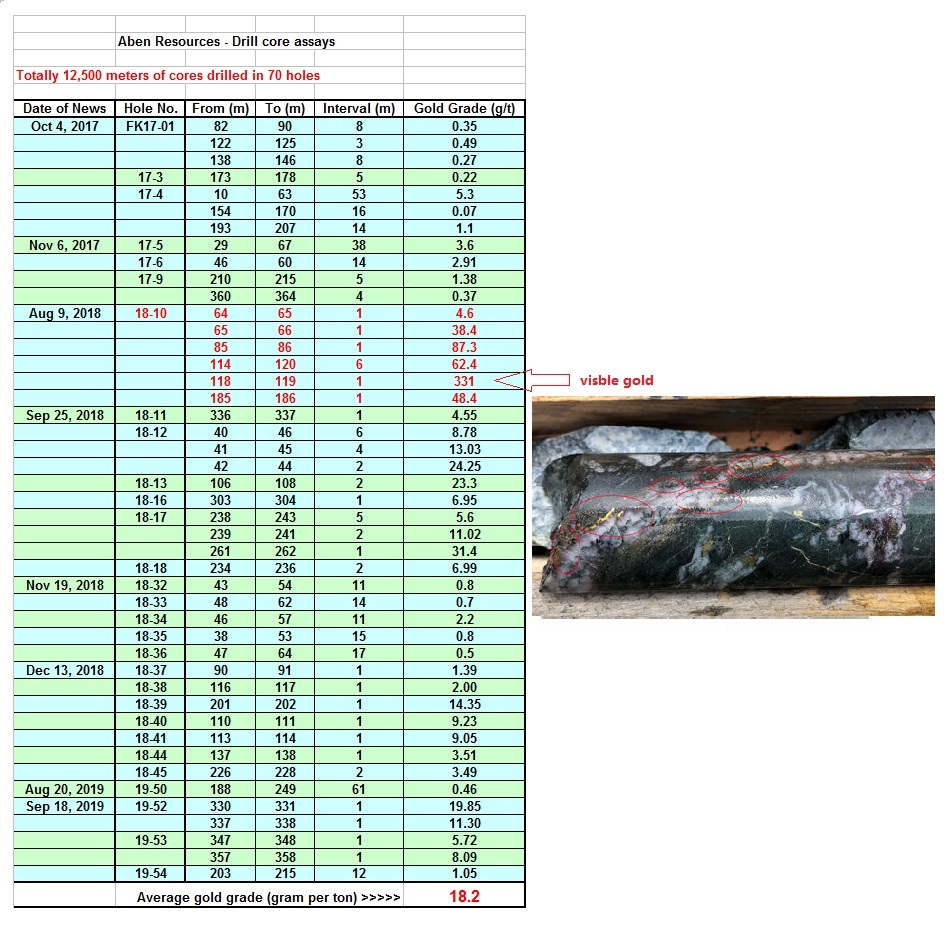

Aben Resources's Forrest Kerr drill core assays

https://investorshangout.com/images/MYImages/...assays.jpg

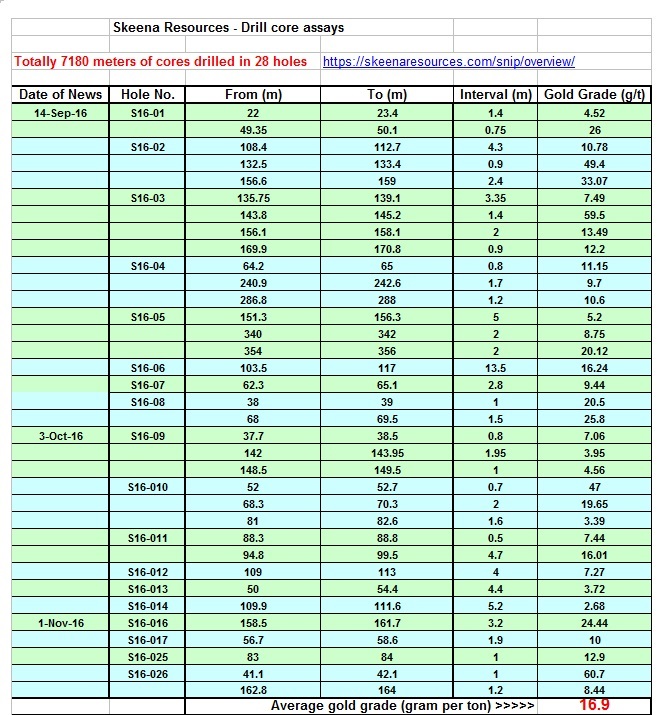

As compared to Skeena Resources's past drill core assays in the Snip Mine

===================================================

Aben Resources Youtube interview videos with CEO James Pettit

===================================================

Massive gold nuggets found in outcrop of Aben's Justin property in Yukon

https://www.youtube.com/watch?v=13goOuptl_w

High grade gold and copper discovery

https://cambridgehouse.com/video/8213/highgra...ources-ltd

Aben Resources CEO at Whistler BC Capital Event Conference Feb. 2020

https://www.facebook.com/abenresources/videos...326774690/

All past media interview videos

https://www.youtube.com/results?search_query=...p=CAI%253D

==============================================

Gold, Silver, Copper, Mining Index and ABN.V price chart

==============================================

Gold Price - Pull back from last August's high has hit strong support level at $1760 with a Double-Bottom pattern, technically up trend will resume soon

https://stockcharts.com/h-sc/ui?s=%24GOLD&...9325303251

https://mrci.com/pdf/gc.pdf

Silver Price formed a Double Bottom pattern at $22, indicating a strong support for the precious metal

https://stockcharts.com/h-sc/ui?s=%24SILVER&a...5832796445

https://mrci.com/pdf/si.pdf

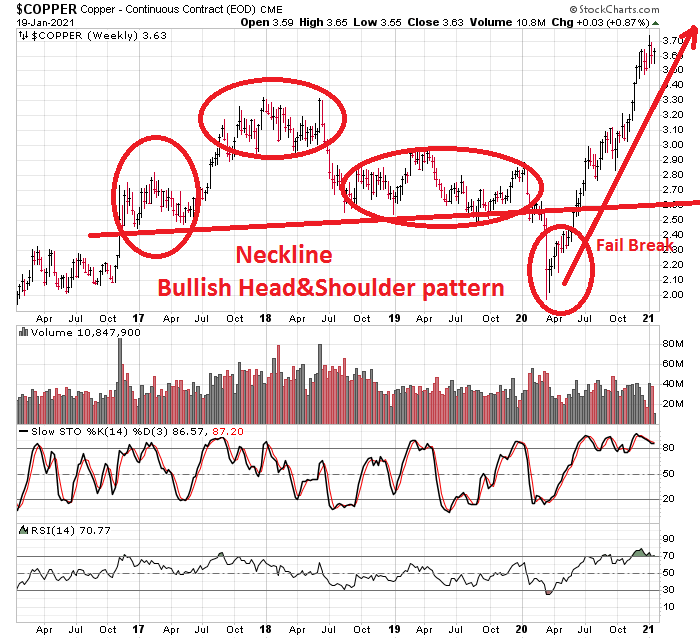

Copper Price weekly chart (The sharp Return Move from under the Neckline may prompt share price to test the historical high at $50)

https://stockcharts.com/h-sc/ui?s=%24COPPER&a...7009666446

https://www.mrci.com/pdf/hg.pdf

XAU Mining Index weekly chart - Pull back from last August's high has hit strong support level at 130 with a Double-Bottom pattern, technically up trend will resume soon

https://stockcharts.com/h-sc/ui?s=%24XAU&...0985509425

Global mining stock Index weekly chart (Historical high is over 135, so it has still a long way to go)

https://stockcharts.com/h-sc/ui?s=%24SPTGM&am...5126536165

ABN.V 5-year weekly chart (Longer the side way consolidation, greater will be the breakout force)

https://stockcharts.com/h-sc/ui?s=ABN.V&p...7496113214

============================

Aben Resources in the social media

=============================

https://ca.linkedin.com/company/aben-resources-tsx-v-abn-

https://twitter.com/Aben_ABN/

======================

Insider Trading Information

======================

Canadian Insider

https://www.canadianinsider.com/company?ticker=ABN

How Many Aben Resources Ltd. (CVE:ABN) Shares Did Insiders Buy, In The Last Year?

https://simplywall.st/stocks/ca/materials/tsx...-last-year

=============================================================

Other mining companies operating in the Golden Triangle of British Columbia

=============================================================

Aben Resources is a new comer to the Golden Triangle while most of the explorers have been operating there for decades, delineating their resources and reserves to enhance shareholder value. CEO James Pettit optioned Forrest Kerr in 2016, in the subsequent 3 years he drilled and incurred exploration expenses to meet the option agreement, completed the Earn-In in November 2019 and own 100% of Forrest Kerr property.

Mining explorers operating in the prolific Golden Triangle of British Columbia and their current share price:

1 RG Romios Gold Resources $0.055

2 ABN Aben Resources $0.070

3 DEC Decade Resources $0.090

4 MRO Millrock Resources Inc. $0.110

5 SKYG Sky Gold Corp $0.140

6 ENDR Enduro Metals Corporation $0.190

7 AMK American Creek Resources Ltd $0.270

8 BBB Brixton Metals Corporation $0.280

9 EVER Evergold Corp $0.240

10 MTS Metallis Resources $0.240

11 MTB Mountain Boy Minerals $0.450

12 GGI Garibaldi Resources Corp $0.410

13 QEX QuestEx Gold & Copper Ltd $0.610

14 DV Dolly Varden Silver Corp $0.850

15 BNCH Benchmark Metals Inc. $1.190

16 AOT.TO Ascot Resources Ltd. $1.200

17 ESK Eskay Mining Corp $2.720

18 TUD Tudor Gold Corp $2.770

19 GTT GT Gold Corp $2.300

20 TUO Teuton Resources Corp $2.480

21 SKE.TO Skeena Resources Ltd. $3.180

22 III.TO Imperial Metals Corp $4.290

23 PVG.TO Pretium Resources Inc. $14.240

24 ELD.TO Eldorado Gold Corp $14.510

25 SEA.TO Seabridge Gold Inc. $25.790

https://www.seabridgegold.com/company/overview

Due to lack of basic infrastructure like powerline and accessible roads, exploration and discoveries were arduous in the Golden Triangle, it took Seabridge Gold 41 years to achieve its current reserves and assets since its formation in 1979. Thanks to Imperial Metals, its desire to construct a copper mine at Red Chris prompted the government to construct highway and roads and install powerline through the Golden Triangle since 2012, with the basic infrastructure in place and with the progress in modern day mineral detection technology, potential rapid discovery of bonanza gold deposits in the Forrest Kerr fault zone and accurate resources estimate through 3-D imaging can be achieved.

==================================================================

Aben Resources - The potential of bonanza precious metal and base metal discovery

==================================================================

Great Bear Resources's long intervals of high grade gold is contributed by bonanza gold deposits along the LP fault zone in its Dixie property in Red Lake, Ontario.

https://greatbearresources.ca/news/great-bear...-step-out/

GBR.V weekly chart

https://stockcharts.com/h-sc/ui?s=GBR.V&p...5415822585

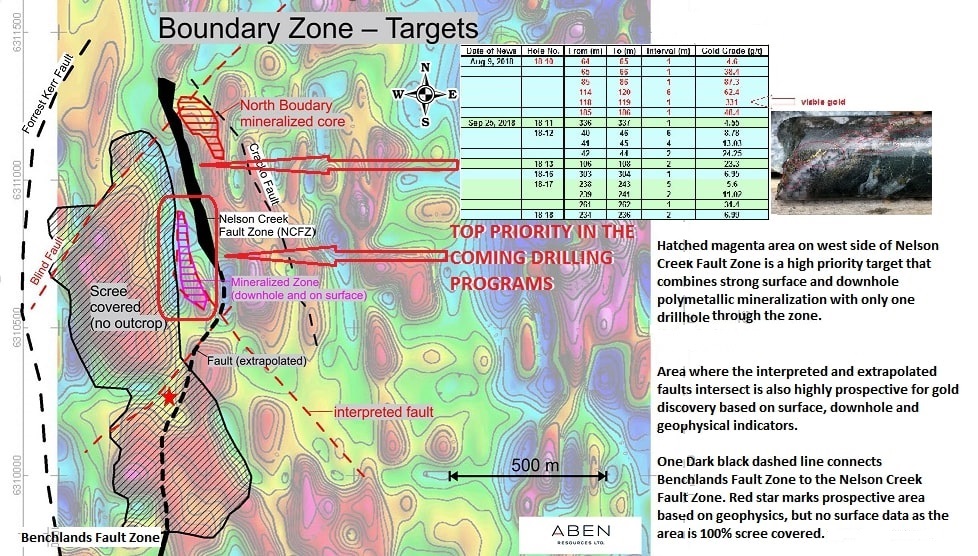

What do Aben Resources and Great Bear Resources have in common? They both have fault line in their property. Aben has an even longer fault line which traverses the entire property of Forrest Kerr in the North-South direction. CEO James Pettit likes Forrest Kerr because of the presence of the fault line. Aben geologists traced the source of the visible gold in the North Boundary zone to an area west of Nelson Creek fault zone and have outlined drilling targets for the coming drilling programs. With high grade gold in its past assays and with the property situated between Snip Mine and Eskay Creek mine, the prospect of bonanza gold deposits in Forrest Kerr is very promising. Constructive chart pattern in share price chart stands out among its peers, reflecting investors' strong confidence in the company's future bonanza discovery as some experienced investors are super keen in their clairvoyance.

Drilling target is set at the west side of Nelson Creek fault zone (Page 17 of Presentation)

As the saying goes: Rome is not built in one day and it takes financing to support drilling programs. Looking for bonanza gold deposit in the big 234 square kilometer area is like looking for a pin in a haystack. Time, patience and endurance are needed but drilling close to the fault line greatly increases the chance of discovery just as Great Bear Resources did. Cross your fingers that bonanza discovery in Forrest Kerr will turn out to be the mother of all discoveries and will send share price soaring.

======================================

Drilling targets in the coming drilling programs

======================================

Page 17 of Presentation

Click for enlarged view

https://investorshangout.com/images/MYImages/...argets.jpg

==========

Media News

==========

https://investingnews.com/company-profiles/ab...-triangle/

https://www.miningnewsnorth.com/story/2018/10.../5372.html

http://energyandgold.com/2018/05/08/aben-reso...-triangle/

https://www.investorideas.com/news/2019/main/...ources.asp

==========================

Outlook for the Resource Sector

==========================

The negative economic impact of the Pandemic will be long lasting, Old Normal will not return until the whole world is virus free as it takes only one cockroach to proliferate and infest the whole world again. Continuous economic stimulus and weak US Dollar are needed. The US Dollar Index will likely decline to level 80 in the coming years before consolidating in a side way pattern amid weak economic performance, economic saturation and fierce global trade war. Gold and mining stocks will strive in such environment.

US Dollar Index is in a long term down trend

https://bigcharts.marketwatch.com/advchart/fr...60&y=5

XAU mining index: The 15-year Head-And-Shoulder pattern formed between year 2000 and 2015 signals a prolonged up trend in mining stocks to possibly new record high.

XAU mining stock Index monthly chart

https://bigcharts.marketwatch.com/advchart/fr...62&y=4

Goldman Sach - The outlook for commodities bull market in 2021

https://www.youtube.com/watch?v=y9yuyAAn5Dc

Potential supercycle bodes well for precious metals in 2021, says analyst

https://www.cnbc.com/video/2020/12/18/potenti...alyst.html

Economic boom in China will lead to another commodities supercycle similar to that between the year 2000 to 2008.

https://www.theguardian.com/business/2021/jan...supercycle

Here's Why Commodities are Worth Investing in Right Now

https://www.nasdaq.com/articles/heres-why-com...2021-01-19

Could 2021 be the start of a new super-cycle?

https://www.woodmac.com/news/the-edge/could-2...per-cycle/

Personal Blog

Just as share consolidation happens when outstanding share becomes too diluted, coming currency consolidation is inevitable as stream of paper money or digital currency floods the financial market around the world. During the Great Depression of 1930's in China, inflation was so rampant that prices changed by week than by day then by hour, 300 old Yuan was replaced by a New Yuan, but shortly afterward, 200 former New Yuan was replaced by another New Yuan, forcing increasing number of citizens into poverty. With American national debt over 106% GDP and rising and with continuous currency dilution, it will be alarming to look towards the future. One can imagine the only solution for the government is to inflate itself out of debt then what happened in China will happen in America. Gold and potential mining stocks will be the only safe haven in time of financial and economic crisis and uncertainty, those not preparing for the inevitable will be forced into poverty as they struggle to survive amid erosion of purchasing power of paper money.

The economic boom of past 100 years was fueled by continuous emergence of new technology and new innovative products amid strong demands from the world's "have nots", but those "have nots" not only are well-fed and well dressed, they have become sellers, vying with the world's biggest economy.

Big economic cycle enveloping small economic cycles is the law of the Universe, the 100 year economic boom will not go on forever and could be coming to an end and another prolonged economic depression may be inevitable. Amid global economic and technological saturation and trade war, aggravated by the Pandemic, the world is basically in an economic depression and in an economic slump, the only economic stimulus is printing money which is inflationary and we are living in the similar situation as in the 1930's but with less severity and austerity because in the 1930's there were limited number of primitive industries supported by global population or customers of only 2 billion, now there are astronomical number of industries and economic sectors amid global population or customers of 7.8 billion. Diversification is the key for security and stability and the world economies are being supported by nearly 4 times the population as in the 1930's. But with astronomical amount of currency dilution chasing limited and finite natural resources amid increasing demands from astronomical number of industries, do expect sustainable and skyrocketing commodities prices in the years ahead.

Gold, the first financial commodity ever traded in the human history will be the last financial security and safe haven the world will be seeking for.

===============

Chart Technicality

===============

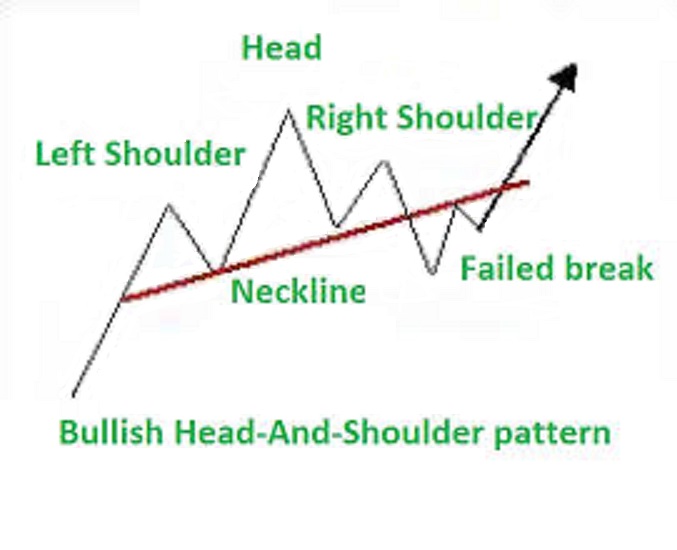

Head-And-Shoulder is a natural chart formation in Nature, it is the most liable and predictable chart pattern among all chart formations.

Bullish and bearish Head-And-Shoulder patterns

https://encrypted-tbn0.gstatic.com/images?q=t...p;usqp=CAU

Bullish Head-And-Shoulder pattern - fail break pattern

Bullish Head-And-Shoulder pattern in copper

Bullish Head-And-Shoulder pattern in XAU mining index

Based on resources potential and chart technicality, a sharp breakout in Q2 is imminent

https://investorshangout.com/images/MYImages/...onthly.gif

https://investorshangout.com/images/MYImages/...nchpad.jpg

In the year 2000 I bought 200,000 shares of American Bullion Minerals at 5 cents. The company owned the Red Chris copper mine with 6 billion pounds of copper reserves. The company was bought out by Imperial Metals in 2011 at $2 a share, the sale offered me $400K for my early retirement. Hope lightning will strike twice.

Red Chris Mine (at the top right corner of the Golden Triangle)

https://investorshangout.com/images/MYImages/...ABNmap.jpg

I always remind myself that Rome is not built in one day, big fortune can only be made in long term holding of stocks with promising future and that patience and endurance will pay off. No short term gamblers ever came out of a casino alive in the long run.

.

.

.

News Flashback - Will history repeat itself? Certainly, CEO James Pettit said in the interview videos that virtually every hole they drilled encountered gold mineralization and with the presence of visible gold and extension of the mineralization to the west of the Nelson Creek Fault Zone, it is a good indication of the existence of bonanza gold deposit along the fault line. Rome is not built in one day but they are getting there, wait till they get closer to the hot spots, 37 meters of 0.46 g/t in each of the 2 test holes in 2000 could turn into 37 meters of over 10 g/t and share price under 15 cents will be history.

June 21, 2018

Aben Mobilizes to Forrest Kerr Gold Project in BC’s Golden Triangle Region

https://sedar.com/GetFile.do?lang=EN&docC...Id=4343523

August 9, 2018

Aben’s First Drill Hole Discovers Multiple High-Grade Zones Including 62.4 g/t Gold over 6.0m within 38.7 g/t Gold over 10.0m at Forrest Kerr Project in BC’s Golden Triangle

https://sedar.com/GetFile.do?lang=EN&docC...Id=4366630

.

.

.

(1)

(1) (0)

(0)