Economic boom in China will lead to another commod

Post# of 1088

https://www.theguardian.com/business/2021/jan...supercycle

With copper topping the $8,000 per tonne price point in over seven years recently, as well as another virus-relief package (estimated to be worth $900 billion), looming large on the horizon - analysts for Goldman Sachs Group and BlackRock are the latest to point out that a commodities supercycle may be beginning. Higher commodity prices naturally lead to higher levels of observed inflation through traditional indicators like CP

https://www.nasdaq.com/articles/heres-why-com...2021-01-19

https://www.theglobeandmail.com/investing/mar...per-cycle/

US Dollar Index in a major down trend

https://bigcharts.marketwatch.com/advchart/fr...60&y=5

Gold Price

https://stockcharts.com/h-sc/ui?s=%24GOLD&...9325303251

Copper Price

https://stockcharts.com/h-sc/ui?s=%24COPPER&a...7009666446

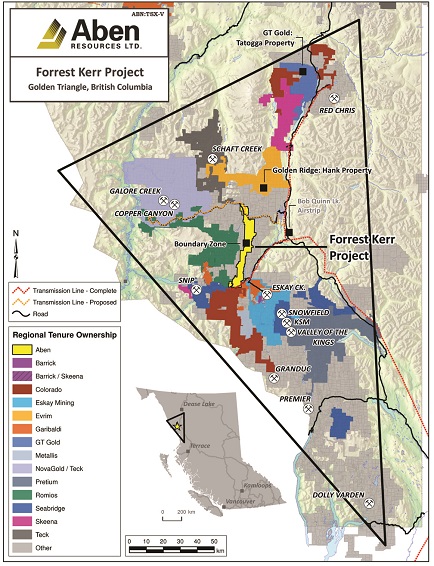

High grade gold and copper discovery in Aben Resources's Forrest Kerr property in the Golden Triangle of British Columbia

https://cambridgehouse.com/video/8213/highgra...ources-ltd

Sharp breakout in Q2 is imminent

https://investorshangout.com/images/MYImages/...onthly.gif

Map of Forrest Kerr property in the Golden Triangle of British Columbia

Forrest Kerr property covers 23,397 hectares or 234 square Km (6.1 Km x 38.3 Km)

Aben Resources website

https://www.abenresources.com/

Drilling target is set at the west side of Nelson Creek fault zone (Page 17)

https://abenresources.com/site/assets/files/3...cp-abn.pdf

(1)

(1) (0)

(0)