The SEC added the requirement I believe back in 20

Post# of 158167

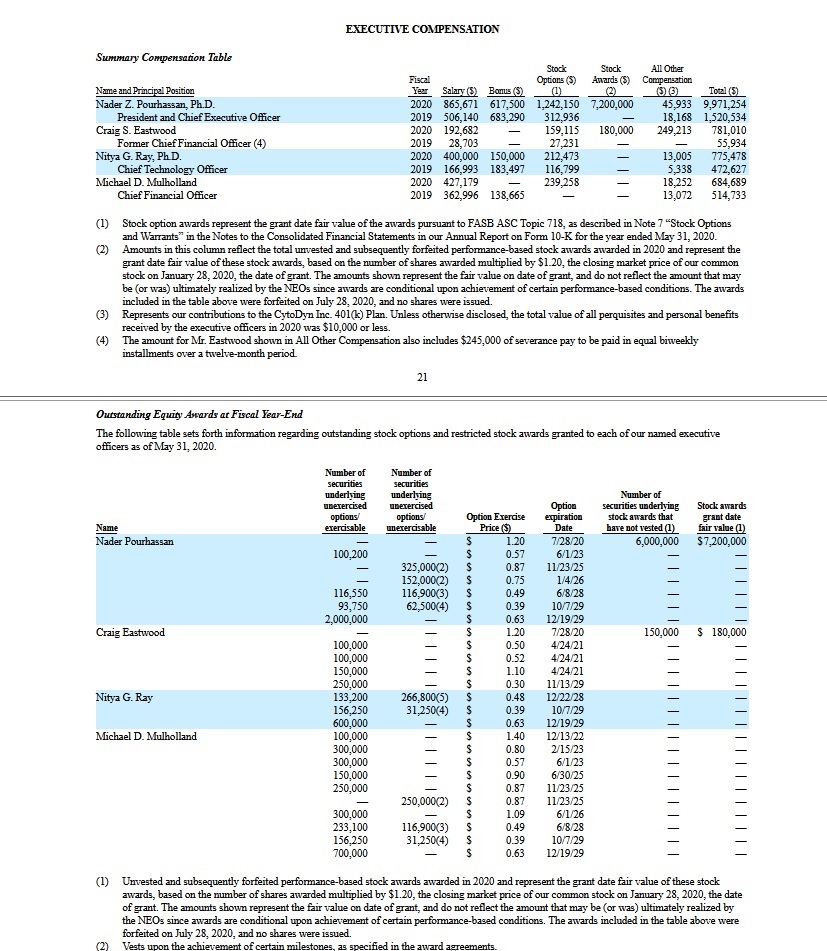

This is the pay

https://www.sec.gov/rules/final/2011/33-9178-secg.htm

Shareholder Approval of Executive Compensation and Golden Parachute Compensation

A Small Entity Compliance Guide1

Introduction

On January 25, 2011, the Securities and Exchange Commission adopted amendments to its disclosure rules and forms to implement Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which added Section 14A to the Exchange Act. The new section requires public companies subject to the federal proxy rules to:

provide their shareholders with an advisory vote on executive compensation, generally known as “Say-on-Pay” votes;

provide their shareholders with an advisory vote on the desired frequency of say-on-pay votes; and

provide their shareholders with an advisory vote on compensation arrangements and understandings in connection with merger transactions, known as “golden parachute” arrangements. Such golden parachute arrangements would need to be disclosed in merger proxy statements.

The amendments take effect on April 4, 2011.

What are the Requirements of the New Amendments?

Say-on-Pay Votes

Companies are required to provide an advisory shareholder vote on the compensation of the top executives of the company – typically, the CEO, the Chief Financial Officer (CFO), and at least three other named executive officers. Companies are not required to use any specific language in asking for shareholder approval. Instead, each company has the flexibility to craft the exact language of the non-binding resolution that its shareholders will vote on.

The resolution could simply ask shareholders to approve the compensation of its named executive officers. For example, a resolution might say:

RESOLVED, that the compensation paid to the company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.

(2)

(2) (0)

(0)