In down markets, value investing becomes the mains

Post# of 33146

In my previous post, I tried to demonstrate that VERB was undervalued based on the valuation of the recent purchase of Blue Jeans. Continuing on that line of thought, there are ways to further capitalize and get an even bigger discount than what you are getting in shares of Verb. That would be investing in the Verb warrants VERBW.

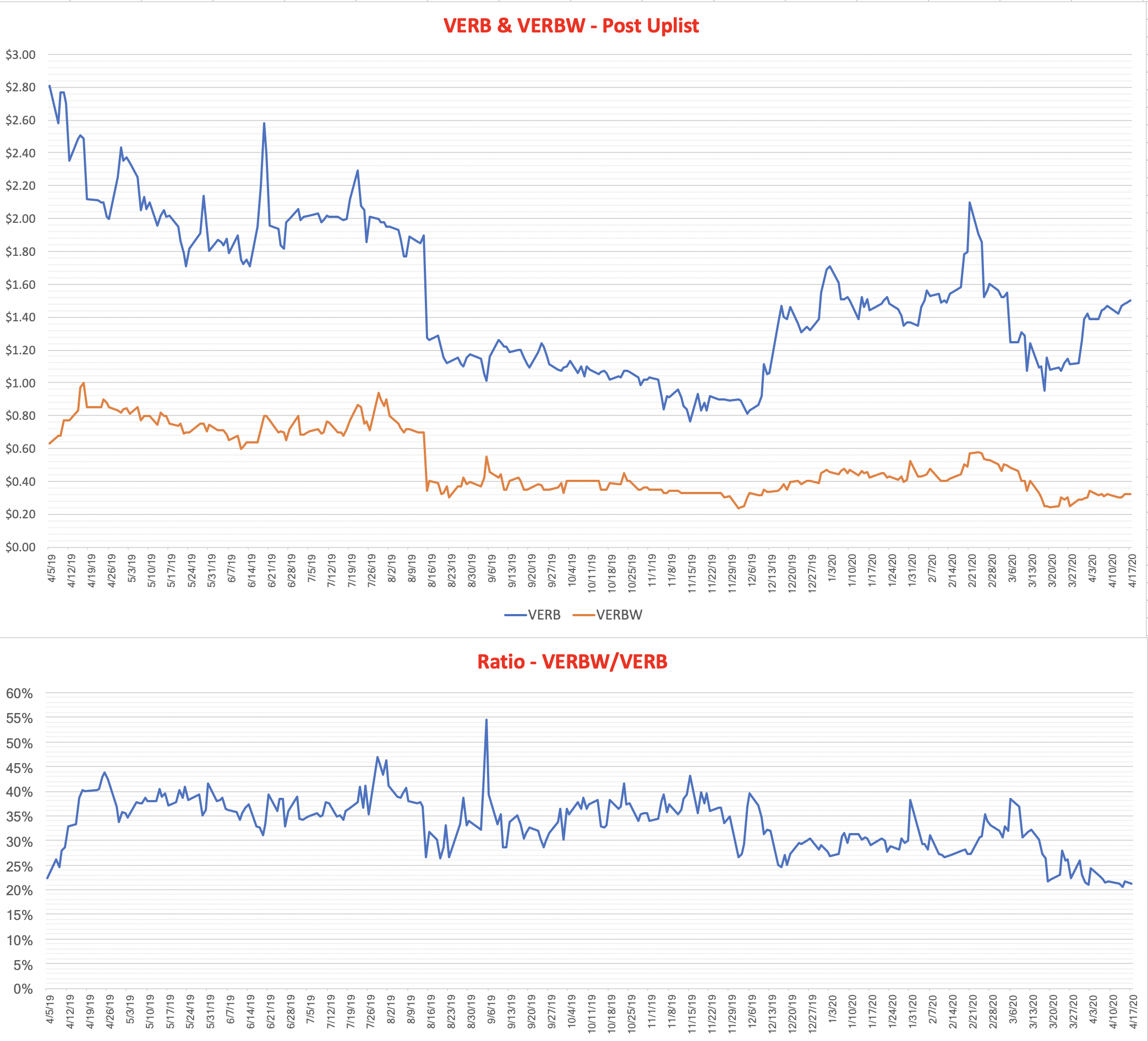

Below are two charts. The top shows the history of prices of VERB and VERBW since the NASDAQ uplist. The bottom chart shows the relationship, or ratio, of VERBW to VERB. in other words, what percentage is the price of the warrant to the underlying stock.

As you can see, historically speaking, the ratio of VERBW to VERB is at an all time low, right above 20%. Why? Well, while VERB has moved off its lows, VERBW has not followed suit.

Could be many reasons for that, but what I care about is the historical significance. The ratio has never been lower.

So my argument is, for those with more risk tolerance, who are aware of the ins and outs of owning warrants, VERBW as it currently stands, presents a great opportunity to get a double bonus on your value opportunity.

P.S. Not giving investment advice or charting, only outlining the opportunity as I see it.

https://investorshangout.com/images/MYImages/...4.27PM.png

(13)

(13) (0)

(0)