Multiplying Multipliers: Speaking of comparison

Post# of 33181

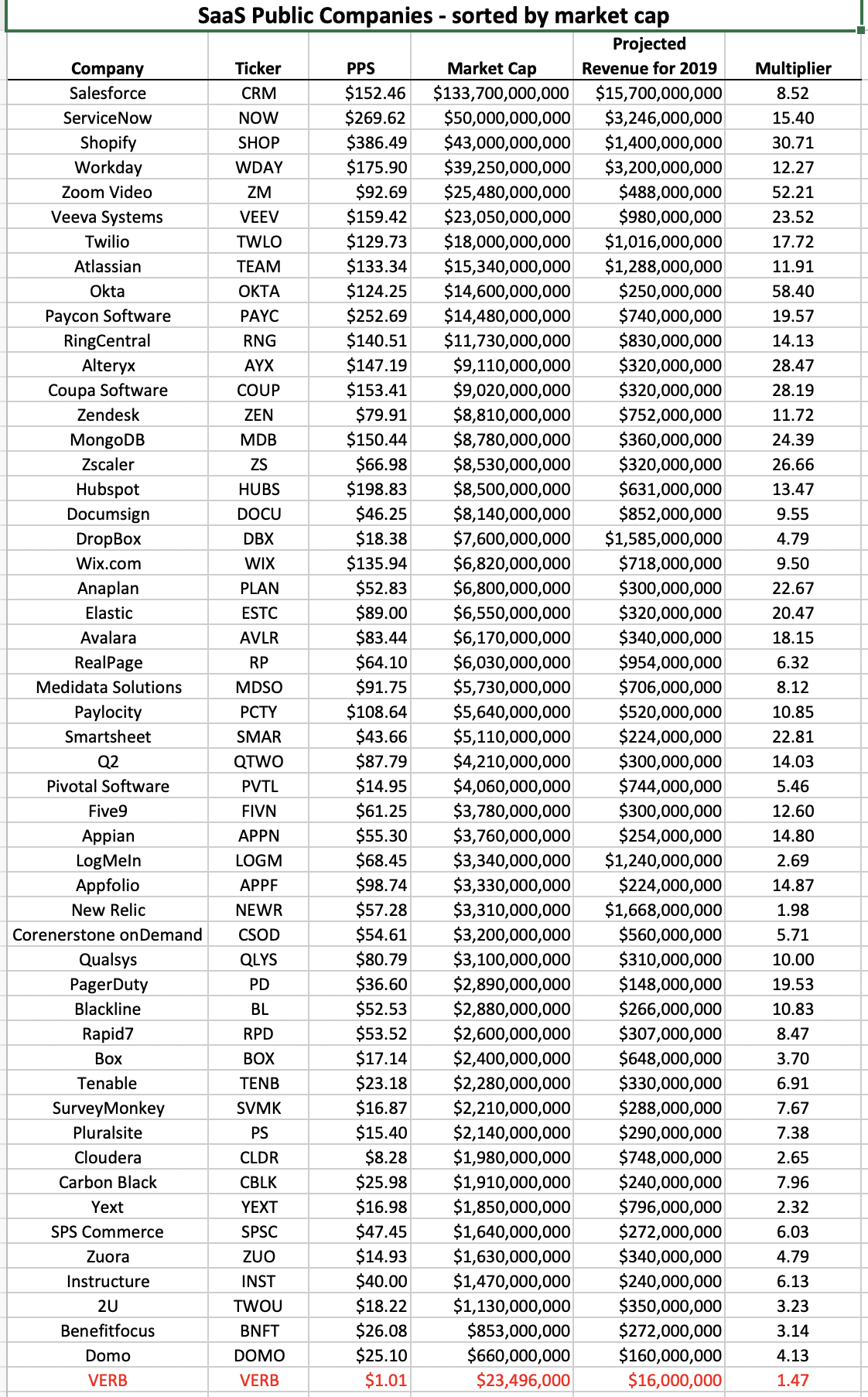

Speaking of comparisons, I was talking with someone recently about comparisons and pulled up an old Matza-Sheet comparing Verb to other public SaaS companies. Below please find the results of my efforts, which I made in Sept 2019 when there was lots of talk of multipliers. I wanted to know how our multiplier compared to the rest of the SaaS market.

Please remember, the numbers are from a day in September 2019 and are not current. Additionally, the Projected revenue are numbers I rationalized looking at the previous two quarters for each company and basically doubling it, they are not actual, and they are not from professional analysts. They are my own, but they suit the purpose and are reasonably close enough to work for this exercise.

In terms of the companies I chose, I just went to good old Google and typed in something like "Public SaaS companies", found some list, and ran with those. There are obviously many more out there, and perhaps some of those in the list below aren't true SaaS companies. But ran with what I found. I also searched hard for any public SaaS company that had similar revenues to Verb.

First and foremost, I could not find any other SaaS company that was PUBLIC that was of the same size as Verb (keep in mind there are probably many PRIVATE SaaS companies that are of the same size). The closest I could find had 10 times the projected 2019 revenue that Verb had.

So quickly realized doing any comparisons to other PUBLIC SaaS companies was an exercise in futility, beyond looking at what our big sisters and brothers look like. In other words, it is very hard to compare the metrics of a company earning 8 figures of new revenue to a company earning 10, 11, or 12 figures of established revenue as they are in different worlds and afforded different metrics. Bottom line is I could not compare the multiplier of Verb to those of its peers, because Verb has no peers….yet.

After coming to the conclusion that I had just wasted a whole lotta time (Matza-Sheet to Matza-Shit), the gears were grinding for a bit and soon realized something pretty special.... SaaS companies are absolute cash machines! Nothing new, I know, but look how much smaller revenue-wise we are to our peers and Verb is just getting started.

We know that the SaaS model works. And Verb obviously has a product that sells in the Direct Sales world, as evidenced by the myriad of customers they keep announcing. And maybe most importantly, we are told they are coming out with products for other markets as well, with some of them being for very large customers, opening entirely new markets for Verb.

In other words, if this does not scream of opportunity and growth potential, I don't know what does. We have the product (with new products on the way), we have the business model, we have the opportunity, we have a rapidly growing user base, and we can see our future. Just look below…..

P.S. A further exercise would be to add in another column for earnings (or lack there of) for each of the companies listed below to further Redspeed’s point.

(19)

(19) (0)

(0)