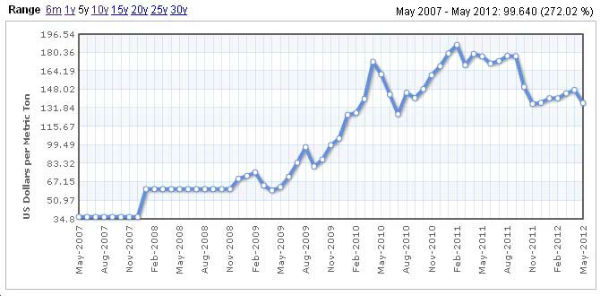

5yr/10yr IRON ore prices on the Rise This is t

Post# of 8059

5yr/10yr IRON ore prices on the Rise

This is to give a perspective why CWRN is way undervalued.and the demand of IRON ore is on the Rise.

> Metal Bulletin Iron Ore Index Link http://www.mbironoreindex.com/

> MBIO Index 7 June 2012; Index sees second biggest increase of the year

- To view MBIO's outlook please see the link below:

http://www.metalbulletin.com/Assets/pdf/MBIO/...on_Ore.pdf

Derivatives traders dive into iron ore market as prices triple .. Frik Els | August 23, 2011/MINING.COM (#51929 posted by johnsync)

New York brokerage GFI’s announcement on Tuesday that it now offers on-screen iron ore swap trading is the latest indication that the economics of the world’s foremost dry bulk commodity are being changed fundamentally.

Started in 2008, derivatives trading in iron ore is up fourfold this year after setting a record in July as investment banks enter the massive market in numbers.

The world’s top three miners – BHP Billiton, Vale and Rio Tinto – control nearly 70% of the 1 billion tonne annual seaborne trade and dominate price talks. The benchmark China import price for iron ore has tripled since late 2008 to $177 a tonne.

MINING.com reported on Monday strong demand in China because of the low quality of its domestic supply and India’s plans to cut exports by half over the next five years should bolster prices in the medium term before huge supplies from Australia start coming on stream from 2014 onwards.

MINING.com reported last week BHP Billiton, the world most valuable miner, is set to report a record $22 billion in annual profit on Wednesday thanks in large part to its iron business.

Credit Suisse and Deutsche Bank began offering swaps in 2008 at the instigation of BHP Billiton as the iron ore producer campaigned to end annual supply contracts and benchmark negotiations against the spot price.

Reuters reports the volume of iron ore swaps cleared reached a record annualised level of almost 50 million tonnes last month, and although it is still small compared with the physical market, it is set to double again before the end of the year.

MINING.com reported in June that pay for star metals traders were reaching $2 – $3 million a year, up 20% over last year.

Iron Ore Monthly Price - US cents per Dry Metric Ton

--- 5 years --- 272 % Rise

--- 10 years --- 975 % Rise

Quote:

Posted by Grajekk: Iron ore spot prices have gone up the last 3 market days. Probably due to the Chinese lowering interest rates to heat up their sluggish economy. It could help with financing if Bao Steel and CWRN decide to build a pellet plant for processing lower grade ore at the Guataloupe mine.

Here's part of an article I read this morning on Chinese lower interest rates and the down trickle effect. Certainly bodes well for CWRN in the long run..

IRON ORE PRICES STEADY SINCE RATE CUT

Steel mills, which use iron ore as a core steelmaking ingredient, generally see lower interest rates as an incentive to encourage more borrowing in order to finance steel production, in the hopes that downstream sectors would see a boost in steel demand.

"Lower interest rates will boost the Chinese property market as the loan rate was too high in the past. Lower rates will stimulate property and thus all related industries -- iron ore, coking coal, and steel -- will be advanced," a source at a state-owned Chinese iron ore trading house said.

$CWRN

(0)

(0) (0)

(0)