Investors Have Already Forgotten The Most Importan

Post# of 52124

yahoonews.com

Dec. 23, 2019

With only a few trading sessions left in the decade, the Wall Street Journal's investing columnist Jason Zweig, the longtime author of paper's "Intelligent Investor" column, is looking back on some of the biggest blunders of the decade.

As it turns out, there were a lot: Remember, investors started the decade with US stocks near their post-crisis lows, with few anticipating the unbridled rebound that would come to pass during the ensuing months and years.

Even more surprising was the drop in interest rates: Negative interest rates were a defining feature of the decade. But few expected them to persist as long as they did, nor did they expect Treasury yields to remain mired in the 1- and 2-handle territory for as long as they have. Ten years ago, most investors expected yields and interest rates to climb back into a "normal" range north of 4% on the ten year.

Investors couldn't have been more wrong. But that's not all that surprising, as Zweig explained. History has shown again and again that investors tend to base their expectations on the recent past. And at the end of 2009, investors were looking back on a decade where stocks had gone nowhere, value shares had outperformed growth, small companies had outperformed large companies, international shares outperformed US shares and EM markets had outperformed developed markets.

One of the more successful trends to emerge over the past decade is worth a quick note. And that trend is: retail investors' shift from active to passive funds, and from mutual funds to ETFs. Over the past ten years, investors withdrew more than $160 billion from all active funds, while pouring more than $3.76 trillion into index funds, according to Morningstar. Few active managers managed to outperform their benchmarks, making the comparatively low-fee index-based ETFs

Another popular prediction from a decade ago that turned out to be way off base: the notion that EM stocks would outperform their American rivals:

Emerging markets proceeded to underperform U.S. stocks by nearly 10 percentage points a year this decade through Dec. 12. Also striking: The MSCI Emerging Markets index has generated a cumulative total return of 42.3% since Dec. 31, 2009—less than half its return from the March 2009 low through the end of that year.

Though that trend got off to a promising start, the top was in by the end of 2009. Over the next ten years, some of the most popular EM benchmarks (like those produced by MSCI) were effectively flat, meaning that investors who committed to EM over US equities missed out on the entirety of one of the biggest and longest equity rallies in modern history.

Even so, surprises lurked everywhere. From the market low on March 9, 2009, through the end of that year, the MSCI Emerging Markets index gained 108%.

Lured by that spectacular return, investors poured nearly $180 billion into mutual funds and exchange-traded funds specializing in stocks and bonds from developing nations between the end of 2009 and the beginning of 2013, according to data from Morningstar. Emerging markets proceeded to underperform U.S. stocks by nearly 10 percentage points a year this decade through Dec. 12.

Also striking: The MSCI Emerging Markets index has generated a cumulative total return of 42.3% since Dec. 31, 2009 - less than half its return from the March 2009 low through the end of that year.

Zweig concluded with some anecdotal evidence to support his theory that investors have forgotten one of the most important, and most painful, lessons of the financial crisis. He claimed that, if you ask investors how much their portfolio lost during the financial crisis, most will say somewhere between 20% and 30%.

But US stocks collapsed by 55% from the October 2007 highs to the March 2009 lows, while global stocks crashed 59%.

Receive a daily recap featuring a curated list of must-read stories.

Your email...

This is dangerous, Zweig said, because investors who underestimate how much they lost during the last crisis can easily overestimate how much they stand to gain from the next one if they can only hold on to their wits.

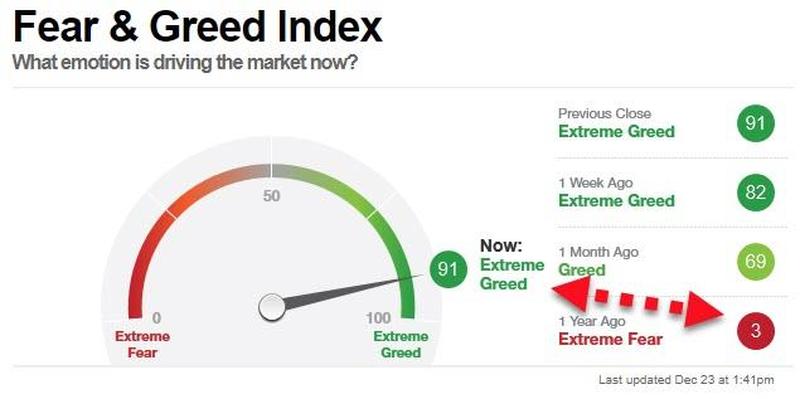

Just like it did ten years ago, the market is beginning a new decade with the prevailing sentiment unquestionably stretched.

But this time, it's in the other direction.

https://www.zerohedge.com/markets/investors-h...to+zero%29

(0)

(0) (0)

(0)