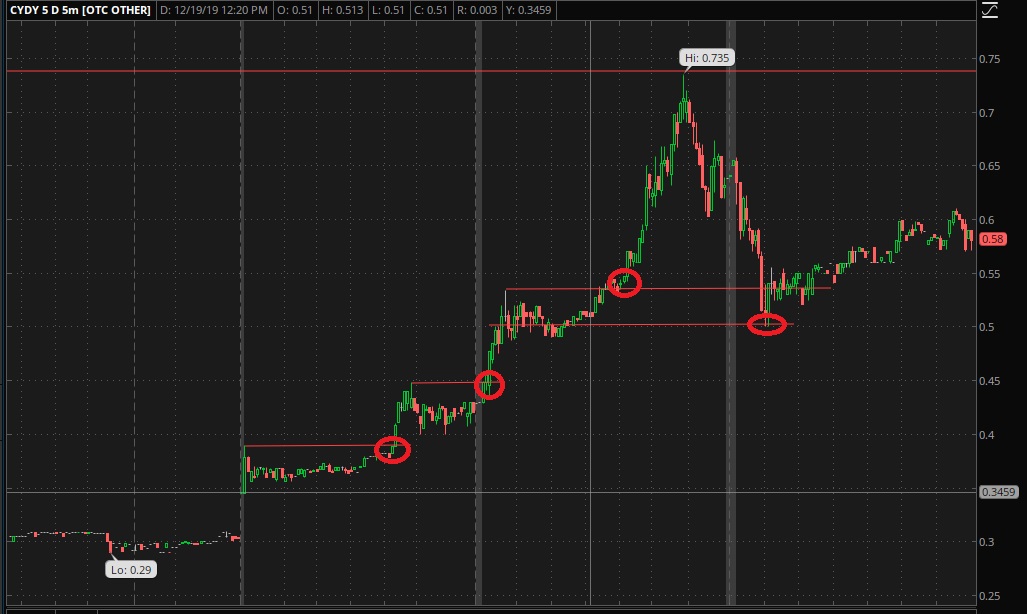

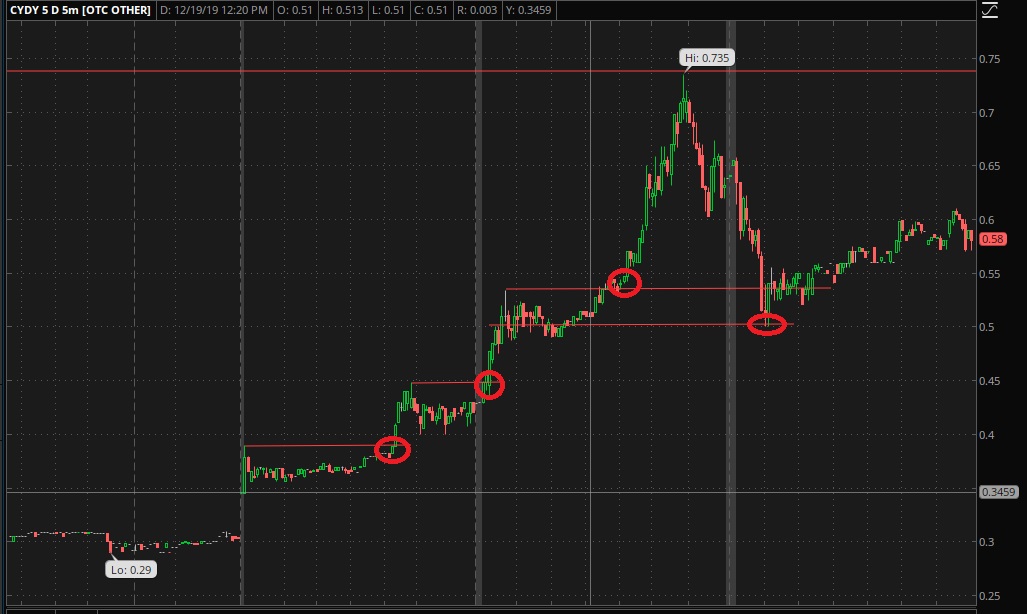

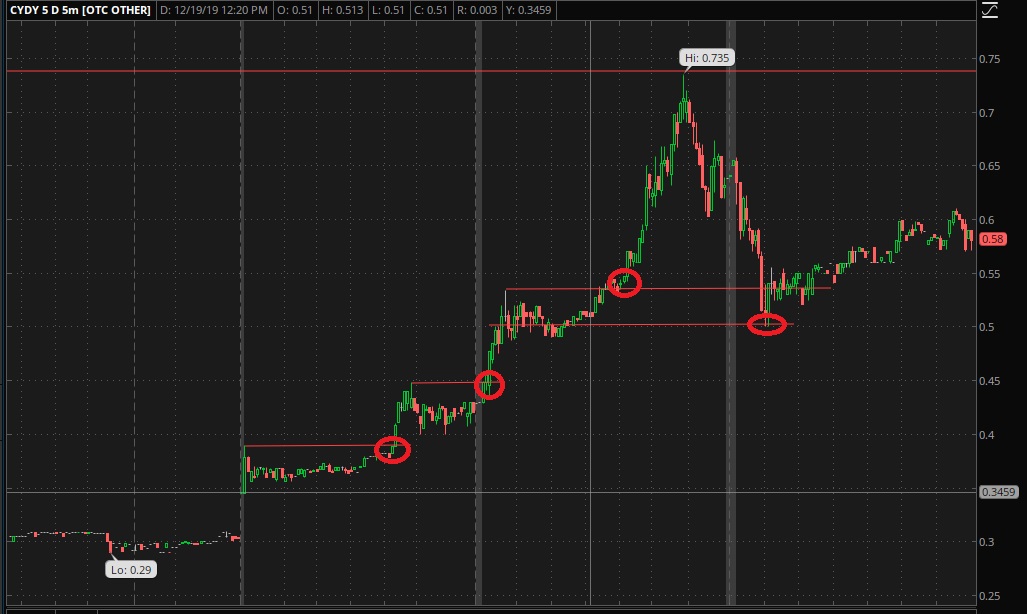

Technique analysis is a big umbrella. Just the very very basic though, look at the inflection points the last 3 days in cydy. The first was 39c, which I commented here it was trying to break before it happened. Since these are not always random, there are patterns and trends in the history we see that influences future price action. It should make sense that learning techniques to recognize these can be used to make money, adding in quantitative analysis, they have even created algorithms which do it. Though I would strongly recommend practicing with PaperMoney stock market simulator when first learning until you find a proven method for yourself that consistently works. Over the years, I have practiced with different tool-kits to enhance my skill set. I spent 2 months one time trading just breakouts. Even then it is hard to switch to real money, because fear and greed can make us do irrational decisions, which is one reason why something like only 5% of attempted daytraders consistently make money, they rest normally give up. Many attempt it without picking up the skill set needed to begin with. Probably why the sec requires 25k minimum to attempt it. Swing trading on TA is easier, I trade a few just on macd crossing momentum indicator. Start small with real money until you have proven consistency over time would be my recommendation. My second recommendation would be to analyze your trades and success over time, example: log daily balance to measure success, to look for ways to improve. It is a lot of hard work, but that pays off with a skill set that can make you a little extra money by clicking buttons on a computer.

(2)

(2) (0)

(0)

(2)

(2) (0)

(0)