Zynex Breaks Out With The Flywheel Effect Yet To C

Post# of 76

< >

Summary

The company basks in device orders growing at 30% sequentially and 95% y/y.

Revenue will follow more slowly, but ultimately much more pronounced as the company gets 80% of revenue from supplies, not device sales, producing a flywheel effect.

Enjoying 80%+ gross margin, profits, positive cash flow and no debt, it's not too late to get on board.

We bought the medical device company Zynex (ZYXI) for the SHU portfolio twice (in June, at $10.36 and $8.75) and we had great expectations for the stock that didn't pan out, at least not immediately:

As you can see, at the end of June the stock sort of crashed, not because of any bad quarterly results, but because of a shelf registration from the CEO Thomas Sandgaard which suggested that he was might be selling all his shares.

That this scared investors is understandable, CEO holds just above 50% of the company, selling all of these shares would create quite a bit of headwind for the stock, despite the stellar business developments which made us take these positions for the SHU portfolio in the first place.

However, the shelf registration was poorly communicated and the CEO had to come out and put things straight, from The Fly:

Zynex CEO and founder Thomas Sandgaard told Bloomberg in an interview that last night's shelf registration, which made 16.7M of his shares eligible for potential re-sale, was "just regular housekeeping" and that he has no plans to sell any shares in the near future. "If I sell a small block in, let's say, a year -- that shelf is live for 3 years -- I will still by far have more skin in the game than anybody else," Sandgaard said. Shares of Zynex are down 23% to $8.10 in midday trading.

However, that didn't turn out to be entirely true either as the CEO sold 100K shares on August 16 and 31,260 shares on August 19. Then he sold 68,740 shares early October, but on close inspection both these sales were under a Rule 10b5-1 Trading Plan.

What it looks like is that this involves selling something in the order of 75K-100K shares on every dollar rise in the share price on the way up. While we can't confirm that with a link, the latest selling is consistent with this.

Perhaps most importantly, one might also appreciate that despite the CEO selling a considerable amount of shares all year, the stock is up a whopping 321% YTD and at best the selling has only slowed down this inexorable rise very temporarily, from Gurufocus:

So we have some conclusions:

Communication about the CEO's selling could have been handled better and the miscommunication looks like it has been a factor in the consolidation phase in the stock.

However, things are better now as the CEO has a 10b5-1 selling plan and the quantities he sells are a fraction of his holdings.

The selling hasn't stopped the shares from rallying, business developments (to which we turn below) trump this.

Business development

The reasons for the spectacular rise in the stock price aren't hard to find and merit restating (for details see our and other's previous articles):

The company is growing revenues at 30%+

The company basks in 80%+ gross margins.

The company is benefiting from two major competitors leaving the market.

The company's razor and blades model produces 80% recurring revenues.

The company is ramping up its sales force.

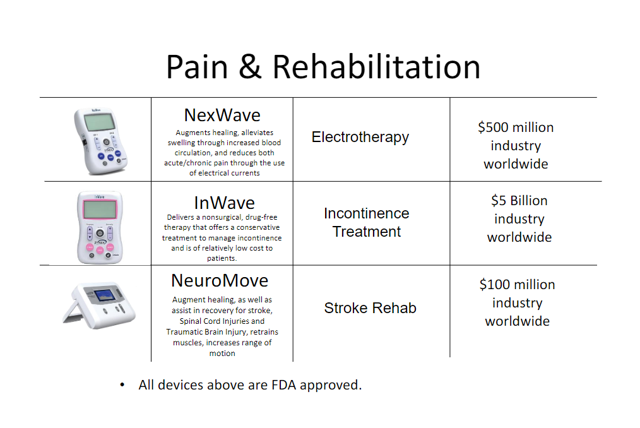

The company has several other promising devices.

The company already produces profits, cash, and has a healthy balance sheet, despite an epic ramp in its sales force.

The device the company is selling is the NexWave, an electrotherapy device for chronic pain management, which can be a side-effects free alternative to opioid use.

But we now know that this investment is paying off. The company announced last week that orders were up a whopping 95% in Q3 versus last year and 30% up sequentially. Here is the CEO (from the PR):

"The investment in our sales force expansion is clearly beginning to bear fruit. Our prescription-strength NexWave device is clearly a healthy alternative to prescribing opioids as the first line of defense when treating pain. We continue to aggressively add additional sales reps in territories throughout the U.S. that we have not covered previously.

Bearing fruit indeed.

Flywheel

The fact that orders are growing much faster than revenues bears some explanation, from the Q2CC:

Orders grew 29% between the first and the second quarters, as we saw more new sales reps becoming productive. This order growth is the result of aggressively adding new sales reps to the sales force every month, and to see all the growth is an early sign of order growth momentum and the subsequent revenue growth that we expect to see over future periods. As you may know already, the revenue of an order is typically recognized over many months as patients continue to use our device and the related supplies for continued pain relief.

There are some noteworthy pointers here:

Orders refer to device sales only (which are prescribed). These then generate subsequent supplies sales.

Sequential order growth now runs at roughly 30% (both in Q2 and Q3).

While the magnitude of the growth has surprised even us, much of it is no surprise, it's simply the result of hiring new sales people (about 10 a month).

Investors shouldn't be side-tracked with the CEO sales plan, nor by the fact that revenues lag orders. The fact that orders are almost doubling is incredibly bullish news that will produce a much bigger revenue ramp than just the device sales.

Remember that 80% of the company's revenues come from supplies sales (batteries, electrodes, stuff like that). This was still the case in Q2, despite the company ramping its sales force rapidly. From the Q2CC:

Orders grew 65% year-over-year, which drove net revenue up 36% to $10.3 million from $7.6 million in 2018. Device revenue increased 37% to $2.3 million, compared to $1.7 million last year. Supplies revenue increased 36% year-over-year to $8 million from $5.9 million.

The fact that order growth is faster than device sales should also not worry investors, it's caused by some lag between orders and revenue recognition.

New sales people have had little time to generate a large installed base of sold devices, hence their sales disproportionately consist of devices, rather than supplies, at least compared to the average of the sales force.

But the longer the new sales people are in service, the more time they have to add to their installed base of sold devices and the more the sales of supplies will ramp. This is a sort off flywheel effect.

Management has said that the most experienced sales people could generate $1M in sales but the company's average stands at a fraction of that. In 2018 the company produced $31.9M in sales with 100 independent sales people and 60 sales employees or roughly $200K.

The figures are actually higher because of the ramp in the number of sales people during the year. Taking Q4 revenue of $9.34M last year would have this at $233K but even that is an underestimation as there is also considerable ramp during the quarter, so we take roughly $250K as the base number.

How quickly can new sales people ramp towards that $1M in sales? We have to distinguish:

Sales rep productivity, which improved 50% for new sales people versus last year's new sales people due to new training, but this 50% refers to 50% more orders in their first 90 days of operation and we know that orders refer to device sales, not supply sales.

Revenue per sales person is mostly a function of time in service, the time necessary to generate a large installed base of devices which generate supplies sales which are a multiple of device revenue.

The second effect is by far the most important, but this simply takes time. It is difficult to gauge how fast new sales people can ramp towards this $1M target from the figures as the company keeps adding new sales people at a rapid pace, so present averages and the (present slow) increase doesn't tell the whole story.

This is likely to be a fairly slow process, but also an inexorable one. We know it's coming.

The company will have some 200 (140 direct, 60 legacy indirect) sales people by the end of 2019, if we put Q4 revenue at $12.5M that would be $250K per employee but we know it's a little higher than that because of the ramp within the quarter.

A "steady state" will be reached at roughly 400 sales people, after which the company will stop hiring (Q2CC):

we mapped that so we ultimately will have sales reps in 400 territories across the United States with a little less than a million citizens in each territory, and we expect to get there in approximately 23-24 months from today. So, we still need to add approximately 200 over the next eight quarters

So roughly by mid to end 2021 the company will be done expanding its sales force, but revenues will not be done ramping as the flywheel effect will still be at full force, with the newer hired people still rapidly expanding their installed base of devices, and hence revenues from supplies.

This means that until mid 2021, revenue will rise, but this will in part be offset by rising S&M cost as the company keeps on hiring, but this effect diminishes because:

Device revenue rises faster than the sales force ramp due to increased sales force productivity (which pertains to order generation).

Overall revenue will rise even faster because the installed base of devices sold keeps on growing, which generates compounding supply sales growth.

So we can expect considerable operational leverage, and things will get really interesting when the company stops hiring new sales people, by mid 2021 (or whenever it has reached that 400 target).

The sales per employee will keep on rising after that date as the newer sales people ramp their installed base, and hence revenues from supplies, all the while when sales expenses won't rise anymore.

The end-point of this flywheel will roughly be the company with 400 sales people generating something in the order of $400M in revenues with 80%+ gross margin.

That is, in the "steady state" the company will generate $300M+ in gross profits, assuming a generous $100K per sales person, that's $40M at most

Additional growth opportunities

Opioid replacement

Other devices

International growth

Asked about the addressable market if the company manages to get into the first-line of treatment, replacing opioids, management had this to say (Q2CC):

That's obviously in the tens of millions of patients that are in so much pain that they seek some level of treatment for it. So, we're talking tens of billions when you multiply that by the revenue we typically see on an average prescription. So, it's in the tens of billions.

Getting into first-line isn't easy for a small device company like Zynex (Q2CC):

There's really two parameters, and they all spin around our sales force. One is obviously to have the geographical footprint, so we have sales reps that can meet with these physicians as well as physical therapists face-to-face and discuss our treatment option as an alternative. And second, the quality of those sales reps are obviously very important, as the better the quality of the sales reps and the message we can deliver, the more efficient they should be in terms of convincing the physician to write prescriptions for our device before they start heading into prescribing a whole lot of opioids for patients in pain.

We see this as a slow-ramp long-term opportunity, but one that could easily become very significant over time and leverages its existing sales force.

Then there are the additional devices the company has developed. Two of these (the NeuroMove and especially the InWave) are quite promising, but the company simply hasn't had the resources to market them:

Then they have the Blood Volume Monitor, but this is waiting FDA (and EU) approval, but this could be a $3B opportunity globally, according to management.

The company doesn't sell beyond the US, but this could clearly change when the ramp in domestic sales force is done and the company's cash flow will allow them to expand internationally.

It's amazing how cheap the shares were earlier in the year:

Conclusion

Zynex is aggressively adding to its sales force and that is bearing fruit, with orders for their NexWave increasing 30% sequentially and 95% y/y. The new sales force increase their orders by 50% in the first 90 days as a result of better training, and the faster they can establish a large installed base of sold devices, the more pronounced the generated flywheel effect will be from recurring supply sales.

Apart from that, the company will face a "steady state" when it will no longer add sales people but the revenue ramp continues. Given the 80%+ gross margin and the fact that the company is already profitable and generating cash, the effect on both cash flow and profits will be pronounced.

The company can leverage its sales force selling other devices and even build expansion abroad in a couple of years. We think the shares still constitute an excellent opportunity to ride these waves.

Disclosure: I am/we are long ZYXI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

(0)

(0) (0)

(0)