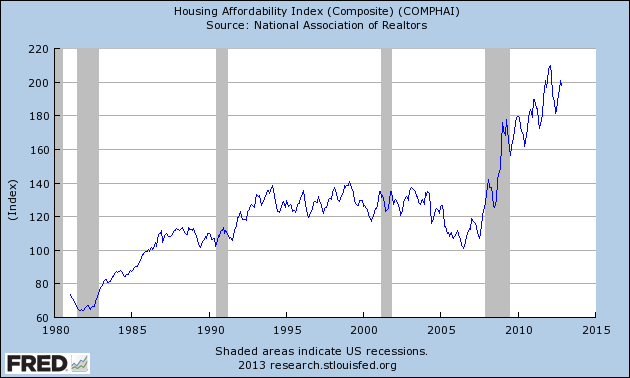

The combination of all time lows in mortgage rates along with the collapse in real estate values has resulted in all time record housing affordability.

During the inflation racked 1980?s, interest rate increases by the Federal Reserve resulted in double digit mortgage rates. High mortgage payments froze most home buyers out of the housing market since the average family only had about 65% of the income necessary to qualify for mortgage approval.

Fast forward three decades and the situation is completely reversed. The housing affordability index has soared since the financial crisis began in 2008. Home prices and mortgage rates are now so low that the average family could actually afford to buy two homes as seen in the chart below from the St. Louis Federal Reserve Bank.

A value of 100 is the point at which the average family with the median income has exactly enough to qualify for a median priced home. An index reading above 100 means that with an assumed down payment of 20%, the average family has more than enough income to qualify for the purchase of a home.

The current off the chart all time high readings of housing affordability of 200 tells us that the average family with average income can now afford to purchase two homes. Since incomes have been stagnant for decades, the collapse of housing prices had a hidden silver lining of allowing more Americans to purchase affordable housing.