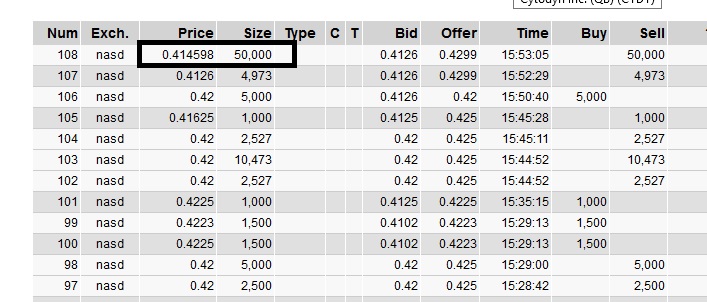

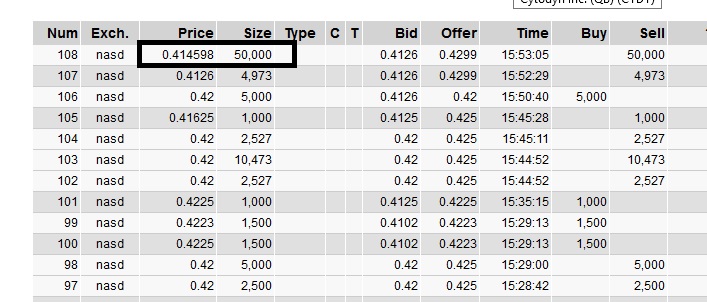

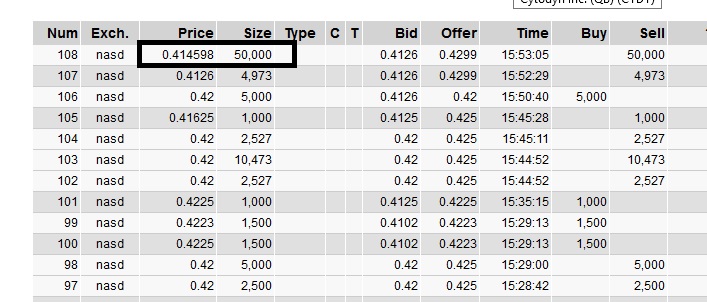

Alps sold 50k shares today, another crosstrade with 6 digits. I watched at the end of day and saw them move up off l2 just as this posted. They have been doing this for a few days now, in the past I have tracked these with other stock to figure out when the shares run out (usually you see a pop in otc stock after dilution ends). If you are not familiar, the note holder gives a block of shares to alps to sell. Alps shorted 50k shares today. Then they bought a 50k block of shares from the noteholder to cover their books at the discounted rate (usually 1-2% fee to sell). So the 50k block was to balance their books (cover the 50k short) and not really new volume. In other otc stock, sometimes these trades will post after hours, an after hour t-trade on otc is normally just balancing books.

50000 x 0.414598 = $20,729.90 is how much the note holder gets (after the discounted fee)

(1)

(1) (0)

(0)

(1)

(1) (0)

(0)