This group has made a lot of money on cydy; so the

Post# of 158026

It amazes me how their concept of warrant escapes that group.

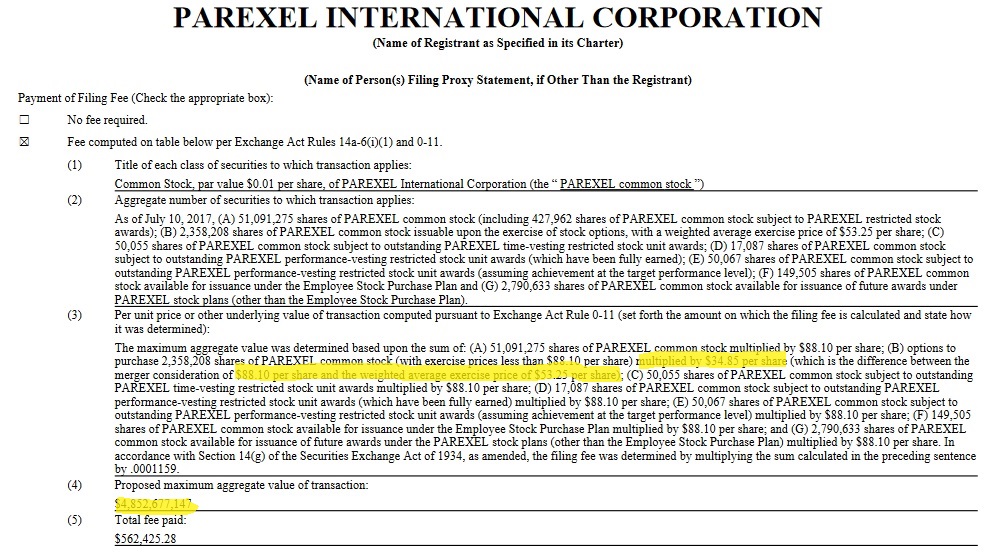

Last year, they didn't know in a buyout the full price is not paid for the warrant, it is the difference between the price and exercise price. It irritated me to the point I found an example to show them.

Quote:

trding - now that was creative Black-Scholz (sic?) math? (o8>

I doubt that the BO party is related to the Warrant holder,

so this strike reduction doesn't really work here.

My response:

https://investorshub.advfn.com/boards/read_ms...=143745814

They still don't grasp how to weight the warrants with the TO

Until today, they have raised cash at $0.40/sh for 1.5 shares or $0.2666/sh twice to existing Warrant holder in a tender offer, gladly public stock price was reluctant to match the tender offer.

I am also trading a stock and came across fine yesterday posting a bearish sticky based on cashless warrant exercise (I guess she is shorting it) It was clear to me she didn't understand how those work either.

I believe the saying goes a little bit of knowledge can be dangerous.

(3)

(3) (0)

(0)