The following summary shows that the company has b

Post# of 40992

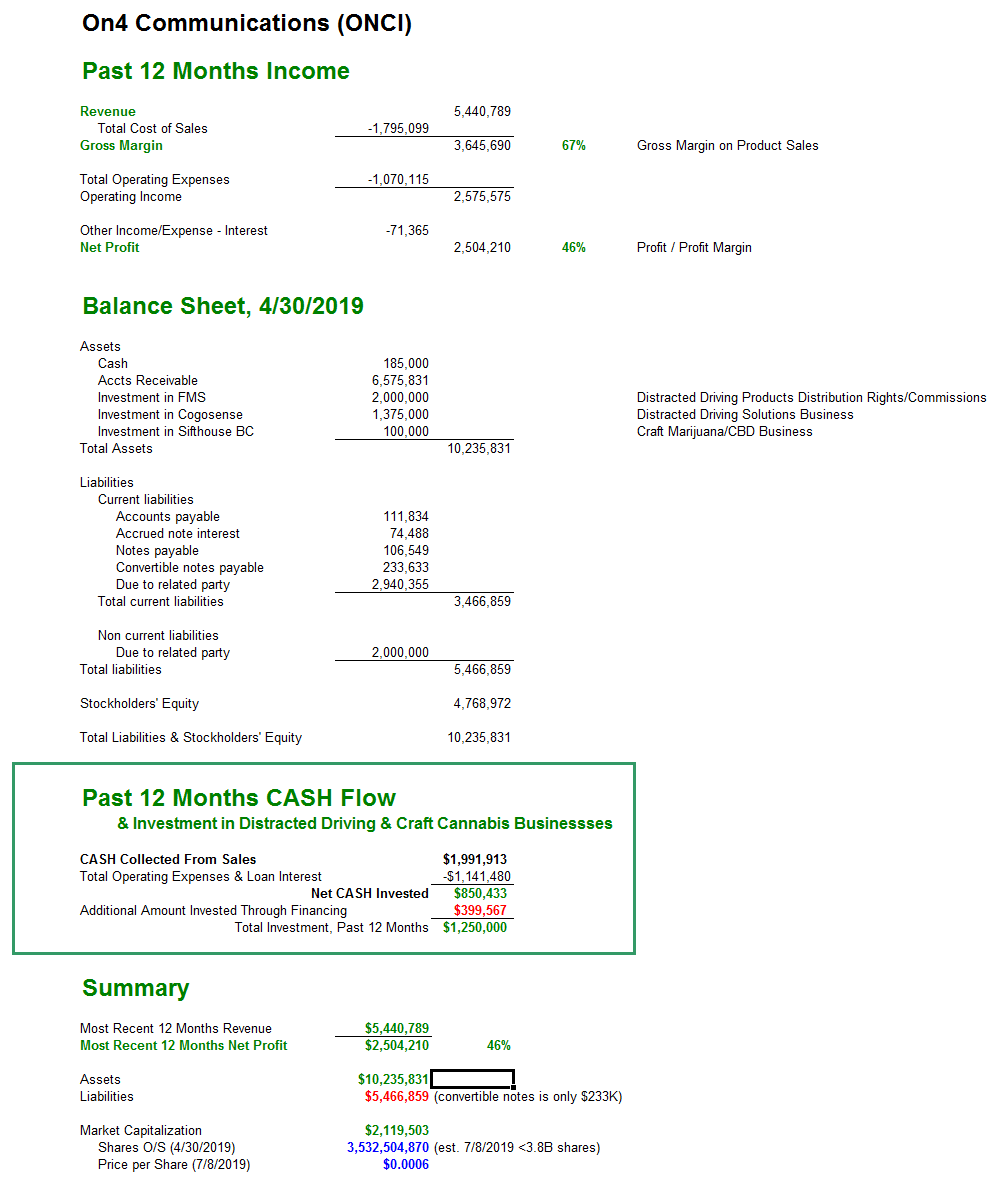

Turned a net profit of $2.5M with a 46% profit margin,

Received $2M in CASH from sales,

Reached over $10M in assets including an increase of $1.25M of cash invested in the Distracted Driving Solutions business, Cogosense, and the startup Craft Cannabis/CBD business, Sifthouse BC, while the liabilities are only $5.5M (of which only $233K are convertible notes) - resulting in Shareholders' Equity of +$4.75M.

Undervalued? No question. Even the most mundane business catagories command a PE ratio of 10x or better. 10x ONCI's profit over the past 12 months is 10 x $2.5M = $25M. This valuation is over 10x the current market cap of ONCI, which is ~$2.1M when the pps is 0.0006. And ONCI's business categories are anything BUT mundane. A PE ratio of 25+ is likely, IMO, when certain milestones are achieved and it breaks away from this penny mentality that retail has been favoring so heavily until now.

I say this is only possible because a small handful of retailers are playing with 50-100M shares each, and it's been fairly easy to control the price with timed buys and sell blocks during the continuous moderate dilution from the note holders and SB's cash-raising shares over the past year+ -- until anytime now. One announcement of a reasonable breakthrough, and many will be surprised to see that ONCI can run just as fast and hard in 2019 as it did in 2017.

(8)

(8) (0)

(0)