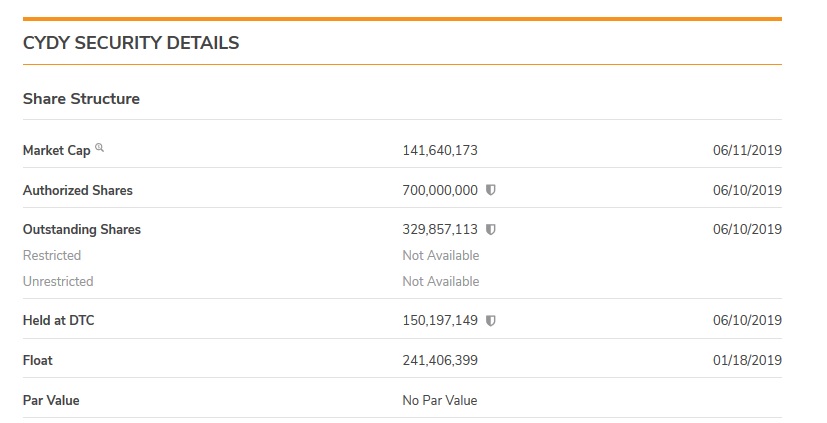

Yeah, OS and held at DTC up 400k, which is very li

Post# of 158050

They get shares at discount 15% last 20 days of lowest bid, say .38. Then they get shares at .323.

So those 400k shares went to $129k towards to loan, $45k towards interest and $85k towards principal.

They then get to sell into into spike like today. They can sell into any spike at the 15% discount before when the spike started, which I feel they are doing. This could be why we are getting big spikes lately that quickly sizzle out. So they are selling starting at 45c-44c, so 44.5c average for simplicity. That is $178k gross with $85k going towards principal. Not a bad gig. The second note conversions start in 6 weeks. Getting rid of at least one of these notes with money from either the TO or other agreement should be a very high priority.

(0)

(0) (0)

(0)