BLOG-6/5: Winning War Against False & Fraudulent F

Post# of 7574

Wednesday, June 5, 2019

HHSE: Winning the War against False & Fraudulent Foreign Judgments

Greetings HHSE Friends & Followers - We realize it's been frustrating for many of our longs, as we have not been authorized to release the details of the various legal maneuvers and activities regarding the disposition of false and fraudulently obtained foreign judgments against the company.

Absent of knowing the company's specific strategic information, it's easy for the chorus of stock "naysayers" to predict the worst... and repeat the same baloney from the past ten-years that these out-of-state judgments are very, very bad, and "oooohhh, you'd better sell me your HHSE shares now!"

However, for those of us living in the real-world, HHSE has shown a consistently positive result in contesting, settling or completely dismissing foreign judgments, especially when based on defaults or plaintiff misrepresentations. The Arkansas Code allows for foreign / sister-state judgments to be reviewed - and if merited - adjudicated within the State of Arkansas, and afford debtors with a variety of response opportunities and supporting regulations (including Ark. Code Ann. § 16-66-301), in support of proceedings against foreign judgments.

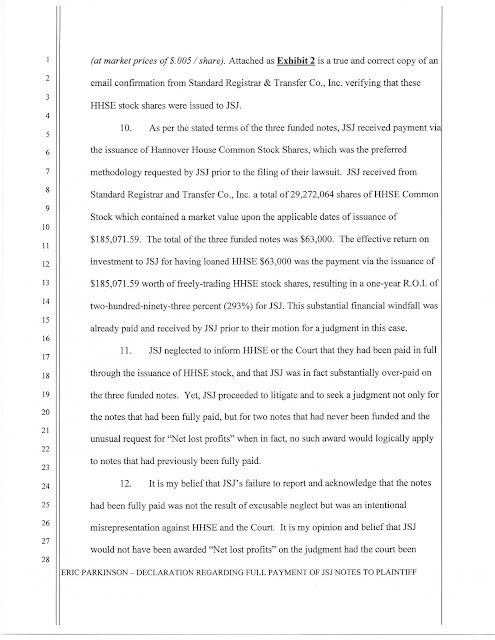

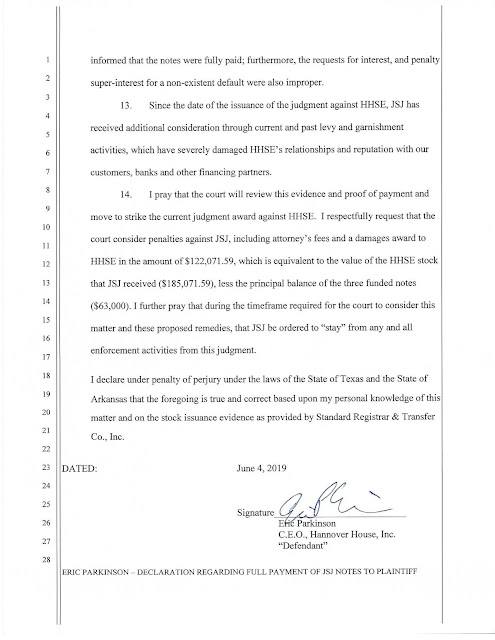

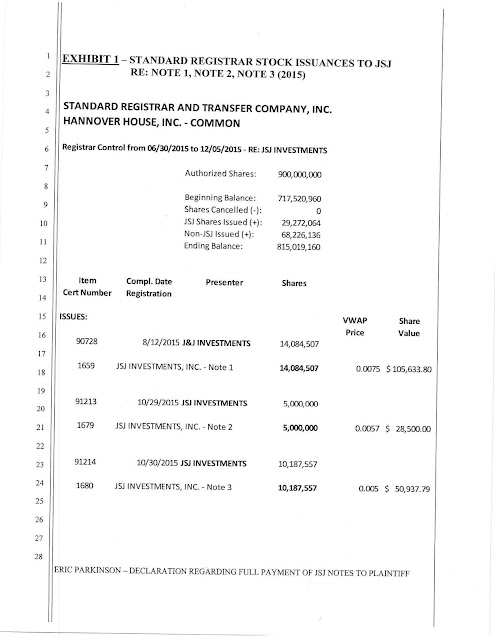

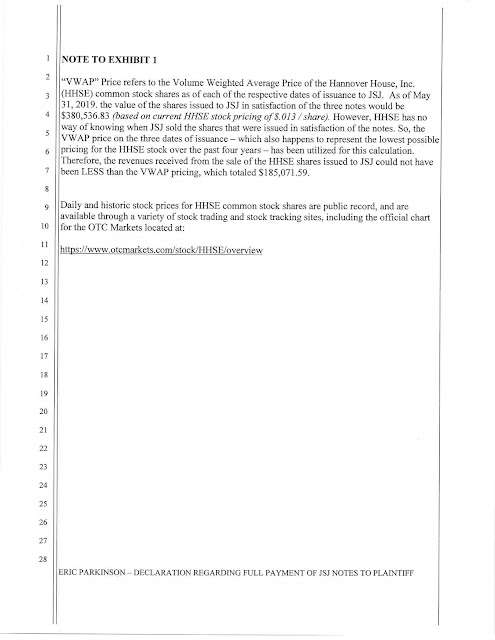

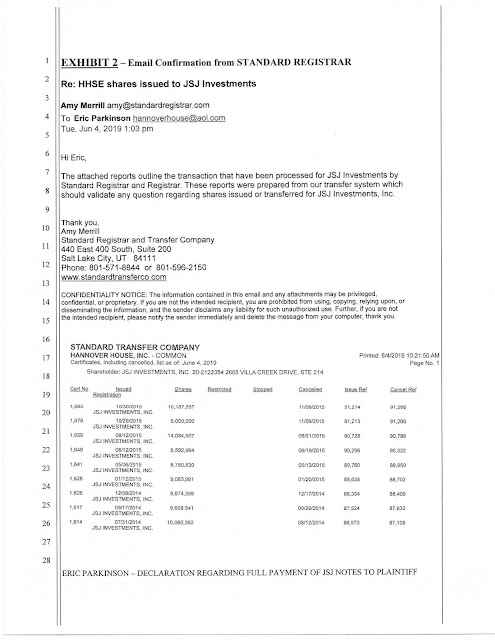

Sometimes, however, it's just as easy to file in the original State of a particular court's jurisdiction. In the case of JSJ Investments vs. Hannover House, our Arkansas attorney and our Texas attorney both agreed that the evidence of wrong-doing by JSJ was so clear and so severe, that filing in Texas (rather than Arkansas) might result in sanctions against JSJ and damages and legal fees for the benefit of Hannover House. Accordingly, the declaration (below) - along with an attorney's cover motion - is in process within the Texas courts to remove the JSJ judgment and to seek damages against them.

Without telegraphing the details of specific legal strategies in the other foreign judgments, we can provide a simple one-liner summary at this time:

1). BEDROCK - Company entered into three agreements that were fully "integrated" (like the three legs of a stool). Bedrock performed on only ONE of three elements, and failed to fund the other two, thus triggering a breach of non-payment by HHSE on the first item. Additionally, Bedrock appears to have fraudulently misrepresented that the sum of $300,000 was "loaned" to the predecessor company (Target Development Group, Inc.), which representation was never supported, but which provided the basis for Bedrock's demand for 200-MILLION shares of TDGI (HHSE) stock.

2). LEWIN - Company had no agreement with Lewin against which such a foreign claim can be supported. Absent of an actual agreement into evidence, this foreign judgment appears unlikely to meet the standards to make it incontestable in Arkansas.

3). ORIGIN RELEASING - Company was induced into a settlement agreement last fall based upon a distribution agreement that Origin brought into evidence, which contained a variety of "hand-written" changes to the deal-terms which were signed and initialed only by an Origin representative. Hannover House was unable to contest the veracity of this agreement placed into evidence because we could not find a 'clean' executed copy without these hand-written changes in the deal terms. However, such evidence of a clean, executed contract was located a few months later, as a copy of the unaltered document had been provided to a third party licensor and since made available back to HHSE. Accordingly, the Origin matter can be re-opened for adjudication in Arkansas.

Any other current or ongoing legal disputes will simply be disclosed in the Form 10, along with management's assessment of the risk levels, if any, to the company.

The elimination of these judgment matters has a positive benefit to the company's balance sheet as well as to the enthusiasm for new shareholders to embrace the new business model. HHSE will no longer be acquiring micro-budget and low-budget films from novice producers in the future. These titles have minimal commercial value - and often result in ludicrous litigation claims against the company. There's no upside to dealing with producers of small titles, as there's no sales potential in the current marketplace that eschews DVD sales for the currently growing model of digital streaming.

The future revenue streams for HHSE will be driven by a handful of HHSE-produced (or facilitated) MAJOR features (thus, without any third-party majority owners), and with the incredibly exciting, multi-studio streaming site, MyFlix. We cannot be assured that someone in the future will never again file a frivolous / baseless or outright fraudulent claim against HHSE. But we can state that it will not be from activities relating to the DVD release of micro-budgeted films that in recent years have generated little or no net sales! That former business model is shelved!

ONWARD!!

http://hannoverhousemovies.blogspot.com/2019/...false.html

HHSE

(2)

(2) (0)

(0)