I imagine calculating "fair value" for warrants is

Post# of 33213

I won't post a link to an options calculator partly cause I'm lazy, partly cause I don't know if that same calculation works for warrants and also I kinda don't want to be the reason someone takes up option (or warrant) trading since some people won't consider the risks involved beforehand. I know I didn't and I don't want to help get anybody into a financial mess. (I like Red's and Maui's constant disclaimers on the mb - "do your own dd, don't do something cause i said so, etc."

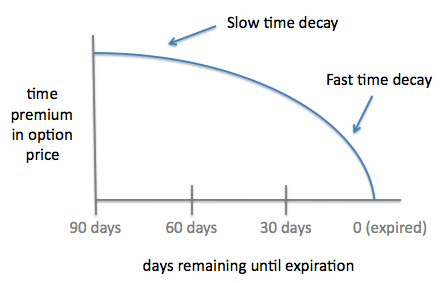

Handy illustration of Time Decay ( Theta ), see how fast time value melts away the closer we get to expiration?

Quote:

Many options traders rely on the "Greeks" to evaluate option positions and to determine option sensitivity. The Greeks are a collection of statistical values that measure the risk involved in an options contract in relation to certain underlying variables. Popular Greeks include Delta, Vega, Gamma and Theta. Rho is another value you may encounter (click here for an explanation).

...

Delta – Sensitivity to Underlying's Price

Vega – Sensitivity to Underlying's Volatility

Gamma – Sensitivity to Delta

Theta – Sensitivity to Time Decay

...

Trading and analysis platforms, as well as online calculators, provide options traders with current Greek values for any options contract. Figure 12, for example, shows the Delta, Gamma, Theta, Vega and Rho values for both call and put options. These values will change as other variables, such as strike price, change.

https://www.investopedia.com/university/optio...greeks.asp

(7)

(7) (0)

(0)