There is a lot of assumptions to calculate such es

Post# of 157833

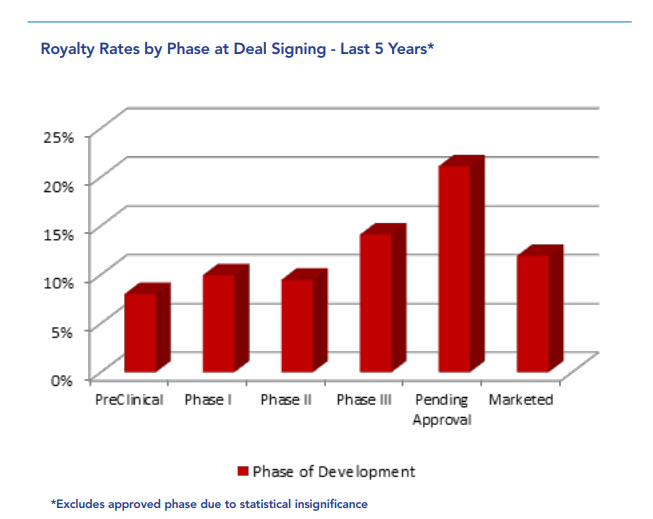

I'll stick to your $1B revenue number in the question instead of trying to guess another number with a lot of additional variables such as FDA approval time frame, market penetration, drug costs, etc. At this stage in the trial and FDA approval, IMO 18% is a conservative / reasonable / fair royalty rate for combo HIV (this varies by up-front/milestone payments, how far along in the trials the drug is, etc.).

https://pharmaintelligence.informa.com/~/medi...report.pdf

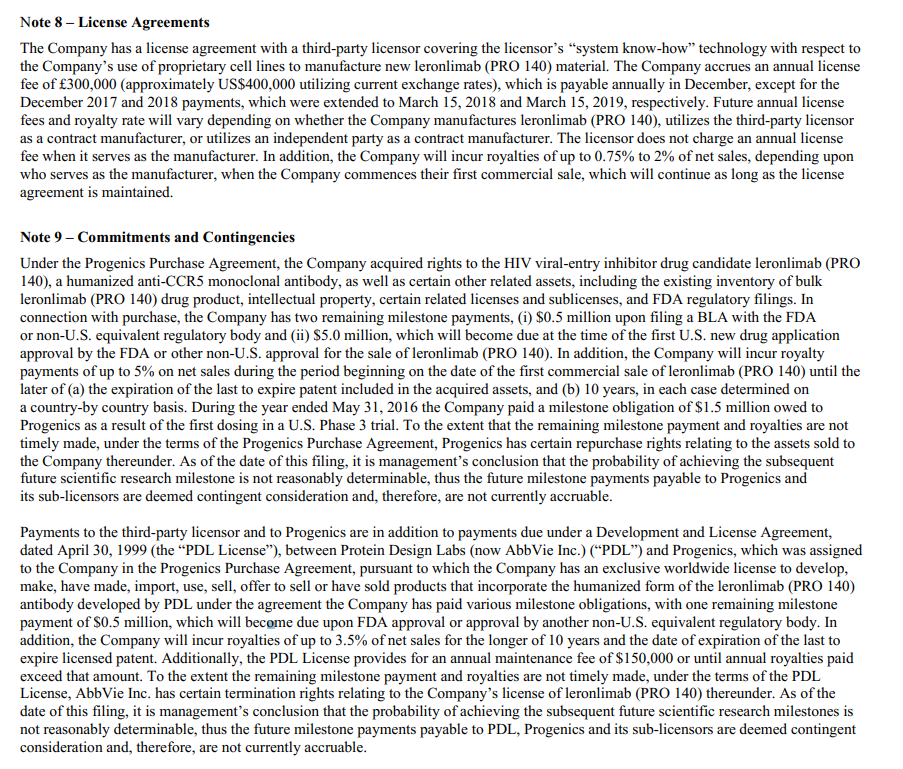

We don't know the terms and revenue threshold limits, but they owe up to 10.5% to other companies (5% to Progenics, 3.5% to PDL/AbbVie, and 2% third-party licencor....see Note 8 & 9 in the Jan 9, 2019 10-Q).

https://ir.cytodyn.com/all-sec-filings/conten...005378.pdf

Based on 18% royalty deal, this leaves CYDY with 7.5% for their revenue (IMO the above percentages are conservative, so the final rates could be higher). 7.5% of $1B = $75M. Valuation on companies can be done multiple ways, but one of the most common is price to earnings ratio (P/E)......pre-revenue companies use price to sales (expected sales) and 4-1 is in the range for biotechs based on my previous research. Since we are talking revenue, I will use P/E of 15 (which is also conservative as this website has biotech P/E at 22.74 and historically has been much higher in the 30+ range).

https://csimarket.com/Industry/industry_valua...mp;ind=801

$75M revenue assuming 75% profit margin = $56.25M Earnings

assuming outstanding shares equals fully diluted shares or authorized shares of 600M

Earnings Per Share = ~$.094

multiply by 15 P/E = $1.41 Share Price

Market cap is determined by multiplying the current share price times the number of outstanding shares. So in this case $1.41 share price times 600M outstanding shares = $846M Market Cap.

(0)

(0) (0)

(0)