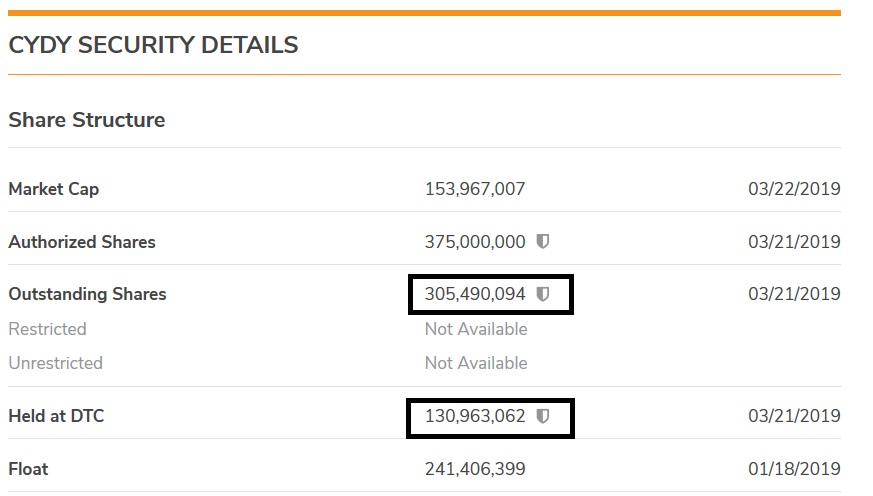

share structure update. OS went up slightly,

Post# of 158030

OS went up slightly, I suspect from the 24 month convertible note. It is 350k per month discounted to 15% of the lowest bid within 20 trading days, which is .4801, my bid I partly keep gtc just for this reason. That should be 850k shares. Some are being slowing sold, alps I believe is the seller.

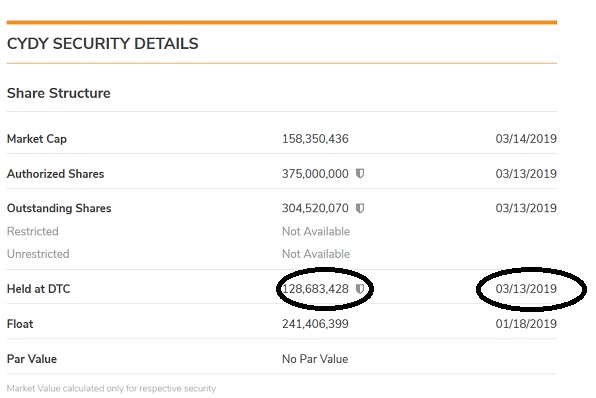

Also, held at the DTC increased also 2M, as these new paulson shares are being sold into the trading float at the DTC.

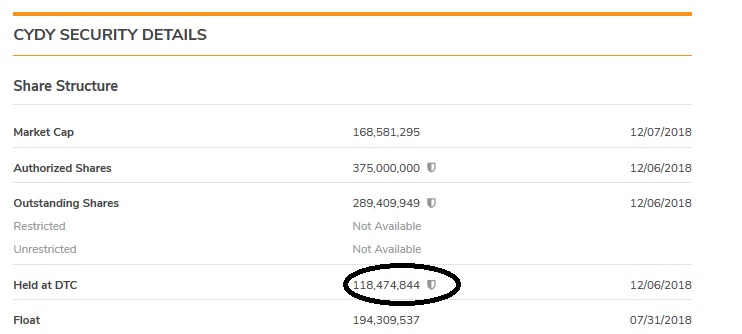

Again to get an idea of how many sold on previous placements, back in December, 118M at the DTC in December. It seems to run about half of the unrestricted or so before as I have been watching it 110Mmat dtc and 200M o/s last year. We have added 12M since then to the DTC and 46M placement shares sold became unrestricted. Based on the past, I would expect another 11M or so more to be sold, but they could hold now we are this close to news...especially non-dilute news, as I suspect some are selling expecting one last round of financing. It has worked out great for them in the past, but it works until it doesn’t. This last small raise seems to point to a deal coming soon, otherwise I would expect a request to raise the AS... though they still have some shares available to sell before that is needed, but the approval takes some time, so if that was the direction, they would be issuing the request asap.

(0)

(0) (0)

(0)