Welcome to the board sjacobs. I've been reading y

Post# of 157853

For shorts, I am guessing that large short position could be pauslon investors shorting ahead of getting shares, which they cover with once they get them. That offering was open for a very long time, this option would be one way to sell before getting shares. We will see when the next short report come out.

There was a theory eetrog was short. Maybe, but normally I would expect him to go quiet after covering, the about-face after the dip, makes me think he was just trying to manipulate the price down to buy shares.

I like newrunner's info on ihub, he is a close insider to NP it seems, and has a different opinion here, so I stopped talking about it on ihub, at some point we are beating a dead horse. If you look at when the first shares in 2016 were released, you can see paulson investors clearing selling day 1 for those that have not seen this graph I posted before. So, imo, all of this selling is from some of those investors. It makes sense from them to do this, until the cycle of warrants is behind us, which hopefully it is.

I think this is why your #2 is very important, engaging the paulson investors. I suspect that is why they held the event this past week. Short term, the price depends of if they hold or if they sell, encouraging them to hold is in everyone's best interest.

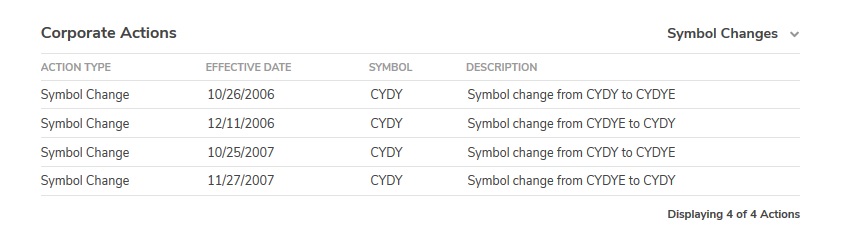

For the naked short, just to eliminate that possibility the company could do what they did in 2006 and 2007, change the name and change it back. I was thinking of a new name last night, maybe more related to leronlimab.

(0)

(0) (0)

(0)