For over the past year, the stocks of big banks have rallied significantly. Lower loan losses, a stabilization of the real estate market and a settlement with the government over shortcomings in foreclosure proceedings have all contributed to a growing conviction by investors that the worst is over for the banking industry.

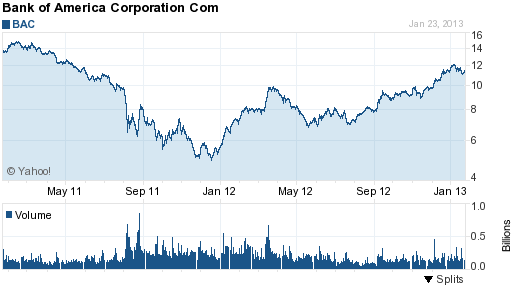

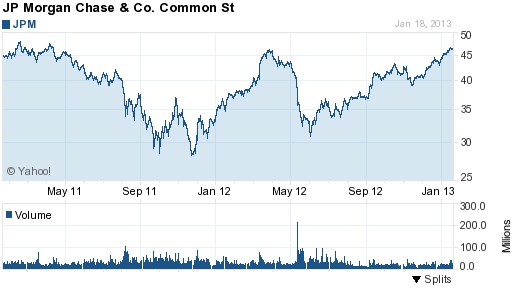

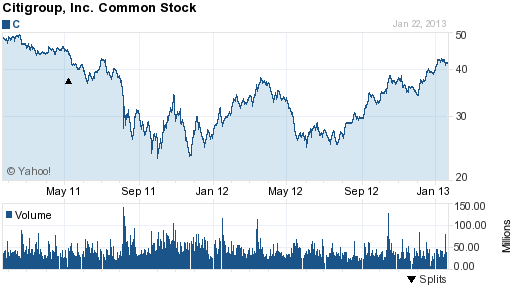

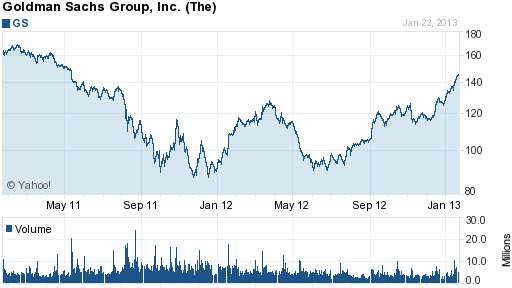

Here’s a look at the huge gains in share values of the five biggest banks in the country from the December 2011 closing prices to today’s closing prices.

| BANK | 2011 CLOSING PRICE | CLOSING PRICE JAN 23, 2013 | % GAIN |

| BANK OF AMERICA | $5.56 | $11.42 | 105% |

| JP MORGAN | $33.25 | $46.23 | 39% |

| CITIGROUP | $26.31 | $42.02 | 60% |

| GOLDMAN SACHS | $90.43 | $145.56 | 61% |

| WELLS FARGO | $27.56 | $34.95 | 27% |

Although Bank of America and Citigroup were two of the largest gainers over the past year, their share prices are still far below levels prior to the 2008 crash in bank stocks. Nonetheless, as a group, big bank stocks have had some phenomenal appreciation over the past year as seen below (all stock charts courtesy of Yahoo Finance).

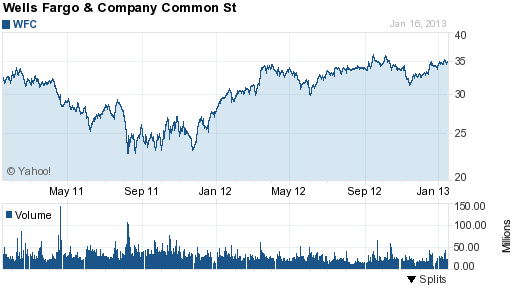

After such a stunning recovery in share values, it is worth considering the extent to which further stock price appreciation is possible. Judging by the recent price action of Wells Fargo, as an example, the market may have already discounted all of the good news to date.

In early January, Wells Fargo reported a better than expected 24% jump in fourth quarter earnings and a 6.3% rise in revenues. On the day Wells reported these better than expected results, the stock price declined fractionally to $35.10. Yesterday, Wells Fargo announced a large 14% hike in the quarterly dividend and again the good news was treated with indifference by investors. Similar price action was seen in other big bank stocks that announced good earnings reports.

When stock prices fail to advance on good news, it’s usually because investors were already expecting the good news and it was fully reflected in the stock price. Although the long term stock prices of the big banks may continue to appreciate, for now, it looks like the big rally is over.