Whatever happened to the concept of earning interest on savings? Since the start of the financial crisis in 2008, the Federal Reserve has aggressively suppressed interest rates to near zero.

Whatever happened to the concept of earning interest on savings? Since the start of the financial crisis in 2008, the Federal Reserve has aggressively suppressed interest rates to near zero.

The Fed’s rationale for lowering interest rates was to get the economy back on track by lowering borrowing costs for both consumers and businesses. Lower raters on mortgages would stimulate home refinances and purchases and stabilize the housing market. Lower rates for businesses would encourage them to expand investment and production which would result in increased jobs. Lower rates for the government means that massive trillion dollar deficits can be financed for virtually free.

The debate on whether or not Fed policies have helped or hurt will go on for years. The recovery from the recession of 2008-2009 is the slowest on record, housing values are still depressed and the jobless rate remains high. Many economists argue that the Fed is in a classic liquidity trap in which borrowers do not need or want to borrow additional money, regardless of the rate, thereby negating many of the economic benefits traditionally associated with low rates. In addition, savers are being deprived of billions of dollars per year in lost income by holding sterile bank accounts.

Most problematic of all for the Fed is what additional actions can be taken at the zero bound where rates cannot be dropped any further and even more critically, what policy action would be necessary if the economy slips into another recession? All of these issues have the Fed in uncharted territory in which “experimental monetary policies” are the only options left.

The typical saver does not understand the nuances of Federal Reserve interest rate policies – all they know is that banks are paying interest rates of close to zero on savings. This is no small issue since banks currently hold about $7.25 trillion dollars in deposits. The Fed is desperately trying to stimulate consumers to spend more money, but Fed actions have left savers with dramatically less money to spend on anything. Before the financial bust, it was easy to get 4% interest on bank savings compared to roughly zero percent today. Thrifty consumers who used to receive $290 billion per year in interest income now receive nothing. Retirees in particular have been forced to dramatically curtail spending based on the decline of interest income. In the battle between debtors and savers, the debtors have clearly been favored.

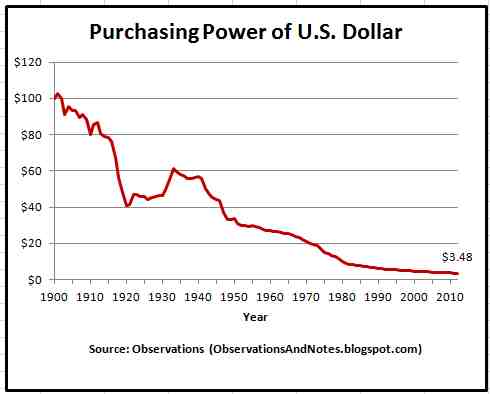

Bank savers would be even more upset than they are now if they realized that their real rate of return on savings is negative due to inflation. Each passing year with zero interest rates means that savers have dollars that buy less and less. Shown below are the real, negative interest rates, after taking inflation into account, according to the U.S. Treasury . As the chart shows, anything under a 20 year maturity translates into a negative rate of return.

| DATE | 5 YR | 7 YR | 10 YR | 20 YR | 30 YR |

|---|---|---|---|---|---|

| 01/02/13 | -1.36 | -1.06 | -0.62 | 0.22 | 0.47 |

| 01/03/13 | -1.30 | -0.99 | -0.54 | 0.31 | 0.56 |

| 01/04/13 | -1.31 | -0.99 | -0.55 | 0.27 | 0.53 |

| 01/07/13 | -1.34 | -1.02 | -0.60 | 0.18 | 0.49 |

| 01/08/13 | -1.36 | -1.06 | -0.60 | 0.24 | 0.46 |

| 01/09/13 | -1.41 | -1.09 | -0.64 | 0.20 | 0.44 |

| 01/10/13 | -1.40 | -1.05 | -0.62 | 0.14 | 0.47 |

| 01/11/13 | -1.40 | -1.07 | -0.63 | 0.16 | 0.45 |

| 01/14/13 | -1.34 | -1.00 | -0.66 | 0.10 | 0.46 |

| 01/15/13 | -1.45 | -1.12 | -0.66 | 0.17 | 0.43 |

| 01/16/13 | -1.43 | -1.11 | -0.65 | 0.19 | 0.44 |

| 01/17/13 | -1.40 | -1.07 | -0.64 | 0.17 | 0.47 |

| 01/18/13 | -1.43 | -1.09 | -0.66 | 0.16 | 0.44 |

| 01/22/13 | -1.39 | -1.04 | -0.68 | 0.09 | 0.44 |

| 01/23/13 | -1.45 | -1.13 | -0.66 | 0.20 | 0.44 |

Savers are currently suffering a loss of real wealth due to negative interest rates under current Fed policies. Worst of all, there is no indication that the Fed’s zero interest rate policy will end anytime soon.