Look Johnny, some of this is plain and simple. But

Post# of 40992

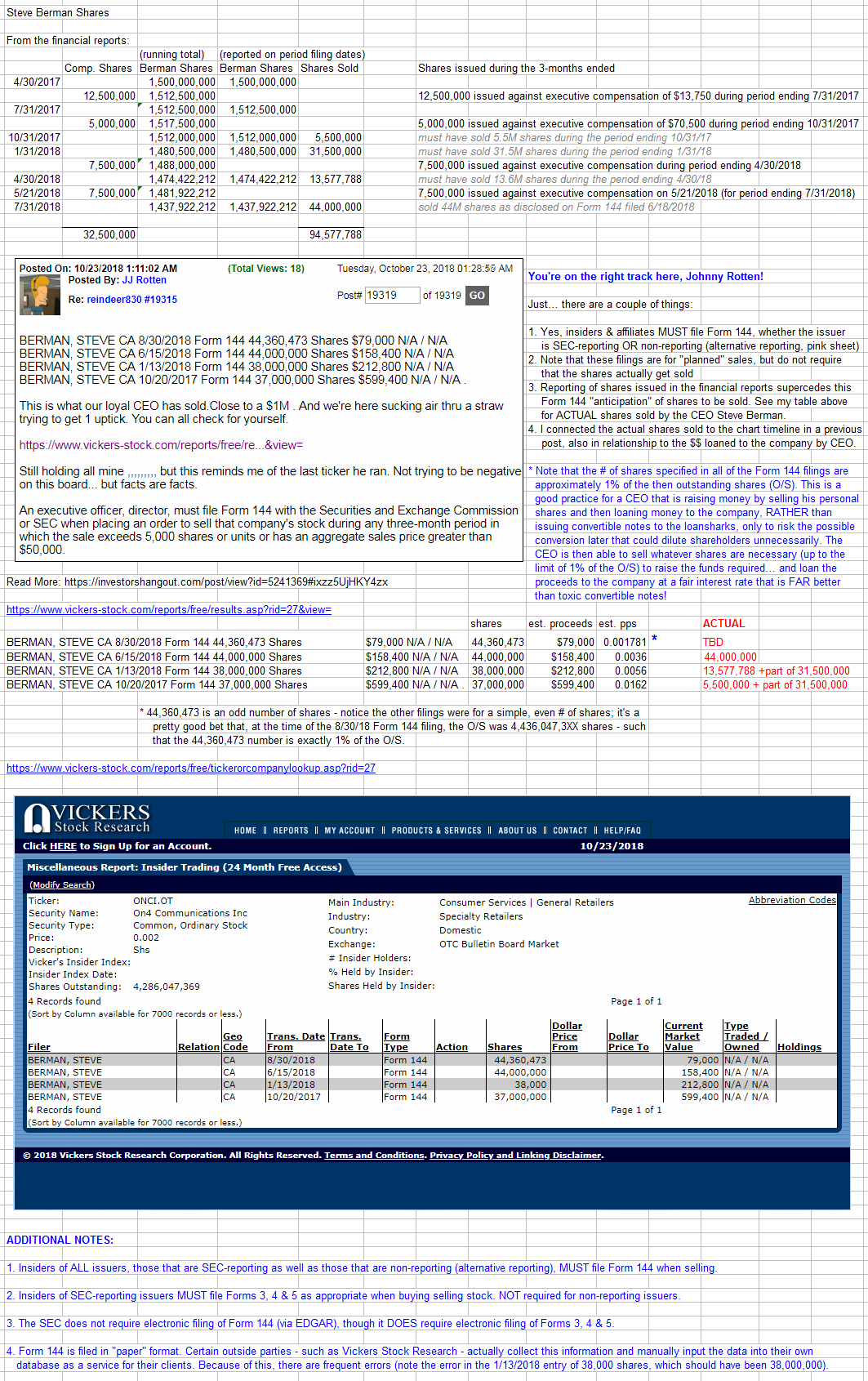

It's clear that the $599,400 sale never happened (37,000,000 shares filed for in October 2017). Instead, it was only 5,500,000 shares that got sold, yielding an estimated $55,000 in proceeds. You can see this from the table below where I've tracked the CEO shares from the financial reports giving shares acquired and held as of each filing date, from which the "number of shares actually sold" can be calculated.

The ACTUAL number of shares acquired and held are given in the financial reports. The shares filed for proposed selling in the Form 144 are just that: "proposed."

The simple part - -

This business is just starting to get funded by profits from sales. Until recently, it was first funded by some small convertible notes, and then by loans from the CEO (5% interest) as well as accrued salary (0% interest loans from the CEO).

It's plain to see that the CEO has been focused on cleaning up the balance sheet, removing various types of debt and liabilities, using every means possible while minimizing dilution of the common stock.

It's also plain to see that he's been very reluctant to take any cash from the company for compensation OR for repayment on loans. So any income needs that he may personally have... and any cash needs the company may have... are most recently coming from (mostly) product sales, but previously (mostly) came from selling the CEO's stock and most of the proceeds being loaned to the company.

The slightly less simple part - -

Just follow the flow below and you'll see that SB is clearly doing what is best for shareholders in order to fund the company and also provide cash for SB in lieu of compensation being paid out of the business sales-generated cash flow.

(9)

(9) (0)

(0)