Nice find, TP - you're Johnny-On-The-Spot! This is

Post# of 40992

Nice to see another liability eliminated from the balance sheet. I figured we were going to lose this one, but it's going to feel better just getting that "current legal action" off the financial reports.

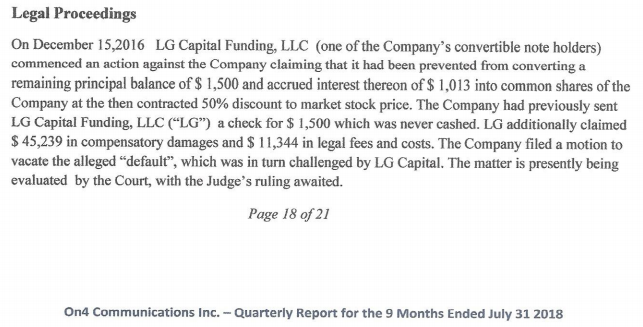

From the 2018Q3 report, period ending 7/31/2018:

I'm going to summarize my take on what appears to have happened with the LG Capital debt - it looks like SB tried to satiate LG with a cash payment of $1,500, but LG wanted more. I think it was worth a try, considering 1) the timing of LG's conversion request, and 2) the number of shares LG would have received.

Since the case was filed on December 15, it's likely (to me) that LG tried to convert within the past 2 months or so, most likely when the stock price lifted off the bottom from 0.0001, and when LG was likely to convert based on the lowest price within the past xxx days, etc. - WITH a 50% discount - resulting in a conversion price of 0.00005. For $1,500 + interest of $1,013, that's about $2,500 converting at 0.00005 which would give LG 50,000,000 shares.

Because of the timing, that number of shares could have been enough to dampen trader sentiment and cap off the initial pps run just as SB was trying to launch the new business. So... it looks like he was doing what's best for shareholders with that "prevention of conversion."

And now... those 50,000,000 shares are worth about $100K today. STILL a good idea to pay them the $55K settlement and go on down the road.

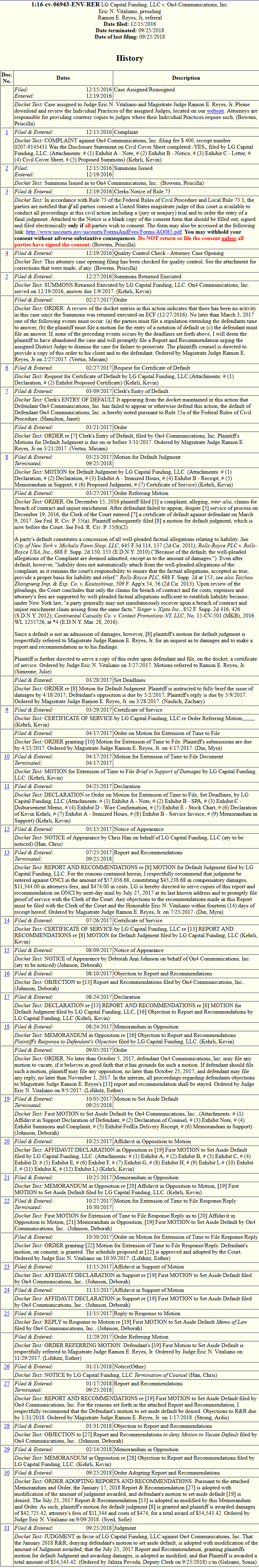

For those without a registration for PACER, here's the history of the case:

(4)

(4) (0)

(0)