That's okay, toodles, I understand. Just know that

Post# of 40992

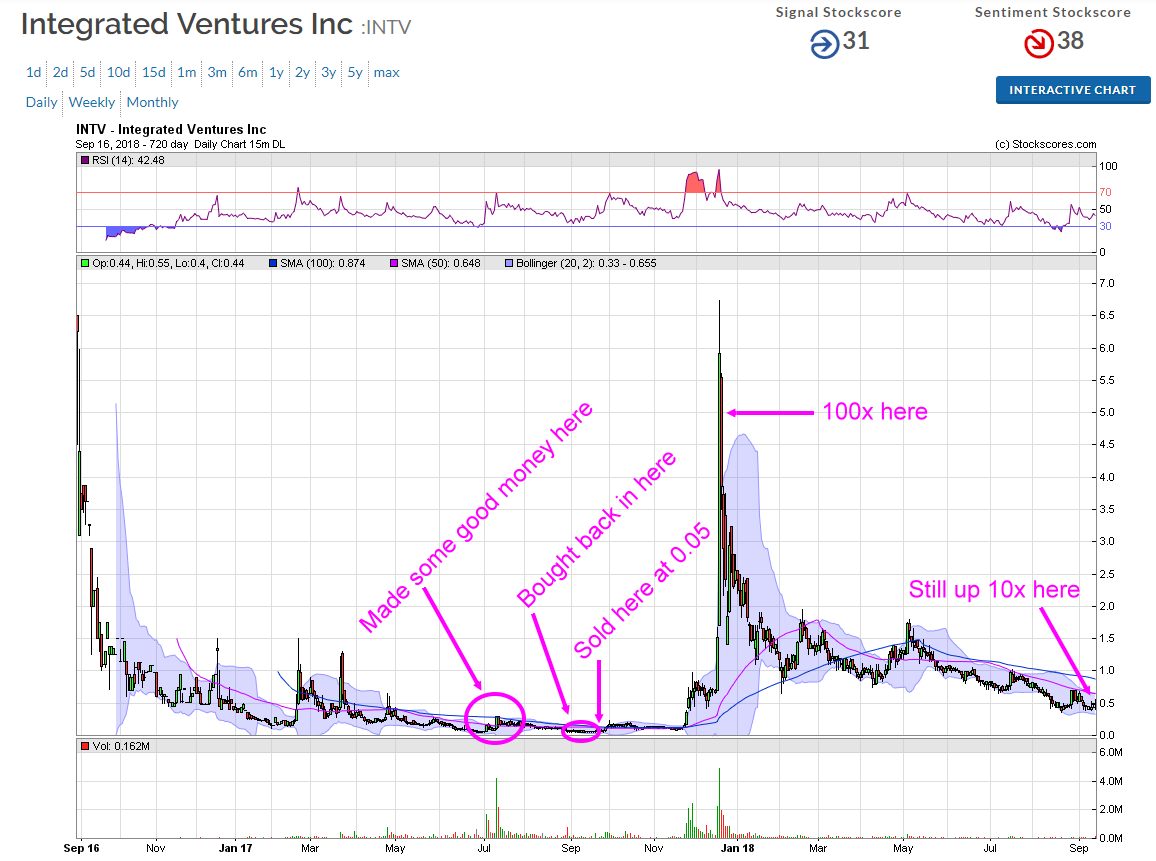

Last time I got emotional was just a momentary lapse of reason - okay, maybe also a little too much ego on my part, against the ego of the CEO. It was a little stock with the ticker symbol EMSF. I'd already made a killing on it from a recent run, sold, bought back in much lower for a small(ish) postion... but then there was a surprise amidst the changes the CEO was making with the direction of the "entity," and I called him (Steve Rubakh). I asked why he was telling shareholders certain things, seemingly putting out limited info without following through on certain claims and commitments, and it seemed like what he was putting out on the website was just to pump the stock but no beef behind it, etc. - much like what folks complain about SB - and he sortof gave me the finger. I told him I was holding a substantial position and that I'd dump them "tomorrow." He didn't care, he was cocky. I dumped the shares. Within a week or two he unveiled more details of what he'd been doing, and over the following 2 months it became a bitcoin company, changed the name and the ticker became INTV and it ran 100x higher than where I dumped (see the image below).

That was a bad call on my part. I called this a momentary lapse of reason because I wouldn't have sold at that time if I didn't feel "emotional" about the CEO's attitude, etc. What I should have focused on is what I normally focus on: "Can I make money here?" Fortunately, but unfortunately, I didn't really lose anything, pretty much broke even. If I was in the hole for a chunk of change I might have given it a chance to see which way it was going to go, rather than lose money (No matter what I think about the insiders of a company I've invested in... I don't cut off my nose to spite my face). But I figured I wasn't losing anything, maybe it would make me feel better to just dump the stock. And so there went a pretty good opportunity to make a half mil - if I held it all for the whole run I could have made a million, but I wouldn't have done that. I figure with the trade time/action I could have easily made half, though.

However, I DID do some "soul searching" sortof retrospective analysis on the situation, and I concluded that I need to step outside of myself a little bit and put myself in the CEO's shoes. The OTC is a tough place to be a CEO, there are all kinds of shitberd traders and manipulators stirring up all sorts of trouble for microcap issuers. These small companies - especially those with few employees due to the early phase in the business - are VERY limited in their resources, making the CEO's time and mindspace very PRECIOUS. It would take an absolute SAINT (or more likely a martyr) to maintain a good image an composure day in and day out and, over time, without someone looking over their shoulder or playing interference with "the public," there's bound to be screw-ups and foot-in-mouth situations... which leads to accusations and hate talk and... well, you can see where this leads.

Bottom line, end-result: I've taught myself more and more, better and better, to keep my emotions (related to the company/CEO/insiders) out of the decision-making process.

So here we are with ONCI...

The Q3 shows that we CONTINUED to pound away and get another $1.2M in revenue, higher than the last Q. This is before any significant contribution from the AutoNation or CarMax sales. So the company delivers another quarter of substantial sales AND fantastic margins. The company made a new and substantial payment toward the Cogosense acquisition, so any concerns about whether that deal was still standing, yada yada... all clear! MORE debt taken off the books, and we have confirmation of the selling pressure being the conversion of the LAM note AND it turns out that we had relatively FEW SHARES issued for that debt paydown...

I think I'm going to have a "Part II" to this post, so I'll just stop with this: What really matters here? If it's RESULTS, well the Q3 report shows F'ing GREAT results!

(5)

(5) (0)

(0)