Today's post. ApollyonZ Friday, 09/07/18

Post# of 40992

Quote:

ApollyonZ Friday, 09/07/18 11:54:15 AM

Re: ApollyonZ post# 181190 0

Post # of 189693

Onci! Well founded events, appraisement & my opinion

Onci was valued at $39M last Sept 2017! Today Onci is extremely undervalued with economic growth and future unrealized accounts, debt reduction, pending negotiations.

We have a Monster Pick

September 15, 2017

Currently trading at a $39 million market valuation ONCI on the books and significant rising debt that usually leads to significant dilution. ONCI is an exciting story developing in small caps; The Company is led by successful entrepreneur. Steve Berman and they are making big moves in the trillion-dollar mobile App space announcing one huge contract after another. ONCI has attracted a huge shareholder base who is bidding this one higher. We will be updating on ONCI when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with ONCI.

Monster Pick

Aegis privately owned valuation peaked at $28M, acquired zoomsafer for $5m plus undisclosed amounts.

Aegis Mobility raises $5m more, buys rival ‘distracted driving’ solutions firm ZoomSafer.

$5m plus some paid

Onci going public was smart move by CEO considering CEO acquired all of COGOSENSE for $2.5M and with A/R $3.1M sufficient to fulfill entirety of acquistion cost's. Baseline valuation last year was $39M with toxic debt, less assets. Where does that put us now with $5.5M assets, $3,1 A/R, $150k cash end of toxic debt (minus few million shares CFGN). How about the twitter and accounts pending announcement as listed in the financials and reported to IRS public ally available.

Apple recognizes

Aegis Mobility Creates the Industry’s First Safe Driving Enforcement Solution for Apple iOS

Apple Magazine

Why did competition lash out and how did it work out for them? Not very good but great for Cogosense. First on the block 32 patents.

Factual Background

Lets dissect the whole scenario.

Pay Attention: Distracted Driving Could Boost Your Insurance Rates By As Much As 41%

National Highway Traffic Safety Administration, 3,477 people were killed and 391,000 were injured in motor vehicle crashes that involved distracted drivers..That may not sound like much of a budget-buster, but it represents a premium increase of 7,944% since 2011,

Forbes

Warren Buffett says distracted driving will cost drivers

..With the mass popularity of smartphones and other devices, distracted driving is also becoming a greater problem on the roads..The agency estimated the costs of accidents..$412.1 billion.

Warren Buffet

Life on the Road: The Cost of Distracted Driving

Distracted driving..costs approximately $175 billion a year, ..HTSA) estimates that all highway accidents represent nearly $1 trillion in economic damages.

1 trillion

Insurance companies and affiliated pay economic damages per year $175 billion due to Distracted driving. All highway accidents represent nearly $1 trillion in economic damages.

Recent accounts

Carmax....During fiscal 2018, we grew total revenues by 8% to $17.1 billion,..grew retail units by more than 7% to 722,000 vehicles,..CarMax Auto Finance (CAF) income increased 14% to $421 million..

Autonation

new vehicle unit sales in 2018 ..16.8 million units..Our parts and service and finance and insurance operations, while comprising approximately 21% of our total revenue for the six months ended June 30, 2018, contributed approximately 74% of our total gross profit for the same period

..ended June 30, 2018, we had net income from continuing operations of $97.4 million..

AN-CM Retail

IBR Dec 18 $.024. IBR

..Insurance companies are the golden goose because they have so many policies in effect. The fact that they can save money by offering Bsafe to their policyholders is very appealing to them. It also provides great branding for them to promote the fact that they can save lives.

SHL

..CNA policyholders have preferred pricing that represents a 25% cost savings over the regular rate for Cogosense services.

CNA Cogosense

ICBC insurance to consider.

Insurance

In my observation insurance companies would rather pay $1b for Cogosense devices-Apps (100% return on their investment $2B) in addition saving-prevent $174 Billion dollars in paid economic damages. Customers save 25% from CNA insurance and other partners for installing Cogosense apps-devices, hence free roughly 18 months later @$250 upfront cost.

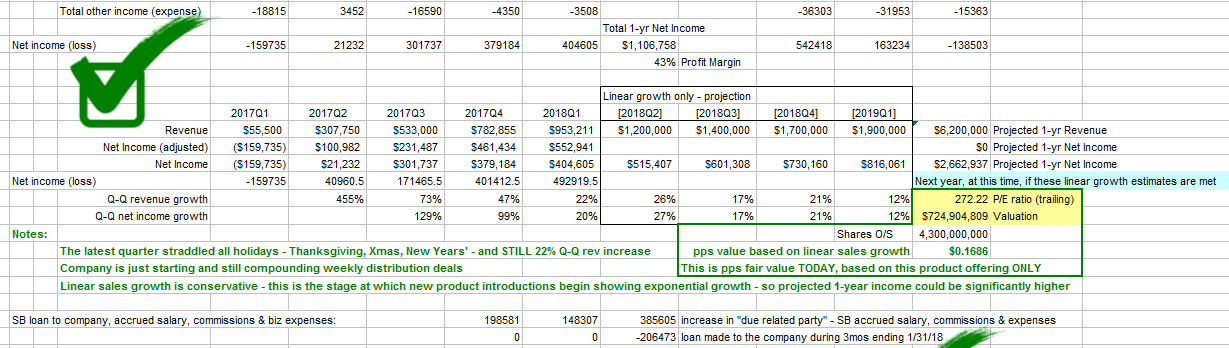

Cogosense valuation prior to Q3 or share reduction, where does that put us?

Sep 15 = Grossly undervalued

$500 M =

$100 M =

$1B =

Quote:\

Valuation

The above without 3 private labels, new fleet deals, Ford, Bmw, Big box etc IMO significant monies to be made.

Glta

https://investorshub.advfn.com/boards/read_ms...=143423531

(1)

(1) (0)

(0)