$GERN Geron: The Better, The Worse And The Uglier

Post# of 4531

https://seekingalpha.com/article/4161369-gero...rse-uglier

Summary

The Better - Michael West’s improbable search for the fountain of youth morphed into a potential cancer blockbuster that is getting ever closer.

The Worse - as Geron thrashes its way to price discovery, the dogs of class action warfare circle.

The Uglier - rumor, innuendo and excess are overtaking the stock.

Why I like Geron so much in today's market.

If you are a fan of morality plays and you don't like Washington politics, give Geron (GERN) a try. The play of good and evil, heroes and villains is becoming an integral part of the daily narrative surrounding this stock.

If one pays attention, disregarding the detritus of bulls fighting bears, one can unpack an attractive narrative for this stock. Only enter this mud pit if you have patience for nonsense and risk tolerance. Those who are sure of its prospects profess to be very, very sure; those who are less so may be equally adamant in the opposite direction.

Trying to maintain an even keel, while you keep up on the ebbs and flows of Geron's fortunes, is no easy task. This is my latest effort and is a follow up to my earlier Seeking Alpha article, "Geron: The Good, The Bad And The Ugly."

My personal bet is that those who dare will be well rewarded. If you are not patient, if you are not prepared for a total loss, the anxiety of owning Geron may wreck your nights' sleep for many nights to come. If you are so prepared, this may turn out to be the big one.

The Better - Michael West’s improbable search for the fountain of youth morphed into a potential cancer blockbuster that is getting ever closer.

According to one account, Geron started life in 1990 to satisfy an oilman's quest for immortality. Chapter 8 in Elaine Dewar's "The Second Tree: Of Clones, Chimeras and Quests for Immortality" tells the tale. Oil tycoon Miller Quarles helped to bankroll Geron with $50,000 in hopes that its visionary founder, Michael West, could parlay his discovery of a longevity gene into a cure for old age.

My first Geron article recounts how Geron's current CEO, Dr. John Scarlett, effectively remolded Geron in pursuit of a single goal - imetelstat. Currently, Geron is pretty much a one-trick pony, but oh what a trick it is.

Geron’s imetelstat has attracted one of the world’s most discerning biotech developers, Johnson & Johnson’s (NYSE:JNJ) Janssen Pharmaceuticals unit, to join it in financing and developing imetelstat for all human therapeutic uses. This arrangement was initially sealed with a collaboration agreement (“Agreement”) between Janssen and Geron entered into in November 2014. Under the Agreement, Janssen paid Geron an upfront payment of $35 million. At the current time:

Janssen is conducting two clinical trials of imetelstat: IMbark™, a Phase 2 trial in myelofibrosis, and IMerge™, a Phase 2/3 trial in myelodysplastic syndromes. Development costs for IMbark and IMerge are being shared between ... [Geron] and Janssen on a 50/50 basis.

... [Geron] remain

The IMbark study has a study start date listed on ClinicalTrials.gov of June 2, 2015. As I write on April 5, 2018, I am encouraged to note that the estimated primary completion date, which once seemed so distant, is now less than a month away, set for May 4, 2018. The action under the Agreement has seemed agonizingly slow. It is about to accelerate substantially.

The Agreement calls for Janssen to make a key Continuation Decision (the “Decision”) as to whether it wishes to opt-in or out of further pursuit of imetelstat.

Per slide 18 below from Geron’s 3/28/18 Needham presentation:

2018 has been an exciting year for Geron with more fireworks expected soon. Importantly, Janssen is expected to make the Decision by the end of Q3, 2018.

Geron bulls, of which I am one on this point, are expecting a positive decision.

The Worse - as Geron thrashes its way to price discovery, the dogs of class action warfare circle.

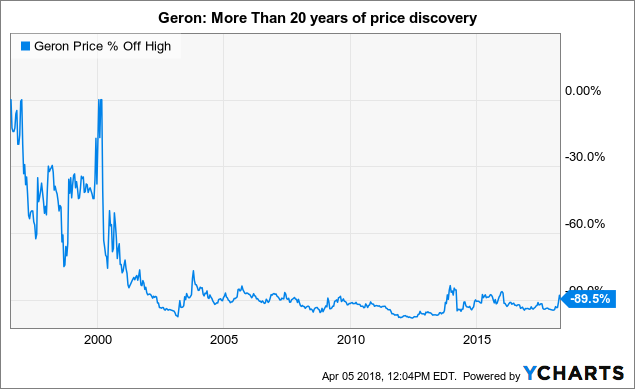

Some will tell you otherwise. However, I consider attempts to value early stage biotech as more art than science. Accordingly, such companies tend to have crazy price movements over their lifespan... none more than Geron, as illustrated by its long-term price chart below:

Before Geron's new CEO John Scarlett restored some semblance of order in the years following his 2011 accession as CEO, Geron's long-term trend was steeply negative.

It has certainly had its bumps and grinds during his tenure, often depending on the latest status of its Janssen collaboration, however the long-term trend is no longer steeply negative. So where does the worse come in?

I will attempt to maintain a respectful tone as I continue in my discussion. If I fail, perhaps I am slipping into recollection of battles waged tooth and nail in my prior life.

Last April, Geron settled a class-action securities suit for $6.25M. Now, as we maneuver through April 2018, brothers of the law have seen fit to notify one and all that Geron is in their sights again. I quote from one recently published notice:

On March 27, 2017, STAT published a report by Adam Feuerstein stating that Geron’s recent stock gains were due to “flimsy” claims regarding the efficacy of imetelstat, Geron’s experimental treatment for myelofibrosis. The report states that available data for imetelstat undercuts Geron’s representations as to the drug’s efficacy. On this news, shares of Geron fell $0.83 or over 13% to close at $5.15 per share on March 27, 2018. Geron shares continue to fall sharply during intraday trading on March 28, 2018.

Surprisingly, not, other similar noticesare coming in. If you care to collect them, throw “Geron class action” into your Chrome browser. Another handy source is likely available through your on-line broker's Geron news feed. I haven't counted, but there are many similar notices.

Now Geron has several legitimate corporate goals. The most important in my mind is providing therapies for cancer patients. The second is advancing the interests of its shareholders. Class action claims do zero to advance either interest.

As an aside, I recently got a class action settlement notice addressed to Facebook (NASDAQ:FB) shareholders. As I recall from my quick review of its tiny print, Facebook was paying $30 million in settlement of claims. It said I could send in a claim form entitling me to an estimated penny per share. I find this abusive.

Why should Facebook have to address such claims at the risk of exposing itself to endless rounds of discovery and attendant motions, all capped off by a jury trial with appeals following? Facebook paid a small price of $30 million to get relief.

Geron's insurance paid most of last year's claim against it. I assume, without having checked its 10-K, that Geron currently maintains some analogous coverage. I am sure it is not cheap, perhaps its coverage is less.

Accordingly, the cost to Geron of this latest round of potential suits, if they can't be handled with summary judgement, will be another deductible and strain on management resources. If there is another payout, it will likely cost Geron increased premium and tougher underwriting standards. Whenever a shareholder gets such a notice it is bad news.

The Uglier - rumor, innuendo and excess are overtaking the stock.

Geron is in play. There are bulls who see it going up to improbable heights. I will not name the values they expect.

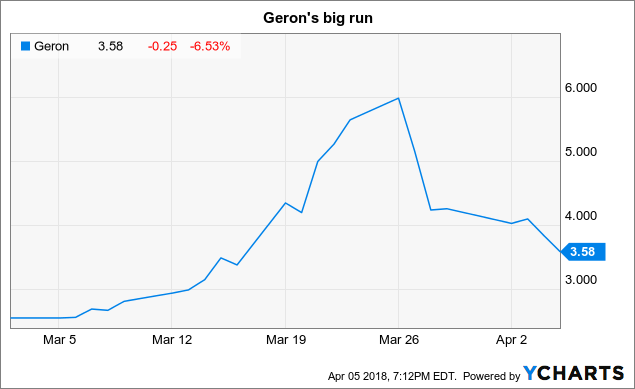

The run that Geron had following its March 12th, 2018 Earnings Call whetted animal spirits. For a few happy days, it seemed as if Geron's power and potential were unlimited. Then it started sliding. It dropped to $4.00 a share, took a stand there and then resumed its slide.

All the way down, Seeking Alpha's Geron comment streams were hot. The shorts who conspired to drag down Geron's price were regularly excoriated as common criminals. The SEC should open investigations. It would serve an author of a hit piece right if a family member with myelofibrosis were rejected for an imetelstat trial based on association of the family name to such hit piece author.

Never mind that natural exhaustion of short covering may have been what caused the rally to fade; never mind that excesses fomented by those actively hectoring all who urge restraint were goosing the rally; never mind that no stock keeps going up forever. America has seemed a contentious place this last few years. Certainly Geron fits right into such a meme.

Why I like Geron so much in today's market.

I regard the current general stock market turbulence as unsettling. Conservative, dividend-paying stocks are greatly in demand. Accordingly, they are highly valued. They are also subject to unnerving price swings. The known unknowns for safe stocks (oxymoronic as such a phrase may be) are particularly unsettling in an era when wars of various types (hot, cold, trade) are in the nightly news.

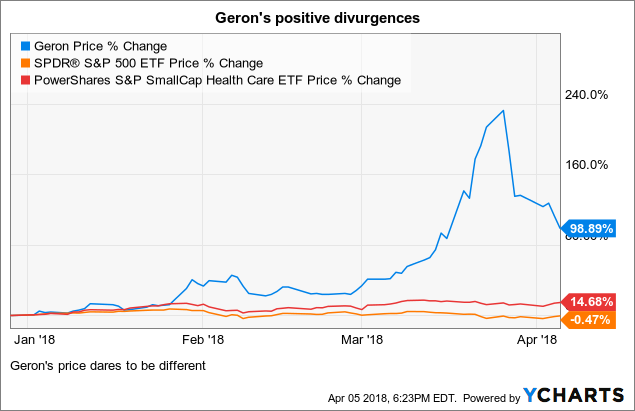

So little Geron, with all of its subtleties and risks, has an attraction. It will move to the tune of a different drummer than will the overall market. Check out Geron's 2018 price action compared to the SPDR S&P 500 ETF (SPY) and the PowerShares S&P SmallCap Health Care ETF (PSCH). Geron is marching to the beat of a different drummer.

Geron pays no dividend. It may come up a total cropper. Nonetheless, Its fate will likely be different from my other stock investments. As shown by the chart above, it has potential to take one's mind off the distractions of the daily news in a positive way. I have been long the name with a modest position for about a year.

I have been keeping a core position and selling covered calls on the rest. Selling a single April 20, 2018 call with a strike price of $6 per share for $85 on March 22, 2018 was particularly satisfying. If it gets called away on April 20 for $600, I will be a happy camper. In retrospect, I should have sold more. Shoulda, coulda, woulda.

Conclusion

Seeking Alpha comment streams following Geron articles remind me of mining for precious metals. To be sure there is plenty of turpitude sprinkled around of the sort I decry in the uglier bullet point above. These are counterbalanced by others that show great depth of knowledge, insight and analysis.

The bull case for Geron excites me. Imetelstat's potential to act as an important component of a cocktail of compounds attacking a variety of cancers is compelling. The best part about this story is the likelihood that we start an important next chapter by September 30, 2018.

If Janssen gives a thumbs down, we longs will have to regroup. No doubt we would have Geron losses to add to such losses as the market may serve to all comers in 2018. On the other hand, if Janssen gives a thumbs up Geron should find a comfortably higher price base.

Then, we can let out imaginations run wild. Is imetelstat the powerful cancer weapon that its supporters believe it to be? A phase 3 in MDS will be likely; a trial in AML expected. What goodies will a more committed Janssen be able to exact from the new more accommodating FDA to further imetelstat's approval timeline?

Is this a situation where we knowingly risk losing our entire investment because we have a credible chance of a double or more? The best part of all for those who are tired of endless waiting is the likelihood that news, be it good or bad, should come next quarter.

Good news does not always move a stock as bulls anticipate. In Geron's case, I believe the prevailing skepticism has kept the price within reasonable bounds. There should be room for a nice run.

In any case, I wish health and profits for all, longs, shorts and particularly skeptics who keep an open mind. On the health front, the benefits that an effective imetelstat would portend outstrip all other considerations.

As a last word, it is critical that Geron investors act carefully and deliberately. This is worth the time it takes to study the situation. Those who let their enthusiasms carry them away or who overcommit for their risk tolerance may act in haste and repent at their leisure.

Disclosure: I am/we are long GERN.

(0)

(0) (0)

(0)