OTCMarkets must think the SEC's case pretty solid

Post# of 990

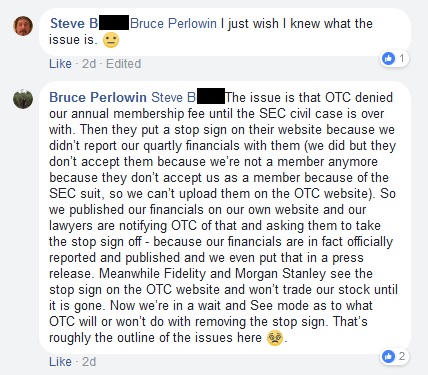

Here's something that Perlowin posted a few days ago on his Facebook page:

If OTCMarkets isn't allowing Perlowin and HEMP to renew its subscription to the OTC Disclosure & News Service -- which is all that is required for a pink sheet stock to post its news and filings at OTCMarkets -- then it must think that the SEC has a pretty solid case against Perlowin, Epling and HEMP.

It appears (from the dates in the OTC Disclosure & News Service list) that HEMP's subscription to the service ended on August 31, 2017, which means that HEMP was able to renew the service in 2016, after the initial case against HEMP was filed in June, 2016, but one year later, the weight of the legal filings must have taken a toll.

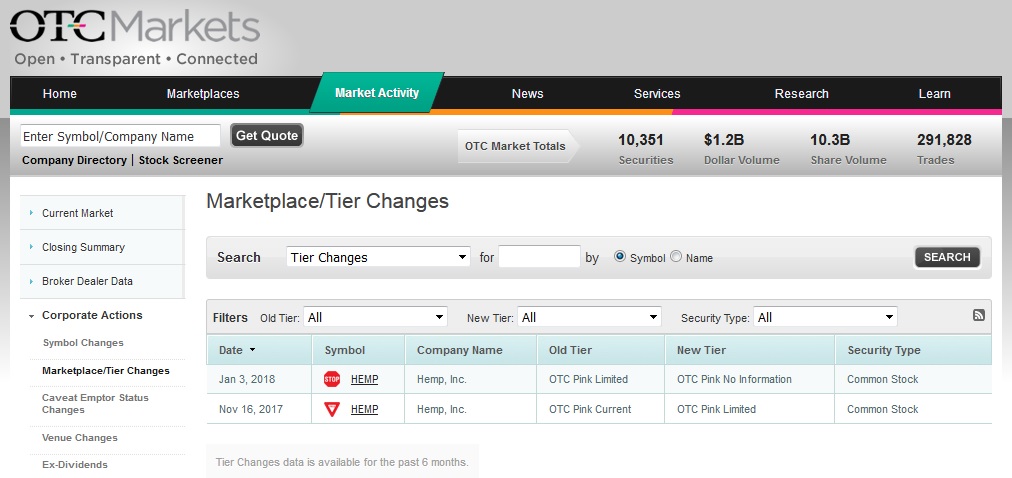

FWIW, the "downtier" of HEMP happened on Jan 3, 2018:

I don't know how successful Perlowin will be with his published-on-the-HEMP-website gambit, because to be Pink Sheet Current on the OTCMarkets site, the company has to have a subscription, with all news and filings published on the OTCMarkets site. If OTCMarkets won't allow HEMP to subscribe, then HEMP can't file on the site, and therefore, it will be considered a No Info (published on OTCMarkets) company.

Finally, the share dilution continues. HEMP and Perlowin added 443M shares to the OS in 3Q/17, taking it to 2.48B shares. That's an additional 1.25B shares added in the first nine months of 2017. Since HEMP gagged the TA in October, 2017, we won't know how many hundreds of millions of shares were added in 4Q/17 until the annual report is issued at the end of March, and of course, that will be the end of 1Q/18, when I expect HEMP's OT to exceed 3B shares.

(0)

(0) (0)

(0)