$NTFL: 3 STRAIGHT GREEN DAYS AND IT'S JUST CRANKIN

Post# of 109441

DOLLARS COMING

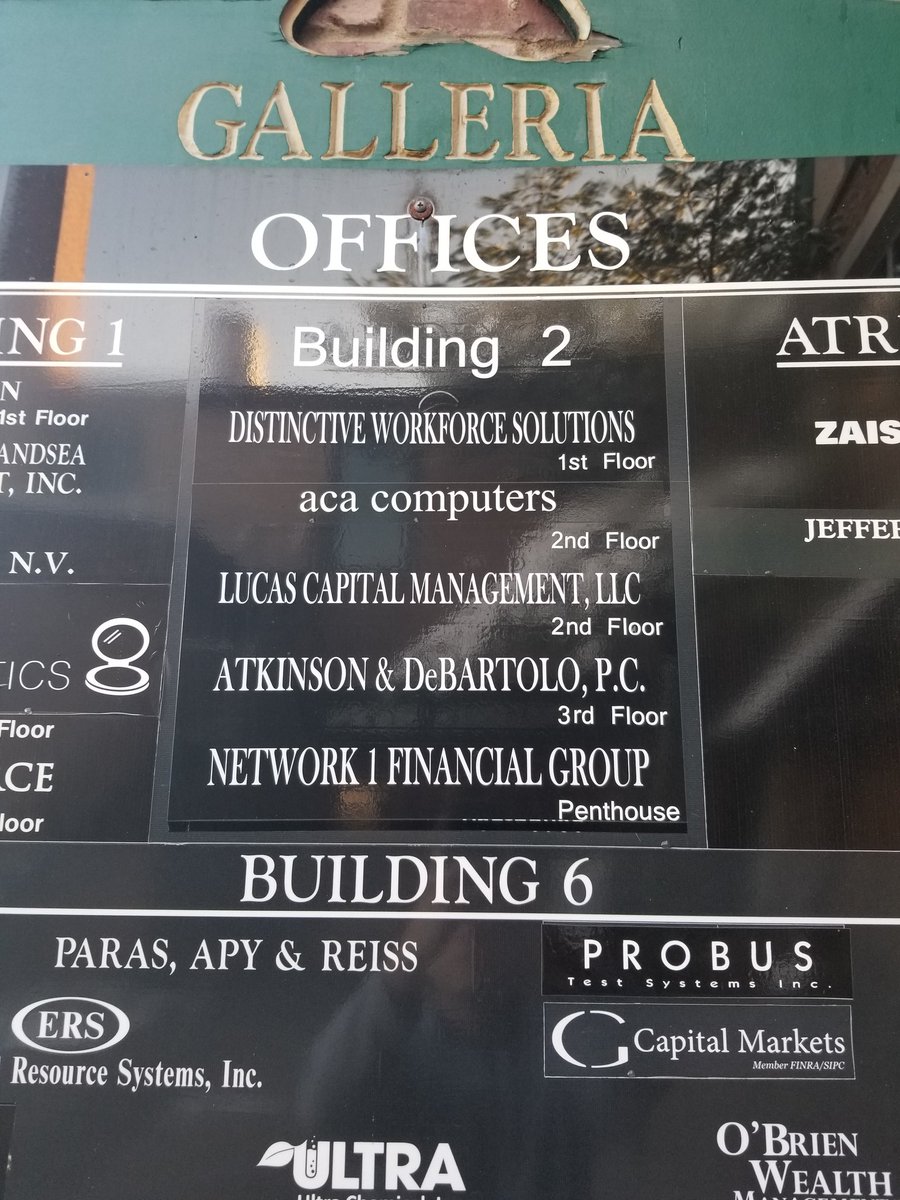

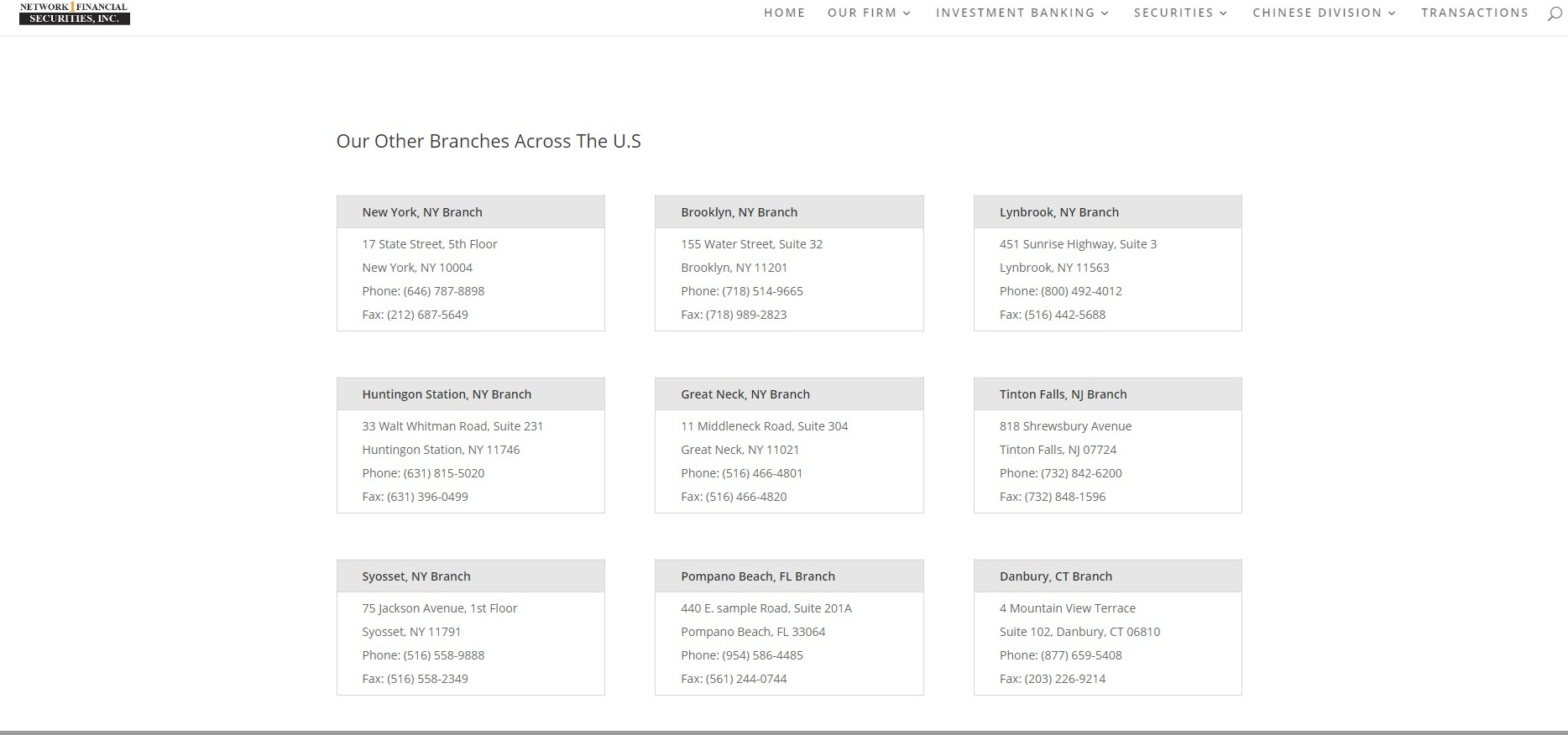

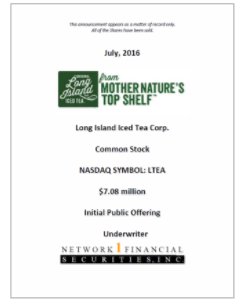

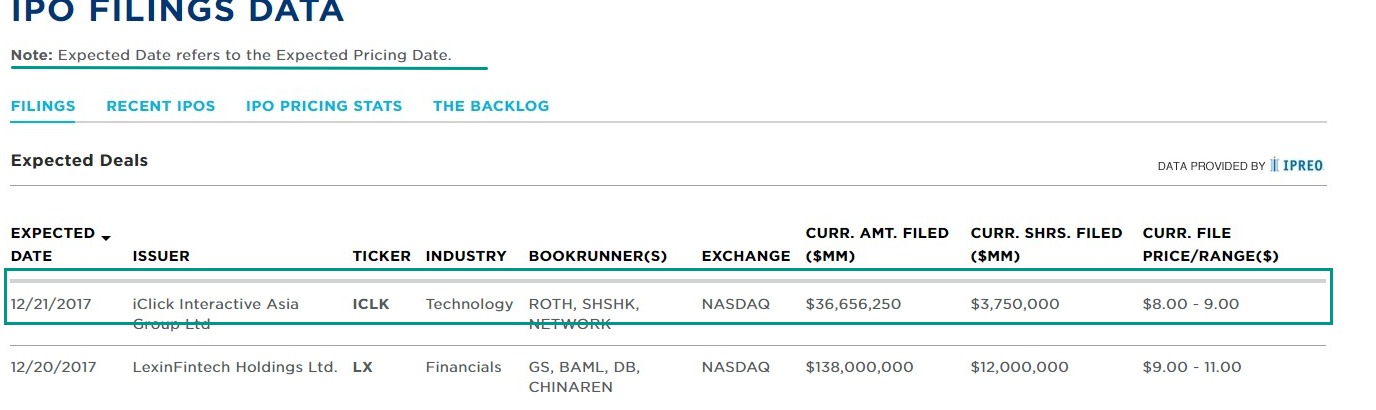

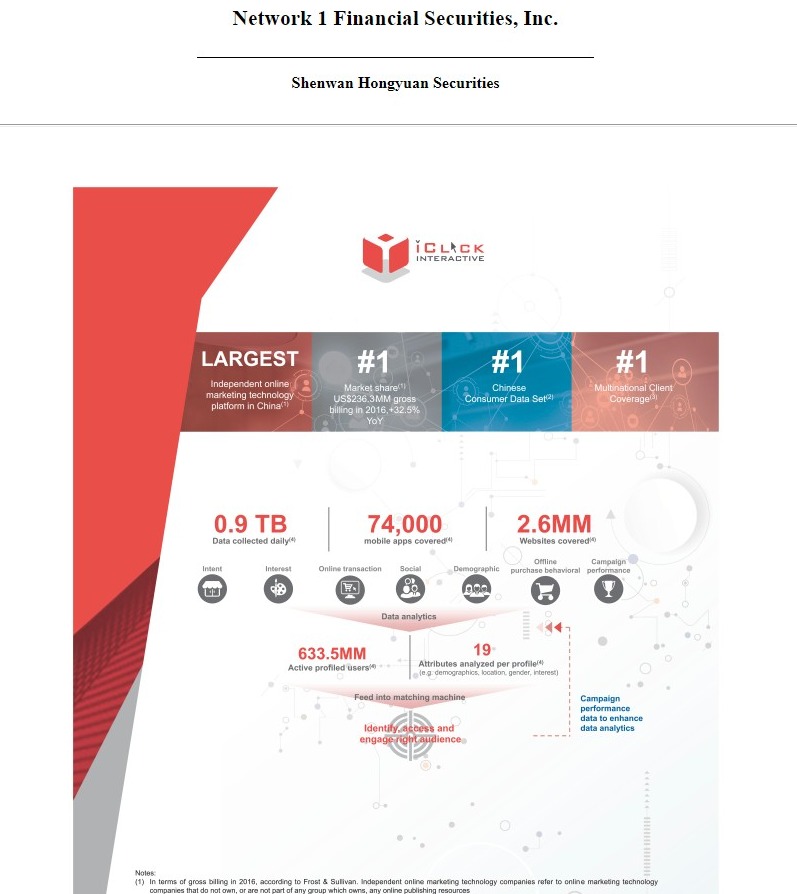

$NTFL: UNDERWRITING HUGE IPOs ON WALL STREET:

Penthouse and offices across the country!

https://www.streetinsider.com/Corporate+News/...63118.html

https://www.google.com/search?q=ICLICK+IPO+DA...p;ie=UTF-8

https://www.nyse.com/ipo-center/filings

https://www.sec.gov/Archives/edgar/data/16978...75df1a.htm

https://seekingalpha.com/article/4128169-icli...on-u-s-ipo

https://www.sec.gov/Archives/edgar/data/16996...7/pos9.htm

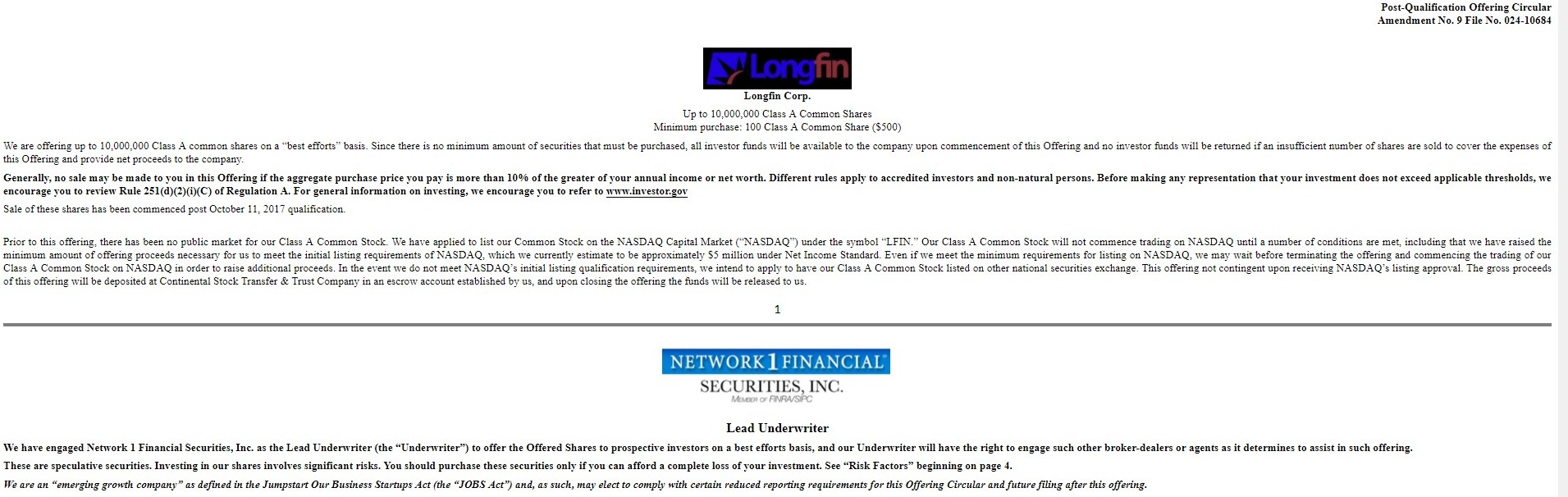

Underwrote LFIN which entitled them to buy 600k $LFIN shares at $7.50 each...they are now worth 10x that price

600k x $80(current price) = $48m THEY ARE CURRENT TRADING AT AN 11M MARKET CAP

COMPANY WEBSITE: http://network1.com/

Other recent transactions by company:

http://network1.com/recent-transactions/

LFIN IPO DOCUMENT: https://www.sec.gov/Archives/edgar/data/16996...7/pos9.htm

(1) We have entered into an Underwriting Agreement with Network 1 Financial Securities, Inc. (the “Underwriter”) to conduct this offering on a “best efforts” basis. We have agreed to pay the Underwriter a cash fee equal to (i) 7% of the gross proceeds from the first 3,000,000 shares ($15,000,000) sold in this offering and (ii) 3% of the gross proceeds from the sale of the last 7,000,000 shares ($35,000,000) sold in this offering. We have also agreed to issue the Underwriter warrants to purchase an amount of shares equal to 6% of the shares sold in this offering for $7.50 (150% of the offering price) per share exercisable from six-month date from the date of issuance until June 16, 2022, the fifth anniversary of the date this offering was qualified by the Securities and Exchange Commission. See “Plan of Distribution and Selling Security Holders” for more information on this offering and the underwriter arrangements.

We have agreed to pay the Underwriter a cash fee equal to (i) 7% of the gross proceeds from the sale of first 3,000,000 shares ($15,000,000) sold in this offering and (ii) 3% of the gross proceeds from the sale of the next 7,000,000 shares ($35,000,000) sold in this offering. The Underwriter may allow, and certain dealers may re-allow, a discount from the concession to certain brokers and dealers. After this offering, the initial public offering price, concession and reallowance to dealers may be changed by the representatives. No such change shall change the amount of proceeds to be received by us as set forth on the cover page of this prospectus. The shares are offered by the Underwriter as stated herein, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in part.

We have also agreed to pay the Underwriter a non-accountable expense allowance equal to 2% of the gross proceeds of the offering for the first 3,000,000 shares ($15,000,000) sold in this offering up to $300,000. In addition, the Company agrees to reimburse the Underwriter for expenses relating to the offering, including all actual fees and expenses incurred by the Underwriter in connection with the Underwriter’s “road show” expenses evidenced by invoices, and the fees and expenses of the Underwriter’s counsel which, in the aggregate shall not exceed $75,000, less the $25,000 payment previously paid by the Company to the Underwriter pursuant to the Engagement Agreement, dated June 30, 2017, between the Company and the Underwriter.

Underwriters Agreement:

https://www.sec.gov/Archives/edgar/data/16996...mended.htm

Recent Headlines:

https://insiderfinancial.com/network-1-financ...close-look

https://www.globenewswire.com/news-release/20...ASDAQ.html

"New York, NY, Sept. 06, 2017 (GLOBE NEWSWIRE) -- LongFin Corp. (NASDAQ:LFIN), today announced its initial public offering of 10,000,000 shares of its Class A common stock at a public offering price of $5.00 per share. The shares are expected to begin trading on the NASDAQ in October 2017, under the ticker symbol “LFIN”. Network 1 Financial Securities, Inc. is acting as lead book-running manager and underwriter for the offering."

Read More: https://investorshangout.com/post/view?id=488...z51wLsdDc6

http://network1.com/recent-transactions/

http://www.nasdaq.com/markets/ipos/offering-h...ies%2C+inc.

(0)

(0) (0)

(0)