So-ACS/SFOR could receive-payment by-Feb1st Tak

Post# of 82692

Take a brief walk with me as I speculate this with you...

So with merchants services needing to be PCI compliant by Feb 1st. could SFOR receive the HUGE PPS changing payment or payments we are hoping for by Feb 1st or before? Since their channel partner ACS per its COO (see below) is involved evidently in providing the security measure to many key huge businesses who are key players in PCI?

No inside info here. Just trying to connect the dots. From CJ Burnetts email to jtech (below) This has been posted by Zpaul check his archives.

Here we go:

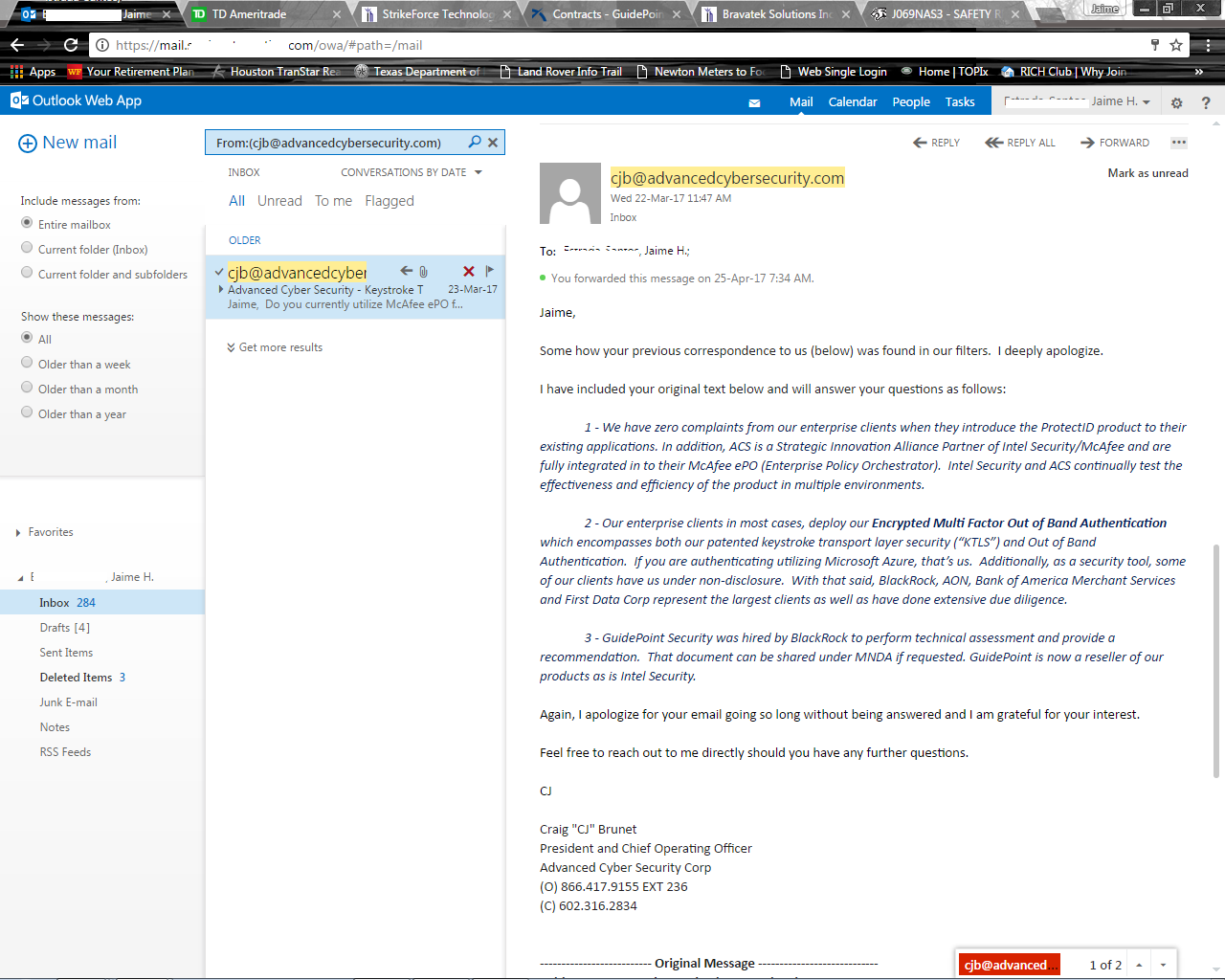

Since Bank Of America and Ropes&Gray client TPG who owns First Data Corp, came together to form BOA Merchant services in 2009 and per ACS's COO Graig "CJ" Burnettts email to jtech whose name is Jaime.

Per Burnett : First Data Corp and BOA Merchant services and Blackrock investments and AON are currently ACS's Clients , (see below)

And to be PCI compliant themselves, they have to have the compliant security measures in place for merchant services by Feb 1st.

Do I understand that correctly? (comments)

Wouldn't that mean then ,that they have to have the security measures installed by ACS prior to Feb 1st and in turn pay ACS when completed and in turn SFOR would be paid by Feb 1st or prior to that date when installed.

Help me connect the dots here (comments)

Wouldn't it stand to reason that they would have themselves installed the security measures for their business perhaps many many months ahead to make sure they worked out all the glitches?

Here is CJ Burnetts letter to JTech:

Jtech Member Level Monday, 05/15/17 08:26:59 AM

Re: Gold49er post# 163046

Post #

163191

of 194238 Go

Email confirming some LARGE deals made through ACS.

Quote:

"it takes about 3 months for them to get to us, we are getting them done

As of 3/22, some of the large deals ACS could talk about were

AON

Bank of america Merchant Services

First DATA corp

Blackrock Investments

First Data Corp owned by TPG

Bank Of America and First Data Corp came together to form BOA Merchant services in 2009.

About First Data Corp:[/Purple]

First Data Launches New Merchant Solution to Prevent Fraud Across All Commerce Channels

01 Jun 2017

Author: First Data

Category: Corporate

Fraud Detect strengthens line of defense for eCommerce, universal commerce, mobile, in-store, and at the pump fraudulent transactions

Leverages artificial intelligence and machine learning for real-time fraud scoring

In pilot test, Fraud Detect significantly reduced fraud risk for merchants

NEW YORK, JUNE 1, 2017 – First Data (NYSE: FDC), a global leader in commerce-enabling technology, today announced the launch of Fraud Detect, a comprehensive fraud solution for merchants around the world. Fraud Detect leverages artificial intelligence and machine learning, fraud scoring, cybersecurity intelligence, and information from the Dark Web to provide merchants with the capability to detect fraudulent in-store, at the pump, online, mobile, and in-app transactions before they occur.

Each year, First Data powers trillions of dollars of transactions around the world, including $2.2 trillion in 2016 . Using artificial intelligence, Fraud Detect analyzes those vast datasets to identify fraud and potential chargebacks. In parallel, Fraud Detect incorporates data from the Dark Web, a collection of websites that exist on an encrypted network, to enhance the power of the solution with information that would otherwise only be viewed by cybersecurity experts.

In a recent pilot, Fraud Detect identified and prevented fraud that was undetected by other solutions in the market. Overall, merchants in the pilot saw lower false positive rates and an 80% improvement in identifying fraudulent transactions before they occurred. Fraud Detect also scored and assessed transactions in less than half a second.

Fraud Detect is available for businesses of all sizes and is applicable to a wide variety of industries, including retailers, restaurants, petroleum companies, and service providers.

“With Fraud Detect, our clients have seen an unprecedented reduction in fraud risk, while increasing payment acceptance and creating a better customer experience,” said Steve Petrevski, Senior Vice President, Security and Fraud Solutions at First Data. “First Data is giving clients an unparalleled line of defense across all commerce channels, allowing these businesses to enhance the way they interact with their own customers.”

Fraud Detect includes:

Dynamic, real-time machine learning so clients can respond quickly to evolving threats

World-class, enhanced, customized solutions for mid-market and enterprise businesses

A “turnkey” solution for small businesses to implement enterprise-quality solutions

Ability to customize settings to tailor to business needs

A reporting and analytics dashboard with near real-time analysis

Consultative client support to assist with implementation and training

Managed services offerings including fraud analysts and fraud program management

One key area for Fraud Detect is eCommerce. According to Aite Group, eCommerce fraud is expected to reach $5.9 billion by 2020, nearly double what it amounts to today. Consequently, merchants seeking to expand their businesses across online and mobile channels are increasingly vulnerable to eCommerce fraud risk.

“As consumers demand frictionless shopping experiences, clients are increasingly turning to First Data to enhance customer engagement with universal commerce,” said Shane Fitzpatrick, Global Head of eCommerce at First Data. “We are able to help our clients move into new channels and offer unique commerce functions, while helping to mitigate their security and fraud risk.”

“Merchants are expanding into new commerce channels, and they want technology solutions that protect their customers and reduce their exposure to false declines, chargebacks, and fraud,” said Julie Conroy, Research Director at Aite Group. “The technologies behind Fraud Detect and First Data’s ability to identify fraudulent transactions in real time will provide significant value to businesses around the world.”

In recent years, First Data has made significant enhancements and investments to its fraud and security offerings. With its unique internal alignment across the cybersecurity and security and fraud teams, clients benefit from the combined assets and resources of all of the businesses. Fraud Detect adds to First Data’s expansive fraud and security portfolio, which includes TransArmor for tokenization and encryption, EMV point-of-sale devices, including the Clover hardware and software solution suite, and the DefenseEdge product suite for financial institutions.

For more information about Fraud Detect, please visit our website.

About First Data

First Data (NYSE: FDC) is a global leader in commerce-enabling technology and solutions, serving approximately six million business locations and 4,000 financial institutions in more than 100 countries around the world. The company’s 24,000 owner-associates are dedicated to helping companies, from start-ups to the world’s largest corporations, conduct commerce every day by securing and processing more than 2,800 transactions per second and $2.2 trillion per year.

Media Contacts

Liidia Liuksila

First Data

212-515-0174

Liidia.Liuksila@FirstData.com

(8)

(8) (0)

(0)