Financials...TXHD Just wanted to take a minute fo

Post# of 1705

Just wanted to take a minute for anyone wanting to learn about the company a bit more. I want to point out what settling debt is doing for the company...I like to look at the quarterly financial statements. To me it shows just how far the company is coming in a short amount of time despite what some may say. The truth is anyone can give me a ticker on the OTC and I can find dilution. You can find it on NASDAQ to. The whole purpose of offering shares to the public in the first place is to benefit the companies. We purchase common shares at a higher risk but also have much higher margins than other ways of investments in the company.

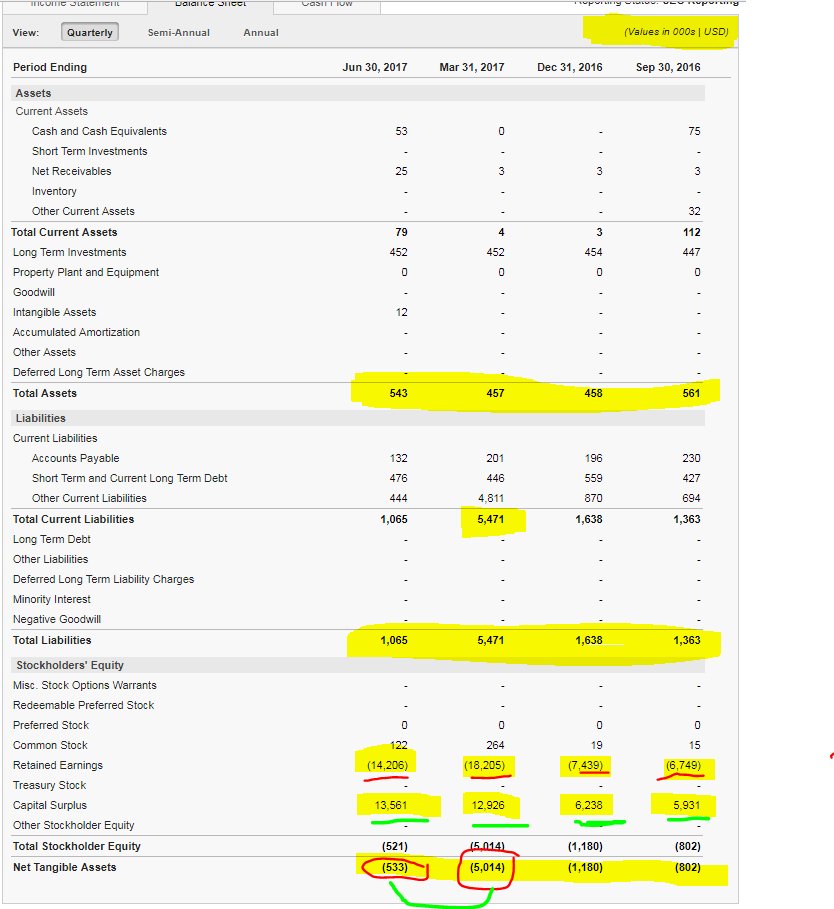

That being said i hope i still have some of your attention lol. First here is an image of the QT Balance statement. Here You can see as of June The equity is -533k. On October 26th LAM settlement was for 490k of debt. So this is beginning to go green on the balance sheet.

Iv highlighted a lot of things here. I want to point out Total Liabilities and notice how that debt is disapeering in just 1 qtr (summer of settlements) also the Capital Surplus. Capital surplus, also called share premium, is an account which may appear on a corporation's balance sheet, as a component of shareholders' equity, which represents the amount the corporation raises on the issue of shares in excess of their par value (nominal value) of the shares (common stock).

This is called Additional paid in capital in US GAAP terminology but, additional paid in capital is not limited to share premium. It is a very broad concept and includes tax related and conversion related adjustments.

Taken together, common stock (and sometimes preferred stock) issued and paid plus capital surplus represent the total amount actually paid by investors for shares when issued (assuming no subsequent adjustments or changes).

Shares for which there is no par value will generally not have any form of capital surplus on the balance sheet; all funds from issuing shares will be credited to common stock issued.

Some other scenarios for triggering a capital surplus include when the Government donates a piece of land to the company.

The capital surplus/share premium account (SPA) is generally not distributable, but may be used to:

write off the expenses/commission relating to the issue of those shares, or

make a bonus share issue of fully paid-up shares.

It may also be used to account for any gains the firm may derive from selling treasury stock, although this is less commonly seen.

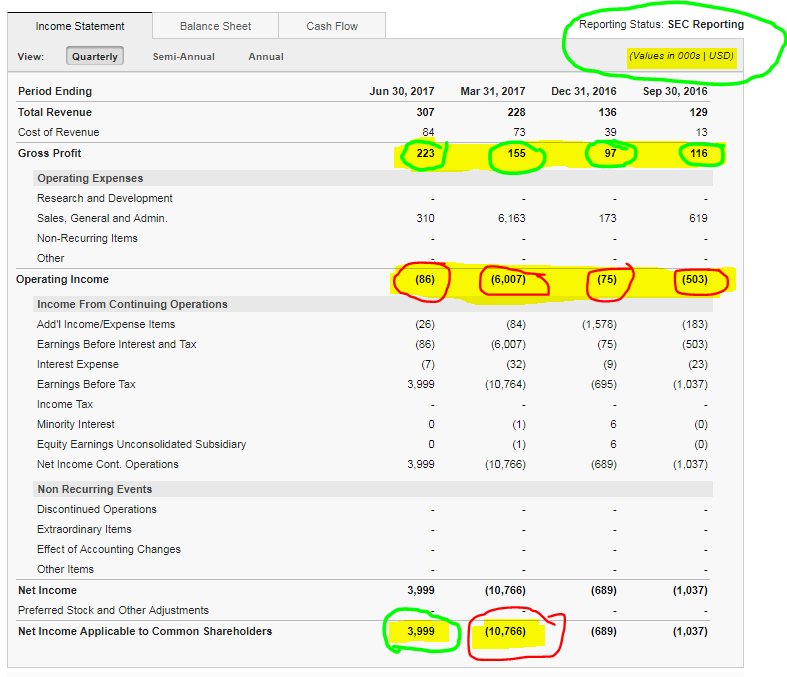

Next we have the Quarterly income statement.

Here highlighted in green you can see the qtr over qtr profit the company now has and is increasing by large %s. Now we can see here also how quickly the company used its strategic road-map to eliminate debt. March Income went from -10.7M to a positive 4M in June. They company is doing well. Dispite what you see has the current PPS down right now, The company is have a lot of growth. IMO...from my own DD I believe you are witnessing this company going from red to green. Every time someone has talked negatively about this company to me and throw in their personal tickers...I can show you dilution in every single one. Massive debt in the majority of them. I was in USRM in Feb....sold before it exploded. I had it like a week in the mid doubles i believe. maybe even lower. it ran to .17 But collapsed over the summer. Alot of debt and a maxed share structure in that stock. Just take the time to reassure yourself. Don't let others influence your decision including myself. That being said my target for TXHD is over the next 2 qtrs. Q3 10K is scheduled for November 21st. However we will be in Q4 then...when I expect many of the catalysts to come to light. Have a wonderful day!

(1)

(1) (0)

(0)Resonate Blends Inc. (KOAN) Stock Research Links