STAF: Prepare For Another Takeover Attempt? 9-25-

Post# of 18884

9-25-2017 Insider Owns Over 40% Of STAF: Prepare For Another Takeover Attempt?

On Thursday, September 21, we recommended a buy on Staffing 360 Solutions, Inc. (STAF), one of two companies proposing vastly improved financials based on last week's news. The stock closed at $0.84 on Friday, up a penny from our $0.83 recommendation so far. However, there is good reason to believe that STAF will be headed much higher. Richard L. Jackson, co-owner of Jackson Investment Group, claims to own 9,411,019 shares according to an SEC filing disclosed on Friday. This represents 42.2% of the outstanding shares of STAF, an increase from a 34.1% stake announced in March when Jackson first offered to buy the company out for $1.10 per share.

Not only has Jackson acquired more shares, but it was instrumental to STAF's announcement of a Transformative $40 Million Refinancing and Closing of Two New Acquisitions as the investment firm was the one to offer the $40 million debt deal. The result is that STAF will double its adjusted EBITDA to $11 million and increase annualized revenue to $265 million. That makes its market cap when trading at $0.84 look minuscule. STAF was $20 in 2014 but dropped under $1.00 and well below its book value upon the fear of bankruptcy. The refinanced $40 million 3-year note alleviates that concern for now.

With STAF and Jackson converging on a debt deal and Jackson acquiring more shares, clearly both believe that STAF is worth more than $1.10. Investors have the chance to buy in the $0.80's, a 20-30% discount to that minimum threshold price. We believe that Jackson will continue to buy on the open market since it is a substantial discount to their original offer and opens up the possibility to own a majority stake and try again for another takeover attempt. As of 8/31, there are 370,487 shares short. It would be highly advisable for shorts to cover at these discounted prices, which would accelerate any run. Jackson also has an additional reason to buy up any shares right now, as STAF must be over $1.00 in order to be in compliance with the NASDAQ's minimum listing price requirements.

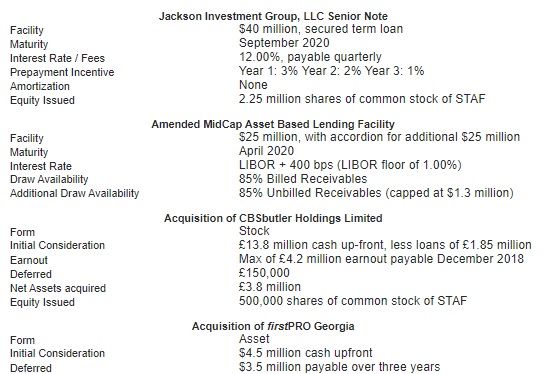

A letter from the CEO outlined the details of last week's transactions:

The key takeaway from this chart is that only 2.75 million shares were issued to make it all happen. Total shares outstanding are about 18.3 million which means the market cap of STAF is only $15 million at $0.84. Senior companies in the staffing industry such as Paychex, Inc. (PAYX) trades at a 6.6x revenue multiple and Salesforce.com, inc. (CRM) trades at a 7.2x revenue multiple. Even Robert Half International Inc. (RHI) trades at 1.1x revenue multiple on the low end of the range. So a $15 million market cap with expected annualized revenue of $265 million means that STAF trades at less than a 0.1x revenue multiple. With alleviated liquidity issues, trading at 10 times below the lowest larger industry peer is far too cheap. There will be a conference call on Wednesday held by STAF to outline the details of the transaction.

STAF NEWS!!! Conference Call Scheduled for 9-27-2017

(0)

(0) (0)

(0)