Bank stocks had few friends during 2011 during which time financial stocks plunged by over 18%, even as the S&P 500 eked out a slim total return of 2.1%.

As financial stocks dropped last year to levels at which they were selling well below book value in many cases, buyers came back in force. During 2012, the best performing sector in the S&P were the financials which soared by over 25%, compared to a gain of only 12.6% by the broader market as measured by the S&P 500.

As the economy and housing markets slowly improved, banks were able to improve their earnings and balance sheets. As the Federal Reserve forced interest rates to all time lows, mortgage lending soared and banks reaped billions of dollars in profits. Lower provisions for loan losses, higher fees and improved asset values also contributed to bank earnings soaring to a six year high .

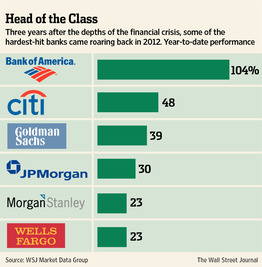

The largest banks in the country all racked up huge gains during 2012, lead by Bank of American which saw its stock value increase by 104%, although it is still down from a high of nearly $60 per share during 2008.

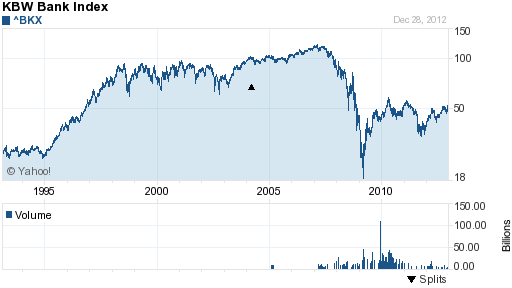

Analysts remain deeply divided on the future performance of bank stocks which still face major regulatory and financial problems. Even with the support of trillions of dollars from the Federal Reserve, bank stocks (as measured by the KBW Bank Index) remain 50% below their level of 2008. The KBW Bank Index, which tracks the performance of 24 of the nation’s largest banks, is no higher than it was during 1997. If the economy slides back into a recession next year, all bets are off and investors who rushed into bank stocks this year could quickly wind up dumping them during 2013.