$AGTK: Own a Pioneer in the Hottest Sector on Wall Street –

Post# of 27509

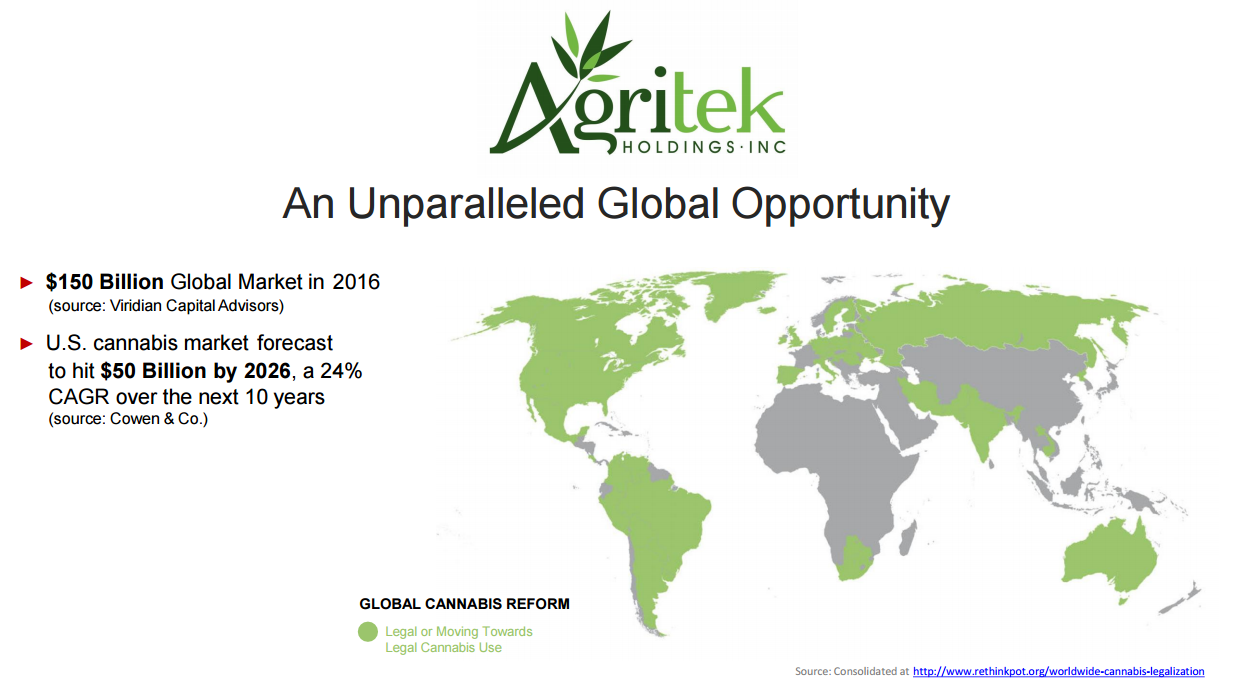

The North American legal marijuana industry experienced growth of 30% — to $6.7 billion – in 2016…

And projections call for an annual growth rate of 25% through 2021 when the legal marijuana market is expected to top a whopping $20.2 billion.

How would you like to own a piece of a company which is a Pioneer in possibly THE hottest sector on Wall Street (Medical Marijuana), is trading just over a penny, generating incredible revenue, owns tons of properties and trading with a market cap just over $5.0 Million ?

Three words: Location, Location, and Location.

This is widely regarded as the three most important factors when buying real estate. And if this property is providing innovative technology and agricultural solutions for both the medicinal and recreational cannabis industry– it doesn’t take a Financial Analyst to realize just how valuable this asset can become. In locations which are dedicated to the science of growing Marijuana, business is booming .

The Marijuana Business Has Transformed the Real Estate Business

While sales of Marijuana seemed to be the meal ticket, the real money nowadays is in the real estate that represents the most crucial part of the cannabis business. The essential need and pent up demand has exploded for rapid growth of infrastructure necessary to facilitate and cultivate these lands.

Agritek Holdings, Inc., (www.AgritekHoldings.com) is a pioneer within the medicinal marijuana space.

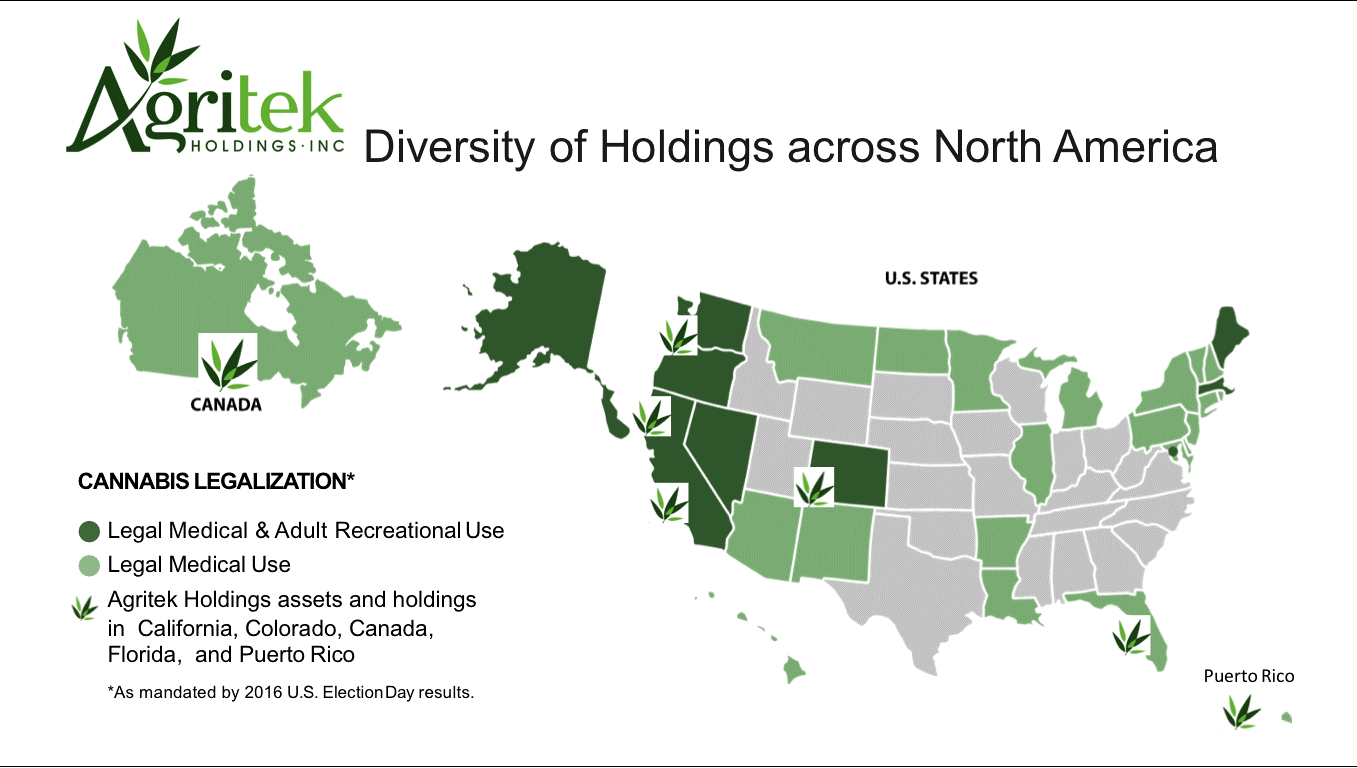

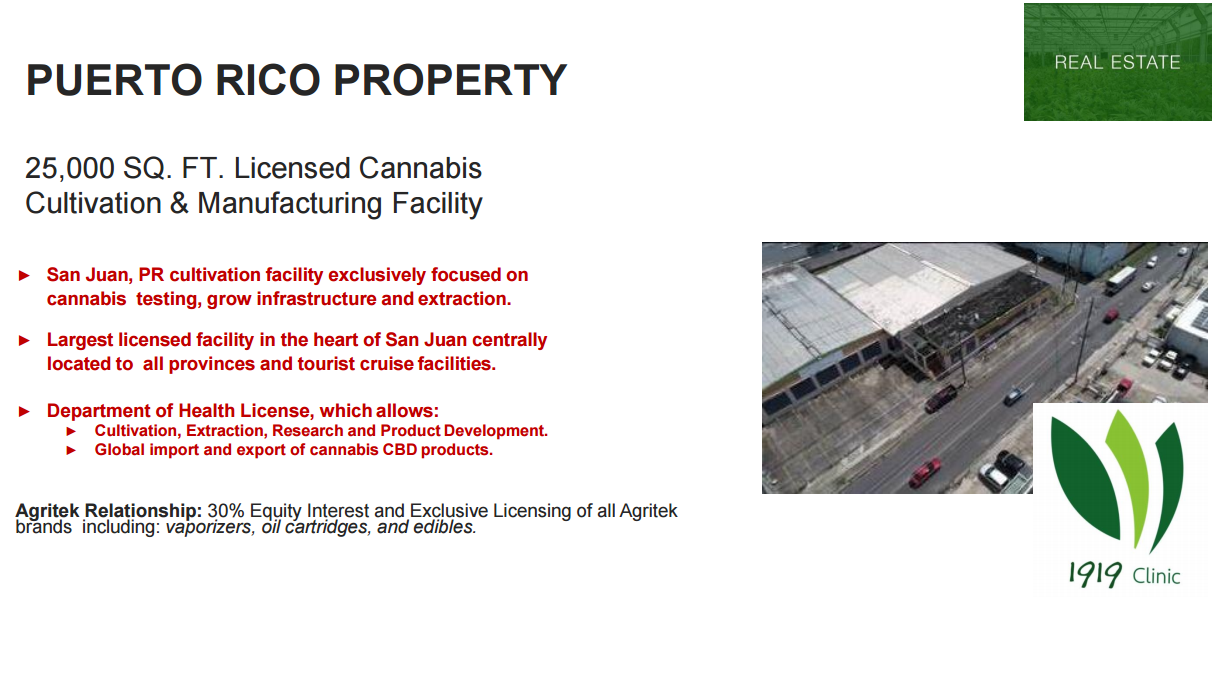

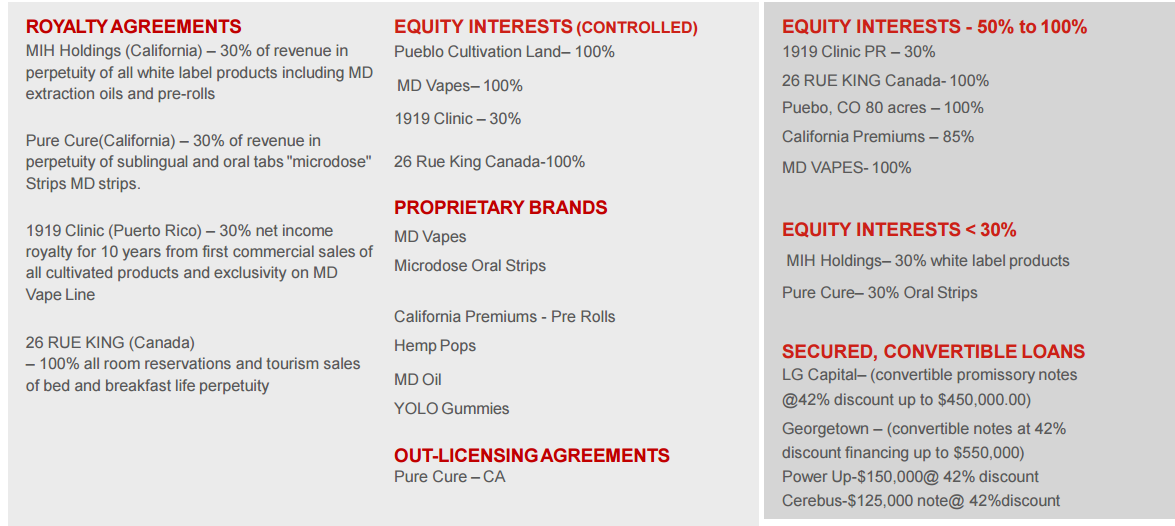

AGTK owns or manages property in Colorado, Puerto Rico and Canada and has licenses with permitted facilities in California approved for cultivation as well as manufacturing capabilities through partnerships.

AGTK provides innovative technology and agricultural solutions for both the medicinal and recreational cannabis industry.

AGTK s owns several Hemp and cannabis brands for distribution including “Hemp Pops” and “California Premiums”.

One simple fact allows Agritek Holdings Inc. to stand out vs their public peers…

AGTK does not directly grow, harvest, distribute or sell cannabis or any substances that violate or contravene United States law or the Controlled Substances Act, nor does it intend to do so in the future.

This creates a VERY compelling opportunity.

For every problem there is a solution.

AGTK has THE solution!

AGTK was chosen to manage one of the largest cultivation facilities in Puerto Rico.

AGTK will receive its first rental income this month and begin funding the 25,000 sq. ft. cultivation facility in San Juan, Puerto Rico previously announced through its five (5) year operational contract. The operational contract and licensing agreement executed last month is expected to produce several hundred thousand dollars in revenue for the Company over the course of the Agreement.

AGTK recently announced the first order for its licensed brand “MicroDose” Oral Strips for the medicinal market of California. Agritek Holdings will provide the licensing and packaging to produce the exclusive line of 10mg and 50 mg oral strips as a medicinal alternative for patients.

AGTK ’s “Microdose” brand will be produced and distributed through its permitted manufacturer and collective to multiple dispensaries throughout California. AGTK will receive a flat fee per package.

AGTK received a $30,000 purchase order for its’ licensed brand “California Premiums” in which Agritek Holdings will provide the licensing and packaging to produce the exclusive line of premium pre-rolls. They will be distributed through its permitted manufacturer and collective to multiple dispensaries throughout Southern California. AGTK will receive a flat fee of $3.00 per box with the first 10,000 units being delivered this month.

“

Quote:.”

Since our inception as the first fully reporting company in the cannabis sector, our strategic vision has been to build a portfolio of assets in high-growth sub-sectors of the rapidly expanding cannabis market. With the ability to access and deploy capital and provide financial consulting and industry expertise, we plan to leverage our network of investments in Colorado, California, Canada and Puerto Rico to drive revenue and growth across our expanding portfolio of assets. Our first meaningful revenue for Q1 with increased distribution was the last piece of the puzzle in showing real growth and increase shareholder value. Our aggressive plans for increasing revenue streams will include developing our real property assets and our existing and new cannabis brands for safe and effective medical applications in multiple jurisdictions

~Michael Friedman, Chief Executive Offices of Agritek Holdings, Inc.

AGTK holdings are almost too long to list as the company has aggressively positioned itself to dominate this segment of the industry in the United States and abroad. Is it properly positioned in your portfolio?

Would you like to own a company with this list of assets and holdings?

If you’re still sitting on the sidelines, you might miss an explosive opportunity!

Now is the time to ACT! Put AGTK on your radar right away.

DISCLAIMER PLEASE NOTE: This AGTK stock report, blog, and any reposts on the TRADDR network are part of a commercial advertisement and is for general information purposes only. All content is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Readers should always consult with a licensed securities professional before making any type of investment decision. Please be aware that TRADDR Affiliates was compensated twenty five hundred Dollars from Agritek Holdings, Inc to assist in the creation and dissemination of AGTK media and social network advertisements and/or corporate updates. We do not guarantee the timeliness, accuracy, or completeness of the information on our site. The information in this blog is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website, press releases, SEC filings, and 3rd party research.

(0)

(0) (0)

(0)