During the past five years we have witnessed the greatest financial turmoil since the Great Depression. Hundreds of giant bank failures rocked the nation, real estate values crashed, trillions of dollars of wealth vanished overnight and millions of Americans lost their jobs. Although a relative calm has been restored due to unprecedented actions by both the Federal Reserve and Congress, there are many reasons to worry about deep systemic risks that could plunge the world into another financial crisis.

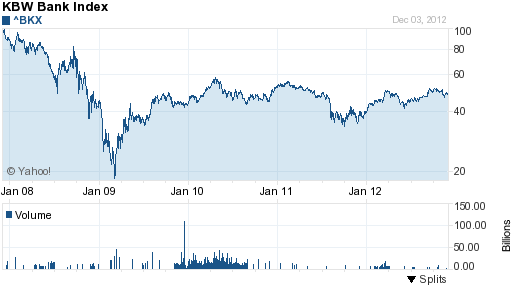

No one knows if 2012 marks the beginning of the end of financial instability, but from a banking standpoint, there were reasons for optimism. Bank profits recovered to a six year high and bank stocks were the best performing market sector during 2012.

2012 marked another milestone in the slow recovery of the banking sector as regulators closed only 51 banks, the lowest number since 2008 when 25 banks failed. During the height of the financial panic during 2008 – 2009, many worried that the entire banking system might wind up collapsing. Since 2008, a total of 465 banks with assets of over $680 billion have been closed by regulators.

At one point during the banking crisis, the FDIC’s Deposit Insurance Fund was completely depleted and plans were implemented to allow virtually unlimited funding from the U.S. Treasury. Gradually and at great cost to the nation and every citizen, the banking system slowly stabilized.

Banking Failures Since 2008

Year Number of Bank Failures

2008 25

2009 140

2010 157

2011 92

2012 51

Total 465

Although the banking industry has seen a gradual recovery, many smaller banks are still struggling. Another recession during 2013, which is forecast by many analysts, could quickly unwind the overall progress of the past several years.

As noted in the discussion on the FDIC’s Quarterly Banking Profile for the third quarter of 2012, 10.5% of all banks reported losses and the number of banks on the FDIC Problem Bank List remains inordinately high.

The number of problem banks in the third quarter ending 2012 declined for the sixth consecutive quarter to 694 from 732 in the previous quarter. For the first time in three years, the number of problem banks has declined below 700, but the number of problem banks still remains extremely elevated. The total number of problem banks is 913% higher than it was before the start of the banking crisis. For the quarter ending December 2007, there was a total of only 76 banks on the problem bank list.

Although the number of problem banks remains elevated, the risk to the banking system remains subdued since most of these banks are relatively small. The average amount of total assets held by problem banks at September 2012 was only $377 million.

Banks continue to reduce their provisions for loan loss reserves which been a significant source of improved bank earnings over the past three years. Third quarter loan loss provisions of $14.8 billion were 20.6% less than last year’s third quarter. Net operating revenue of $169.6 billion represented an increase of $4.9 billion or 3% over last year’s quarter, but the bulk of revenue increases came from $3.9 billion of loan sales. Net interest income rose by only 0.7% in the quarter to $746 million.

Although the banking industry has substantially recovered from the depths of the banking crisis, investors still seem skeptical of the recovery. The KBW Bank Index remains about 50% lower than before the banking crisis began. In an uneven and slow economic recovery, continued improvement in banking industry profits may remain a tenuous proposition.