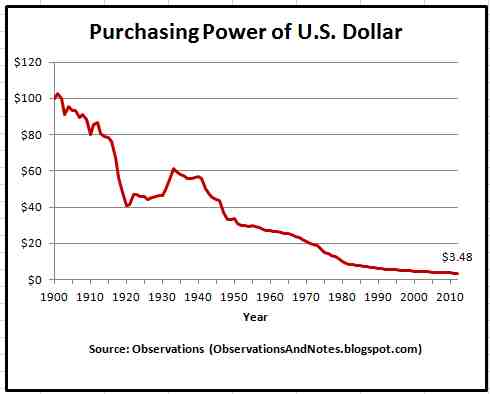

Anyone with savings in the bank is painfully aware of the fact that they are receiving only slightly more income than someone who keeps their savings under the mattress. In an attempt to stimulate credit demand by lowering interest rates to near zero, the Federal Reserve has effectively guaranteed negative returns to savers after taking inflation into account.

Anyone with savings in the bank is painfully aware of the fact that they are receiving only slightly more income than someone who keeps their savings under the mattress. In an attempt to stimulate credit demand by lowering interest rates to near zero, the Federal Reserve has effectively guaranteed negative returns to savers after taking inflation into account.

The actions taken yesterday by the Federal Reserve made it clear that zero interest rates will continue indefinitely as long as unemployment remains above 6.5% and inflation remains below 2.5%. The Fed took the unprecedented step of setting a specific threshold for employment despite the fact that there is no evidence that quantitative easing or low interest rates have created new jobs. By explicitly endorsing an inflation rate of 2.5% the Fed has moved completely into the zone of “unconventional policy” measures and totally blurred the line between monetary and fiscal policies.

The Federal Reserve also committed itself to purchasing, with printed money, $85 billion per month ($1.02 trillion per year) of mortgage-backed securities and longer-term Treasury securities. At this pace the Fed’s balance sheet will balloon to $4 trillion by the end of 2013 from $1 trillion in 2008.

In the end, the Fed may wind up doing little to reduce unemployment, even as rampant money printing pushes the inflation rate well above the Fed’s 2.5% “threshold.”

Impact Of 2.5% Inflation

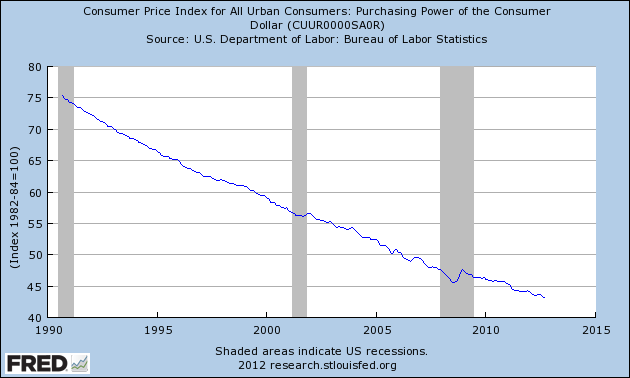

Even a relatively “benign” inflation rate of 2.5% rapidly erodes the purchasing power of savings. Over a short 5 years, the purchasing power of $100,000 in savings is reduced to $88,110 at an inflation rate of 2.5%. At a 5% inflation rate, the value after 5 years is only $77,378. We don’t even want to look at how much purchasing power would be lost over a decade.

There are no easy answers on how to increase returns on savings without taking on an unacceptable amount of risk. Savers, however, need to start looking at the risk of purchasing power loss. From my experience, most people find it conceptually difficult to see a real loss (in purchasing power) when there has been no change in the principal amount of savings.

Release Date: December 12, 2012

For immediate release

Information received since the Federal Open Market Committee met in October suggests that economic activity and employment have continued to expand at a moderate pace in recent months, apart from weather-related disruptions. Although the unemployment rate has declined somewhat since the summer, it remains elevated. Household spending has continued to advance, and the housing sector has shown further signs of improvement, but growth in business fixed investment has slowed. Inflation has been running somewhat below the Committee’s longer-run objective, apart from temporary variations that largely reflect fluctuations in energy prices. Longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee remains concerned that, without sufficient policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee will continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will purchase longer-term Treasury securities after its program to extend the average maturity of its holdings of Treasury securities is completed at the end of the year, initially at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and, in January, will resume rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until such improvement is achieved in a context of price stability. In determining the size, pace, and composition of its asset purchases, the Committee will, as always, take appropriate account of the likely efficacy and costs of such purchases.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Jerome H. Powell; Sarah Bloom Raskin; Jeremy C. Stein; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who opposed the asset purchase program and the characterization of the conditions under which an exceptionally low range for the federal funds rate will be appropriate.