Fed Debate Over $4.5 Trillion Balance Sheet Looms

Post# of 52125

Calls to shrink portfolio come as economic outlook improves

Some say using balance sheet could blunt impact on dollar

It’s time to talk about the balance sheet.

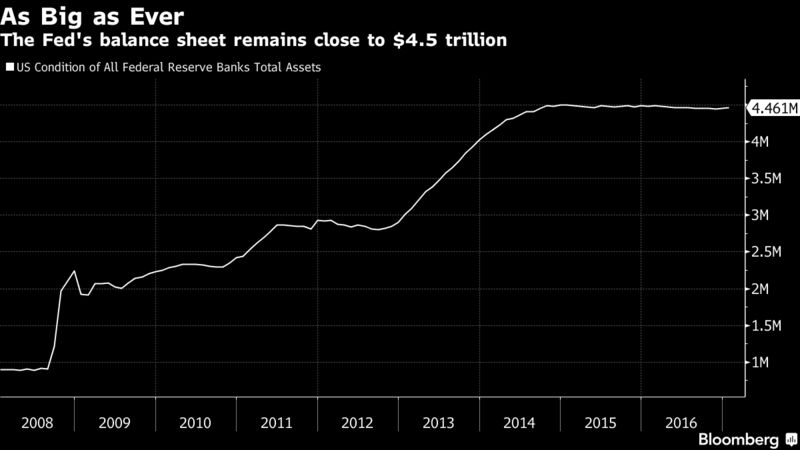

Eight years after the Federal Reserve launched the first of three controversial bond-buying campaigns to help save the U.S. economy, its holdings are stuck at $4.5 trillion, and the question of when to let them shrink is beginning to simmer.

Several policy makers have pushed publicly to get the debate started. How the discussion plays out could have big implications for the pace of future interest-rate hikes and for the dollar.

“They should start framing this for the market,” said Michael Gapen, chief U.S. economist at Barclays Plc. Investors need to hear what the “balance of policy” will be between the balance sheet and the central bank’s main tool, the federal funds rate, he said.

Sheer Weight

The sheer weight of the balance sheet helps hold down long-term U.S. borrowing costs, which is why the Fed bought bonds in the first place. If officials allow holdings to mature without continuing their current practice of reinvesting the principal, they could push yields higher by reducing demand in the bond market.

The topic has shot to renewed prominence as the outlook for the U.S. economy has brightened. The Fed has raised rates twice in the last 13 months and penciled in three quarter-point moves this year. Moreover, newly-inaugurated President Donald Trump has put expansionary fiscal policy on the horizon.

If fiscal stimulus begins to overheat the economy, the Fed might tighten policy more sharply. St. Louis Fed President James Bullard said he’d prefer to use the balance sheet to do some of that lifting, echoing remarks by his Boston colleague Eric Rosengren.

“If you think the economy is growing more rapidly then you want, you can either continue to raise short-term rates, or you can also do balance sheet in conjunction with that,” Rosengren said in a Jan. 9 interview.

At the very least, he said, the Fed should be talking about the issue soon. San Francisco Fed President John Williams, Atlanta’s Dennis Lockhart, Philadelphia’s Patrick Harker and Dallas chief Robert Kaplan have all agreed.

No Rush

None of them has expressed urgency, and the topic may not be on the agenda when the Federal Open Market Committee convenes again on Jan. 31. But each knows it can take the FOMC several meetings to make big decisions, and they are likely eyeing where rates will be a year from now. Rosengren is thought by Fed watchers to favor four hikes this year.

“I don’t think it’s something they’ll do in 2017,” said Mark Zandi, the New York-based chief economist at Moody’s Analytics Inc. “My guess is they view this as a 2018 project.”

Even if they don’t make changes to the balance sheet this year, current policy makers may be keen to hammer out their strategy for another reason: Trump is expected to appoint a new leader at the Fed when Janet Yellen’s term as chair expires in February 2018.

“That individual might want to undo what has been done in a fashion that could be disruptive to both the financial markets and the economy,” economist Raymond Stone, of Stone & McCarthy Research Associates in Princeton, New Jersey, wrote in a Jan. 19 note to clients. That “argues for the FOMC to at least have a plan in place, which is understood by the markets as well as the public, before Yellen’s term ends.”

‘Well Underway’

Right now, the Fed’s position is to maintain the balance sheet by reinvesting principal repayments until its rate-hike cycle is “well underway” -- language that’s appeared in every policy statement since December 2015.

Some officials will be keen to hold off while they push the fed funds rate further from zero, making more room to lower if a shock brings back recession. The rate is currently between 0.5 percent and 0.75 percent.

Fiddling with the portfolio can also be risky. Memories are still fresh of the “taper tantrum” plunge in Treasury prices after then-Chairman Ben Bernanke mentioned in mid-2013 that the Fed might reduce monthly bond purchases later that year.

On the other side, some can argue that Fed bond purchases distorted markets, increased financial stability risks and were, in the first place, an emergency measure, and so should be unwound sooner rather than later. That view is shared by some Republican lawmakers, making the balance sheet a lightning rod for critics who saw asset purchases as an overreach of authority that encouraged Democratic President Barack Obama’s Treasury Department to issue more debt.

Wall Street

Meanwhile, a big balance sheet has generated large bank reserves held at the Fed, requiring the central bank to make interest payments to Wall Street that will grow as rates rise, attracting the ire of Democrats.

“Their objectives really are first and foremost macroeconomics,” said William Nelson, a former senior Fed staffer and now chief economist at The Clearing House, a banking trade group in New York and Washington. “But politics enters into the discussion.”

Then there’s the argument that using the balance sheet to remove accommodation could help restrain the dollar.

The dollar is a particular source of worry for U.S. policy makers, having appreciated 23 percent since mid-2014. The Fed expects to keep tightening while central banks in Japan and Europe hold steady or consider more accommodation. That could further strengthen the greenback and introduce a headwind for U.S. growth.

“Slowing down the economy a little bit at the long end of the market has some benefits if you think primarily that exchange rates are driven by short-term interest rates,” Rosengren said. “You might want some of the removal of accommodation to come at the long end, which would be done by the balance sheet.”

The Boston Fed released research on Jan. 19 that backs up this view of exchange rates and the yield curve. Former Fed economist Roberto Perli was more skeptical, pointing to global demand for longer-term U.S. Treasuries.

“If long U.S. rates were to increase significantly as a result of balance sheet shrinking, there would still be large inflows into U.S. assets, which would support the dollar,” said Perli, a partner at Washington consulting firm Cornerstone Macro LLC.

Another detail to work out is whether the Fed should reduce the balance sheet in a steady, predictable manner, or adjust the movements meeting-by-meeting.

Nelson, who prepared a briefing for the FOMC when the panel considered the question in April 2011, said the committee will likely do the former, and hold on to the fed funds rate as their main tool for reacting to economic conditions.

“I don’t think they will ever use the balance sheet as an active tool when they have room to just allow it to roll off gradually,” he said.

(0)

(0) (0)

(0)