$TNTY ~ Up 44% on Friday and New Short Term Highs

Post# of 2561

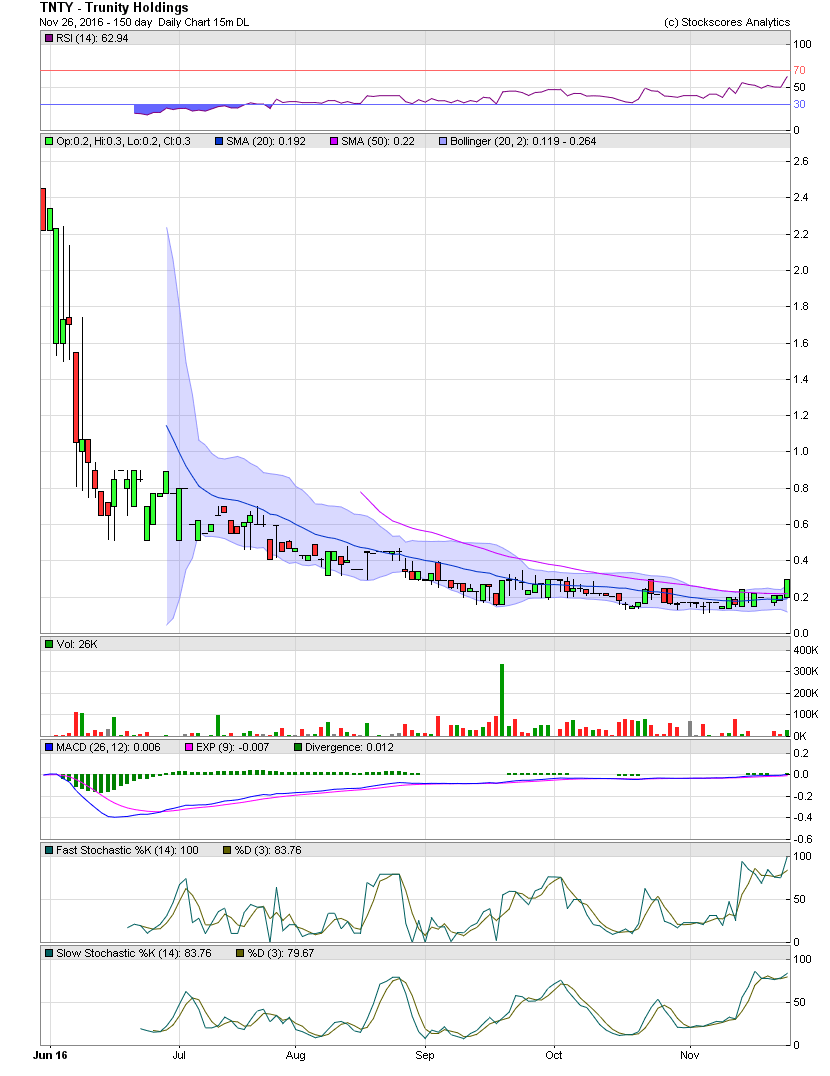

After $TNTY failed to break above the MA20 and MA50 in October, the stock retested its lows set prior to that failure. The stock has since traded in a tight range before Friday's move of 44% to just under .30. TNTY closed above both the 20 and 50, which I had hoped would occur last month. As one can see on the chart below, the stock has been basing for approx two months in the teens and low .20s but for a few intraday moves to .30. The MA200, which is not on the chart, is currently at 1.00. The would be my first line of resistance should the stock break and close above .35 with strong volume.

In brief discussions with management, there are numerous acquisitions in the works including the financing necessary for the execution and closing of said acquisitions. Any material event at this point in time, should reflect in much higher share prices. On the news of an acquisition earlier in the year, the stock had rallied from the .60-.70 area to over $3.00. Due to the 'unwinding' of that acquisition for various reasons (check filings/news), the stock declined to prices lower than those of the pre-acquisition level.

(1)

(1) (0)

(0)