According to the latest FDIC Quarterly Banking Profile, the banking industry recorded its 13th consecutive quarterly year-over-year increase in profits. Total net income for all FDIC-insured institutions rose to $37.6 billion in the third quarter of 2012, a 6.6% increase from the third quarter of last year. Most of the increase in net earnings were the result of lower provisions for loan losses and increased noninterest income.

According to FDIC Chairman Martin Gruenberg, “This was another quarter of gradual but steady recovery for FDIC-insured institutions. Signs of further progress were evident in a number of indicators, such as loan growth, asset quality and profitability.”

Despite an overall recovery by the banking industry, many banks are still struggling. For the third quarter of 2012, 10.5% of all banks reported losses although the number has improved from last year when 14.6% of all banks reported net losses. Although 57.5% of banks reported earnings improvements, the trend of improved bank earnings has been trending downwards since the third quarter of 2011 when 62.6% of banks reported earnings gains.

The number of problem banks in the third quarter ending 2012 declined for the sixth consecutive quarter to 694 from 732 in the previous quarter. For the first time in three years, the number of problem banks has declined below 700, but the number of problem banks still remains extremely elevated. The total number of problem banks is 913% higher than it was before the start of the banking crisis. For the quarter ending December 2007, there was a total of only 76 banks on the problem bank list.

The number of problem banks in the third quarter ending 2012 declined for the sixth consecutive quarter to 694 from 732 in the previous quarter. For the first time in three years, the number of problem banks has declined below 700, but the number of problem banks still remains extremely elevated. The total number of problem banks is 913% higher than it was before the start of the banking crisis. For the quarter ending December 2007, there was a total of only 76 banks on the problem bank list.

Although the number of problem banks remains elevated, the risk to the banking system remains subdued since most of these banks are relatively small. The average amount of total assets held by problem banks at September 2012 was only $377 million.

Although the number of problem banks remains elevated, the risk to the banking system remains subdued since most of these banks are relatively small. The average amount of total assets held by problem banks at September 2012 was only $377 million.

Banks continue to reduce their provisions for loan loss reserves which been a significant source of improved bank earnings over the past three years. Third quarter loan loss provisions of $14.8 billion were 20.6% less than last year’s third quarter. Net operating revenue of $169.6 billion represented an increase of $4.9 billion or 3% over last year’s quarter, but the bulk of revenue increases came from $3.9 billion of loan sales. Net interest income rose by only 0.7% in the quarter to $746 million.

Banks continue to reduce their provisions for loan loss reserves which been a significant source of improved bank earnings over the past three years. Third quarter loan loss provisions of $14.8 billion were 20.6% less than last year’s third quarter. Net operating revenue of $169.6 billion represented an increase of $4.9 billion or 3% over last year’s quarter, but the bulk of revenue increases came from $3.9 billion of loan sales. Net interest income rose by only 0.7% in the quarter to $746 million.

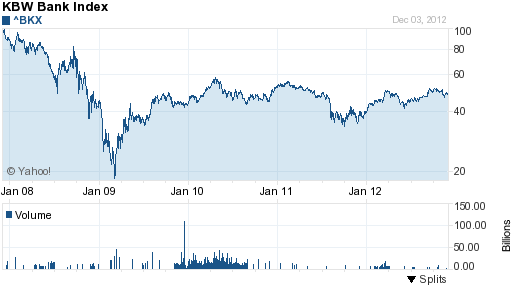

Although the banking industry has substantially recovered from the depths of the banking crisis, investors still seem skeptical of the recovery. The KBW Bank Index remains about 50% lower than before the banking crisis began. In an uneven and slow economic recovery, continued improvement in banking industry profits may remain a tenuous proposition.