In the aftermath of the banking meltdown that began in 2008 many large depositors with balances in excess of the standard deposit insurance limit of $250,000 became very concerned about losing money in a bank failure. In an effort to instill confidence in the banking system, the Dodd-Frank Act instituted temporary unlimited deposit insurance on noninterest bearing transaction accounts (NIBTAs).

In the aftermath of the banking meltdown that began in 2008 many large depositors with balances in excess of the standard deposit insurance limit of $250,000 became very concerned about losing money in a bank failure. In an effort to instill confidence in the banking system, the Dodd-Frank Act instituted temporary unlimited deposit insurance on noninterest bearing transaction accounts (NIBTAs).

Nervous money flooded into the U.S. banking system from both investors and U.S. and foreign companies. Last year when the European banking system was on the verge of collapse, money seeking safe harbor poured into the U.S. banking system. At June 30, 2011, FDIC insured institutions held a staggering $1.9 trillion of NIBTAs. Large investors, companies and financial institutions were more than willing to accept a zero per cent return on their money in exchange for FDIC guaranteed deposit insurance coverage.

Banks would normally love to have zero cost deposits but the Temporary Liquidity Guarantee Program (TLGP) was too much of a good thing. Given the limited duration of the TLGP, the money flooding into banks was likely to leave just as quickly when the program expired. Given the zero interest rate policy of the Federal Reserve, banks perceived the large money inflows as more of a problem than a blessing since it could not be profitably invested in short term instruments.

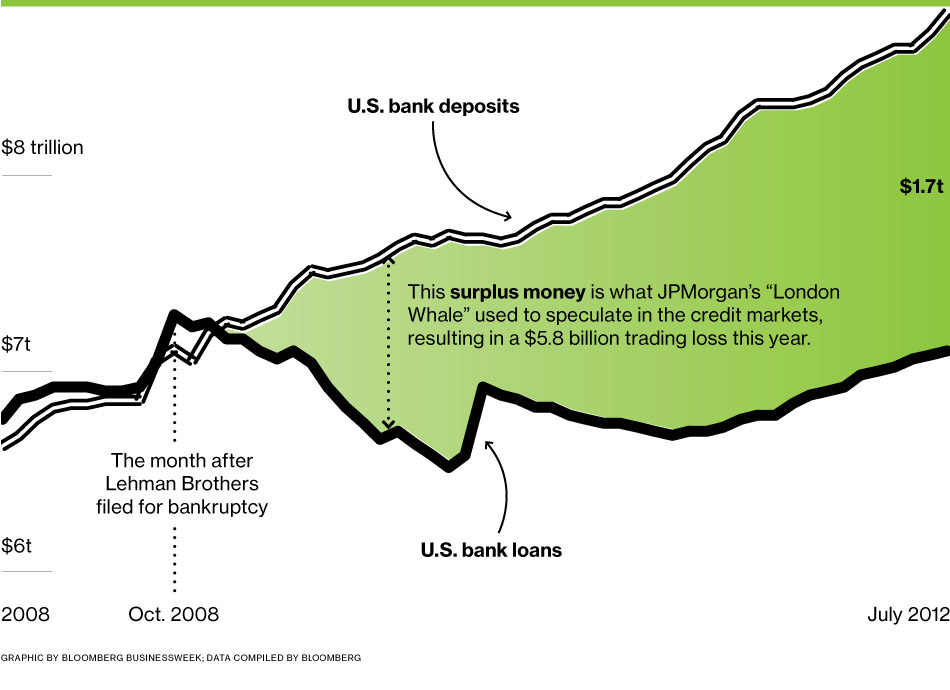

Nor were banks willing to lend the money long term since that would have caused a severe maturity mismatch by funding long term loans with short term funding. Some banks tried to discourage the huge money inflows by actually charging depositors fees for funds held in NIBTAs. Banks effectively had little use for the trillions of dollars that flowed in under the TLGP and the result can be seen in the large gap between bank deposits and loans .

Much of the surplus money now held by banks is likely to be moved into other financial assets with the termination of the TLGP. Current estimates of the amount of money held in noninterest bearing transaction accounts is $1.4 trillion. With the stabilization of the financial system since the height of the banking crisis, much of the money held in NIBTAs is likely to be moved into other assets that offer some type of return.

If a significant amount of money pours into other financial assets such as short term treasuries, mortgage backed securities, money market funds and commercial paper, this is likely to exert additional downward pressure on interest rates. Long suffering bank depositors looking for higher rates of return are likely to have a long wait.