Tax Cuts, War Costs Do Lasting Harm to Budget Outl

Post# of 65629

Quote:

Tax Cuts, War Costs Do Lasting Harm to Budget Outlook

http://www.cbpp.org/research/economic-downtur...e-deficits

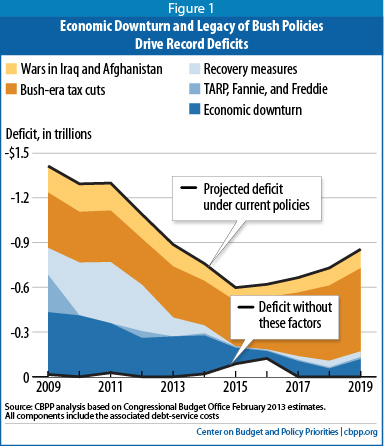

Some commentators blame major legislation adopted since 2008 — the stimulus bill and other recovery measures and the financial rescues — for today’s record deficits.

Yet those costs pale next to other policies enacted since 2001 that have swollen the deficit and that have lasting effects.

Just two policies dating from the Bush Administration — tax cuts and the wars in Iraq and Afghanistan — accounted for over $500 billion of the deficit in 2009 and will account for nearly $6 trillion in deficits in 2009 through 2019 (including associated debt-service costs of $1.4 trillion).

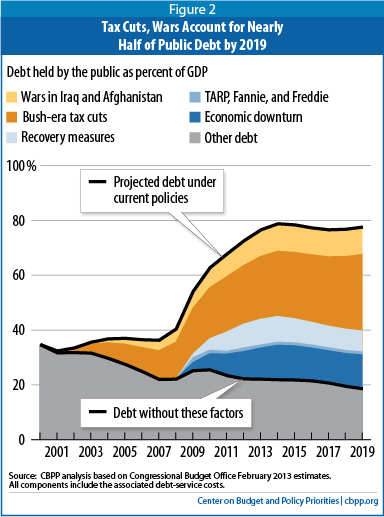

By 2019, we estimate that these two policies will account for almost half — over $8 trillion — of the $17 trillion in debt that will be owed under current policies .[7] (See Figure 2.)

These impacts easily dwarf the stimulus and financial rescues, which will account for less than $2 trillion (just over 10 percent) of the debt at that time. Furthermore, unlike those temporary costs, these inherited policies do not fade away as the economy recovers .[8]

Without the economic downturn and the fiscal policies of the previous Administration, the budget would be roughly in balance in this decade.

Even if we regard the economic downturn as unavoidable, we would have entered it with a much smaller debt — allowing us to absorb the recession’s damage to the budget and the cost of economic recovery measures, while keeping debt comfortably below 50 percent of GDP, as Figure 2 suggests.

That would have put the nation on a much sounder footing to address the demographic challenges and the cost pressures in health care that darken the long-run fiscal outlook.

(1)

(1) (0)

(0)