I received a PM asking what I know about Progressi

Post# of 1525

This is not inside information, pieces of it have been posted by others on the board previously, and company IR has openly discussed in PR's and in conversations with investors.

Most recently, Shital made a statement in the 2016 Open Letter to Shareholders (Jan 7, 2016):

Quote:

Outlook

Moving forward, we will pursue new avenues of advancement of the PharmCo brand through continued marketing campaigns and creation of new products and services. We will also look for opportunities to expand the pharmacy through establishing new locations or through mergers/acquisitions with similarly positioned independent pharmacies.

As we enter into 2016, we will look to take advantage of our marketing efforts with doctors' offices, clinics, and hospitals, as well as seek licensures in additional states in order to begin positioning PharmCo as a national brand. We will continue to expand non-sterile compounding department to develop new products and therapy alternatives.

Dec 30, 2015 - INSTATRADER Conversation with Armen (including Q's from RXMD longs and A's from Armen)

Quote:

Q: You recently had positive feedback from the NON DEAL ROADSHOW in NYC. Does that mean we are no longer looking at (debt financing)?

A: "Yes, we met some great people there who are very interested in our turn-around story. There is private money available to us for acquisitions when the time is right".

Q: In regards to M&A... would you say you are looking for anything specific?

A: "We are currently on the hunt for acquisitions mainly on the east coast. Weve looked at companies in Atlanta and South Carolina, and interested in the right situation up to NY as well".

Q: What are you looking for from a potential acquisition?

A: "We are not looking at your traditional pharmacies, in fact we do not consider ourself a traditional pharmacy, more like a health services company. We are looking at pharmacies with specialty licenses with niche practices. A high script count is more important than the revenue, as well as the TYPE of scripts. If they are doing lots of long term care and infectious disease scripts we are interested".

Expansion Geography

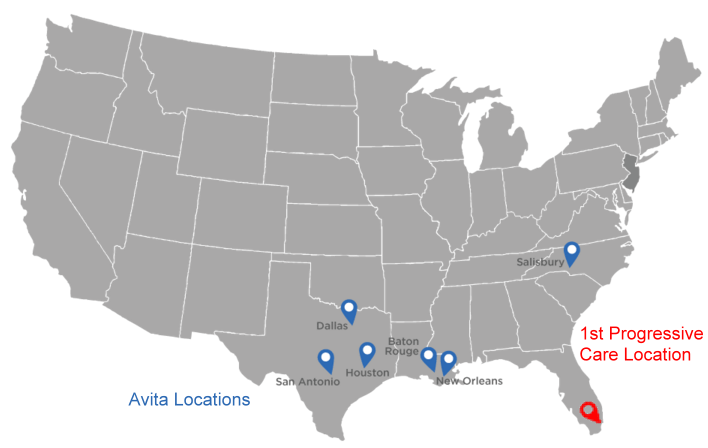

You may recall my previous post Case Study for Acquisition - unless you're new to RXMD and haven't looked back that far. In that post I gave an example of a company with many similarities that has also been growing rapidly over the past several years. This company, Avita Pharmacy, is a private company - very secretive of revenue, margins, acquisition, etc. - recently expanded by purchasing the MedExpress pharmacy business in 2014 in Salisbury, NC. Last reported (INC 5000) revenue for MedExpress was $32.7M in 2013. One difference is that Avita is funded by small investment funds that are looking for conservative growth in the 10-30% range, supporting acquisitions of well-established businesses that are past the high-growth stage. Whereas, Progressive Care seems to be more interested in "making" such businesses by building on the base foundation of a specialty core with high growth opportunity, more to the tune of 500-1000%, leveraging Progressive Care's know-how and proven specialty business model (modeled after PharmCo) - the PharmCo national brand.

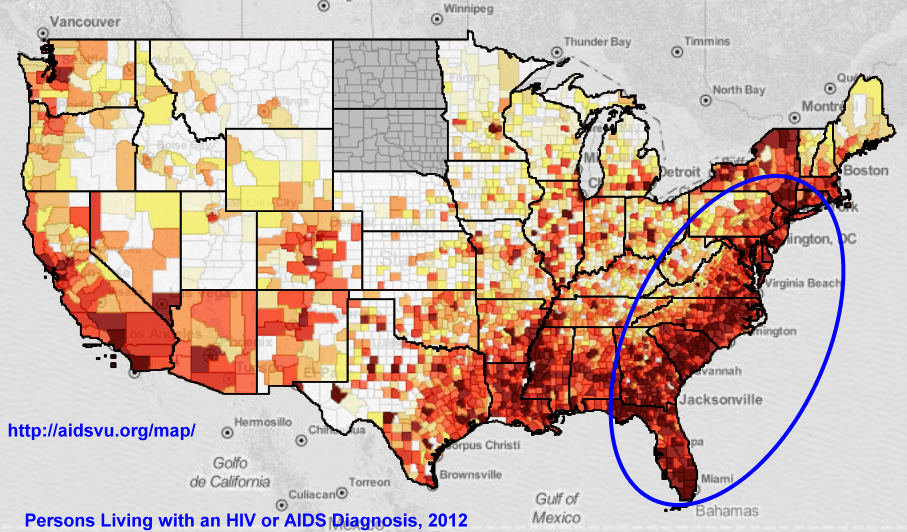

You can see from the HIV heat map that there is a reason Avita purchased MedExpress in Salisbury - presumably the same reason that Progressive Care has targeted the eastern coastal states for M&A expansion plans. I expect that we will be able to look at these maps 5 years from now and see a good handful of pins with the Progressive Care / PharmCo (RXMD) stamp on them. They may have a different name behind them, maybe more of a household brand name - if, say, we are acquired - but I'll bet the PharmCo brand name will remain front and center in view from the street.

(0)

(0) (0)

(0)