There was a good bit of discussion on another mess

Post# of 791

There is debt. At last reported count, $8,187,762 of debt and liabilities. I am personally thankful for it. As others have noted in recent posts, this is exactly what presents this great opportunity for us with HCTI. Debt financing is the primary reason companies trade on OTCBB. Of course, that's the same reason many scam stocks trade here, but it's our goal and task to sort the wheat from the chaff. It's extremely difficult to find a good stock on the OTC, but that is just the first challenge. The second challenge is to be able to recognize it when you find one.

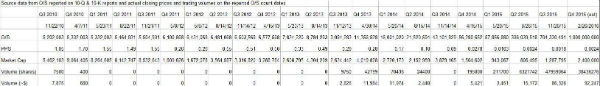

If you look at the following table and charts, you will see that HCTI pps has been depressed completely out of proportion. There are various reasons for this, but it generally follows the principle pattern that OTC stocks experience through the early development phase and ensuing debt payment dilution prior to a price correction breakout. I'm not referring to a chart pattern breakout here, I mean a breakout stimulated by real fundemental business progress milestone(s). This could be anything from a successful phase "x" clinical trial for a pharma stock, a key patent grant for a tech stock, debt payoff (clean balance sheet) news for an otherwise fundementally sound growth business, or a new contract or product launch for a company exiting the development phase. In the case of HCTI, it is the latter example.

A. Initial valuation after limited awareness/exposure with investor knowledge of "Development Phase" valued HCTI at $8M-$9M, and held for over a year while thinly traded. Expectation for those early investors was a year or two of development following by commercialization and exponential price breakout on the order of 10x in reasonably short time: expecting $80M-$100M market cap within 3 to 5 years from the initial investment (yes, company projections surely showed significantly higher/faster growth, on the order of 2x or more of that... as they always do - but investors will discount that by a factor of 2 or more, as everything always takes longer than planned).

Development stage took longer than expected (no real surprise).

B. Management was 1 month late on filing 10-K and 10-Q; that is, 1 month beyond the extension date that they filed for, so... short-term delinquency. Disenchanted shareholders penalized the company, and the price dropped 80%. Interesting to note that volume was very low, so not many sold, it's just that the stock was very thinly traded and the price never recovered (not much, anyway). The company did itself and then-current shareholders no favors here because, eventually, the price would dictate how much all stakeholders would be diluted when shares need to be sold for repayment of debt. But this did in fact create a huge windfall opportunity for late-comers like myself.

C. HCTI still very thinly traded, but held price fairly stable at the new low Market Cap in the range of $2M-$4M. Dilution was low, slow and steady.

D. Exit the Development Stage, beginning Commercialization & Marketing, Market Cap held fairly well even with significant dilution for payment of debt and liabilities.

E. Price sliding due to longer time required to commercialize and obtain first contracts in combination with debt/liability payment dilution. Management was too aggressive with projected timeline relative to the speed of courted customers/partners in executing evaluation and formulation projects. Volume has increased as the company and shareholders began to see the light at the end of the tunnel.

F. Price has begun correcting in the positive direction as HCTI has achieved significant milestones in executing initial contracts. Price consolidates with each new period of dilution for debt/liabilities payments. Price is still depressed and greatly undervalued. Price never recovered from drop in 2012 caused by that short period of delinquency when 2011 10-K and Q1 2012 10-Q were filed 1 month late, as well as recent dilution periods for debt/liability payments prior to recent business milestones.

Discussion

One easy opportunity for management to improve market value (pps) and thereby minimize dilution... It's not a huge deal to file an extension for late reporting of a quarterly or annual - once in a while - but only for a good reason under special circumstances. How true is it that just about every Q & K filing is delayed due to: '(a) The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense' ? But this is something that can become the status quo and a habit and, to me, reflects a sloppy management attitude. Shareholders may ask themselves, "Is this indicative of the cause-effect with the commercial rollout timeline?" In reality, I don't believe there is a 100% direct correlation, as these are completely different issues and involve substantially different resources, but... leadership and leading by example is important for a CEO. If Kristul wants the filings to be done on time, he can make that happen. I believe he should make that a priority, and that alone would reinstill/improve confidence and loyalty among shareholders which could immediately be reflected in buying and price action. Keeping in mind that the 80% drop in 2012 was with very thin trading, and it also was due to an outright delinquent filing - late even for the extension - it seems reasonable to believe that actually filing on time (without an extension) could result in a 10-20% positive correction all by itself. (If they get this next one done on time, I expect to see a positive price effect immediately - I hope this suggestion finds its way in front of Kristul)

Price correction and breakout - understanding the stock price behavior and reasoning above, this can be combined with the HCTI Investor Presentation of 2015 (financial projections) to project the future stock price and business valuation by investors. Price is determined by the market - what investors are willing to pay, what they believe it's worth. We're fortunate enough to have real, actual numbers to work with. IMO, the best numbers to work with are those from the beginning, before any factoring due to a missed timeline milestone or a late Q filing or dilution that may result in ambiguous or arbitrary valuation adjustments.

Valuation - original investors priced the company at $8M-$9M at the early stage, holding that price for over 1 year with very thin trading. That's pretty solid. Management's investor presentation last year is pretty consistent with this, showing that, indeed, $8M-$9M invested in year 1 could be worth $80M-$90M within a year or two (more, if you believe management's aggressive timeline - I don't). Much has been accomplished since the early valuation of $8M-$9M, and HCTI is signing contracts, product is starting to hit the shelves. The way I view this, the hardest part is in the past, and we're more than half-way to that first milestone of $80M-$90M. I don't know how the rest of the market views this, but I can see from the buying pressure whenever dilutive shares are not being sold that many recognize this great opportunity. How high will it go and how fast? Not really my primary concern. I believe there is a very solid potential for the company to achieve the $100M+ revenue target within a few years with corresponding high margins to reach a valuation in the hundreds of $M's, giving a 100-fold increase in valuation. Does the rest of the market believe HCTI should be trading at a Market Cap of $30M to $50M as I do? I'm glad that it didn't over the past 2 weeks when I bought my initial position. Is the rest of the market slowly soaking up the "gift" shares as I did? Yes, I see evidence of that.

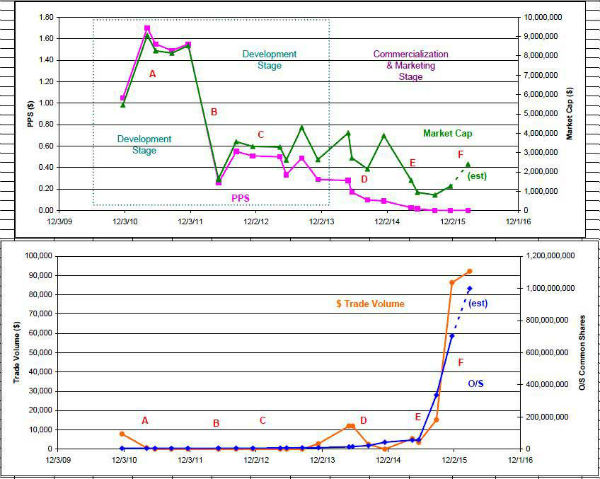

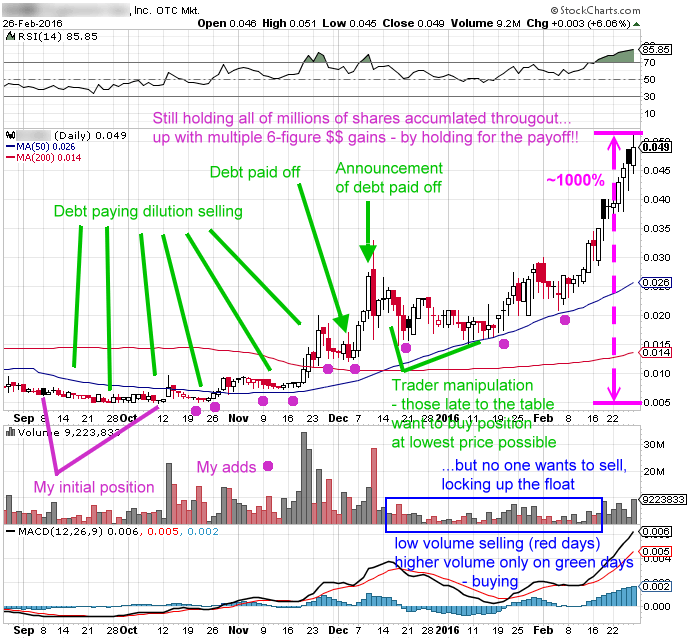

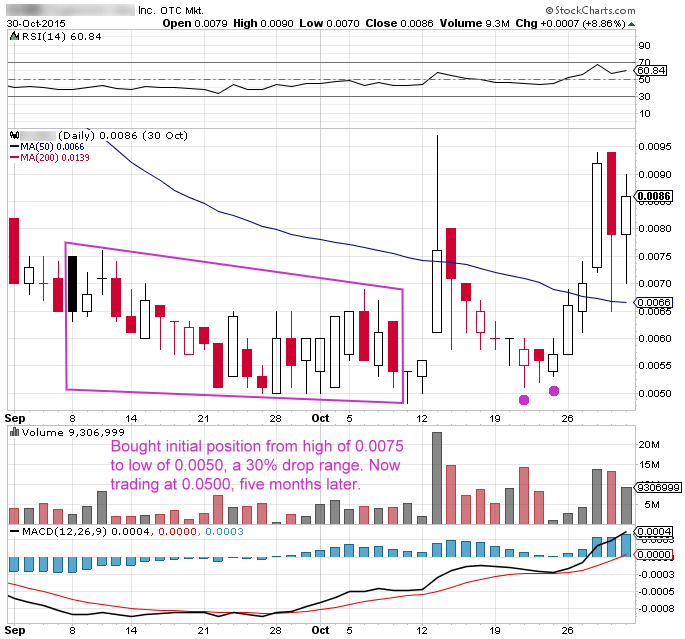

So yes, I see the price correcting, the beginning of a breakout. Is my timing perfect for the absolute best price? No, I missed it just over two months ago at the 0.0008 bottom. What if it falls by 10% or 20% or 30%? Same as I did with the example below, I'll take advantage of the opportunity. What if it drops to no bid? Well, I'll take my loss. Hey, I didn't buy into HCTI until I did my DD; if I thought there was any significant chance of that, I wouldn't have bought in the first place. I'm not about to get spooked by price action or dilution over daily/weekly trading periods. I'm in it for real gains. Below are two examples of recent/ongoing breakouts that show exactly what I expect - in general - over the coming months. These are two different types of businesses, both completely different from HCTI. Of the three, HCTI actually has much more potential growth and also higher potential for faster/higher price correction, due to the type of business. HCTI actually has it's own product, well-protected by IP, and can scale up very quickly. It is also virtually unlimited in manufacturing capacity and selling to a very large and diverse marketplace. Combine that with legislative and other pressures to adopt Hybrid's product. I look for a 100-fold+ return on my investment over 3-5 years. The second example profiled below shows the detail of a stock that I invested in. If/as HCTI achieves similar chart milestones and if/as Hybrid management delivers on fundemental business/performance milestones over the coming months and years as I expect, I will do as I did with this other stock - buy, accumulate at dips and consolidation levels and hold for the long haul. There is no other way to "nail a 50x+ bagger". I don't try to catch the pops of PnD stocks but, if I did, I could never hold them to actualize realize even a small fraction of such gains with a significant basis for substantial profits. It's the steady rise on an undervalued stock with great fundemental value that I can hold on to - typically one that has debt or some other reason that the price is depressed to such a level of great disproportion to it's true/fair value.

Example No. 1:

Example No. 2:

Same Example No. 2 - closeup of initial buys for starting position:

(4)

(4) (0)

(0)