$WMIH let's look at some diligence: a double then

Post# of 63914

a double then a 2 year-consolidation (sideways) $2.35

called 8/10/13 $1.04

WMIH emerged from bankruptcy proceedings

as the successor to Washington Mutual, Inc

Seeking Alpha - A top Pick / ** posted article bottom of this post.

link to the web page

Website

Barchart Snapshot Opinion

Stock Watch recent trades

Technical Analysis Stock Ta

10-Q 11/6/2015

206,168,035 O/S

Headlines

Company Profile - WMIH Corp., through its subsidiary,

WM Mortgage Reinsurance Company, Inc., engages in reinsurance

business with respect to mortgage insurance in runoff mode.

The company was formerly known as WMI Holdings Corp and changed

its name to WMIH Corp. in May 2015. WMIH Corp. was founded in 1889

and is headquartered in Seattle, Washington.

Seeking AlphaTop Pick :

12/28/15

** WMIH is a SPAC controlled by KKR with $6B of NOLs.

Valuation uncertainty and dilution pessimism continues to devalue shares.

Preferred stock floor limits risk on common shares.

First M&A likely to yield 30% to 50% return.

12-month target: $3.60.

WMIH Corp. (NASDAQ:WMIH), formerly WMI Holdings, represents the reorganized remains of Washington Mutual's holding company following the 2008 seizure of the bank by the FDIC. In 2012, WMIH emerged from bankruptcy with approximately $75M of cash, $5.97B in NOLs, and ownership of a mortgage reinsurance subsidiary in run-off mode. Since then, WMIH has successfully executed two private equity raises with Citigroup (NYSE:C) and KKR (NYSE:KKR), raising over $600M to fund strategic acquisitions as a KKR-directed SPAC. In September 2015, the company completed its uplist to the NASDAQ.

Despite significantly outperforming the market since reemergence, WMIH shares continue to offer strong value for those willing to overlook valuation uncertainty and dilution pessimism. With its downside limited by a preferred stock conversion floor, WMIH appears poised to move substantially higher upon announcement of its first acquisition. Thanks in part to the track records of KKR and an improved board of directors, WMIH should be considered among an investor's top picks for 2016.

A Consistently Rising Valuation

Since emergence from bankruptcy in March 2012, WMIH shares have steadily increased in value, returning 142% to date, or 38% a year, on an annualized basis. At first, WMIH was valued by the bankruptcy court at just $210M on 200M shares, or $1.05/share. This valuation was exceedingly pessimistic as it assumed WMIH would only be able to utilize approximately $150M of its nearly $6B of NOLs, valuing them in total at just $.25/share, based on expert testimony. The experts, however, did not see the true value that KKR & Co. L.P did. In December 2013, the equity firm purchased preferred stock and warrants in WMIH that vaulted the company to a $365M valuation and set a floor price on the stock at $1.38/share based on the issued warrants. Since then, a further $600M capital injection by KKR and Citigroup again raised the company's prospects, to $735M based on 544M shares, and set a floor price of $1.75/share based on the Series B worst case conversion price.

The repeated improvement of the company's valuation and the following price spikes in WMIH are obvious signs that the market has consistent issues with properly valuing the company. This is largely because WMIH has no analyst coverage and that without ongoing operations the company's NOLs are difficult to properly value. This uncertainty creates a distinct buying opportunity. As it currently stands, WMIH is a cash rich shell corporation controlled by KKR as a special purpose acquisition company. Once the company makes its first acquisition and the valuation picture becomes much clearer, share prices will undoubtedly appreciate.

Evaluating WMIH's NOLs is a difficult process, but not impossible. Assuming a 35% corporate tax rate, the company's estimated $5.97B in NOLs is worth approximately $2.09B in savings. However, because WMIH will not be able to exhaust its NOLs overnight, they must be discounted for time value. This is where the valuation picture becomes muddy. Ultimately, I decided upon 7% for 11 years as a cautious approach that could see significant upside should WMIH be able to achieve faster than anticipated growth at less than expected interest rates. As it currently stands, junk bonds are yielding 6.3%. WMIH has issued preferred at 3% and drafted (but never issued) subordinated debt PIKs at 7.5%. Since WMIH's first acquisition will likely be a leveraged buyout shepherded by KKR, I expect the interest rate to be similar to junk yields and between 6% to 7%, though it could be possibly lower based on the Series B preferred rate. Additionally, WMIH would have only passed on $275M of additional PIK financing if it thought it could do better than a 7.5% rate.

As far as the time factor, 11 years is based in part on the expiration schedule for the company's NOLs which begin to lapse in 15 years. It is highly unlikely WMIH will allow the NOLs to go to waste. I expect WMIH to grow in a series of accretive acquisitions that will repeatedly raise the company's share price, allowing for further capital injections through additional equity issuances. With 3.5B shares authorized, WMIH is expecting to do a lot of growing.

Based on 11 years at 7%, WMIH's $5.97B in NOLs has an estimated value of $940.5M, a far cry from the bankruptcy expert testimony of $50M. This figure is also supported by Citigroup's and KKR's purchase of 57% of WMIH's then cash, NOLs, and WMMRC equity in December 2014 for $600M through the Series B preferred.

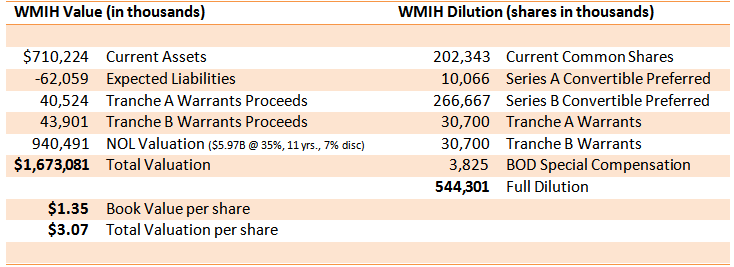

In total, pre-acquisition WMIH is worth approximately $1.7B based on a fully diluted share count of 544M or $3.07/share, a 27% upside based on WMIH's December 24 close.

Table 1: WMIH Valuation

M easured Risk, Exaggerated Reward

Despite being worth at least $3, WMIH shares continue to remain undervalued. With no history of earnings and only a promise of future revenue at an unknown time, the market continues to avoid WMIH. Additionally, fear over the amount of impending dilution also continues to depress the stock towards a worst-case scenario. In fact, based on current prices, the market is anticipating the company's first acquisition to be either overpriced or somehow otherwise punitive to the company. This is unlikely to be the case. After all, in April, the company's chairman of the board explicitly stated that they are looking exclusively for accretive acquisitions.

WMIH has already attempted one major deal that did not work out, the details of which remain limited. In October, WMIH reported participation in a competitive sale process for an operating division of a public company, but was unable to reach a definitive agreement, spending a massive $10.2M on due diligence in the process. Such a move clearly signals that WMIH is seeking a large-scale acquisition but also shows its willingness to walk away from overpaying, a solid display of fiscal prudence. Consequently, it is only a matter of time before WMIH attempts another large-scale acquisition, likely in the next six to nine months.

However, it would be imprudent for an investor not to consider the worst case. For WMIH, there are two built-in floor prices for the company, $2.25 and $1.75. $2.25 represents the maximum conversion price for the Series B preferred, a major support level for stock, and a price tested in the past months and held. The absolute worst case for WMIH is $1.75, which is the minimum conversion price for the Series B. Any price below that would mean that KKR and Citibank would lose money in the mandatory conversion process. Simply put, there is no way KKR and Citi would come into WMIH expecting to lose. Quite the opposite, KKR has a history of generating big returns.

In 2014, the equity firm closed the second half of a two-part sale of Alliance Boots to Walgreens, quadrupling its investment the process. In 2013, it returned nearly 500% on its leveraged buyout of Dollar General Corp. KKR missed big however in the energy sector on Texas utility TXU Corp. in 2014 and natural gas producer Samson Resources Corp. in 2015, signaling that huge returns with KKR are not a sure thing. Generally, equity firms aim to double their investors' money, meaning KKR may expect WMIH to achieve at least $4.50/share in the coming future.

A CashCall Catalyst

For NOL rich shell corporations, first acquisitions can be a major catalyst for share price appreciation. In January 2015, Impac Mortgage Holdings (NYSEMKT:IMH), which held NOLs totaling approximately $489M, acquired the mortgage operations of CashCall, Inc., turning Impac profitable. The stock gained as much as 356% in the following months and remains 275% ahead as of December 24. In October 2014, Signature Group, formerly Fremont General with $934M of NOLs, acquired the aluminum recycling operations of Aleris Corp. and became Real Industry (OTC:RELY), gaining as much as 76% during 2015, before pulling back to just a 11% gain to date.

Previous announcement news has resulted in big gains for WMIH. In December 2013, when WMIH released word of KKR's Series A purchase, shares appreciated by 50% in a single trading day. The following year in December, WMIH's announcement of its Series B sale pushed prices 24% higher the next day. Anticipation of repeated big news in December 2015 caused WMIH shares to seesaw heavily, appreciating as much as 20%, before ending 2% lower for the month on December 24.

Without acquisition news, share prices are likely to remain in the $2.25 to $2.40 range. However, once WMIH makes its first move, I anticipate shares to hit at least $3 as the market recognizes the company's NOL value, barring the deal being overly dilutive or the target involving a severe premium. I expect the news to break mid-2016.

Upwards Spiral

With $6B in NOLs to consume, WMIH is going to be closing a number of deals down the road. The first acquisition, however, will be the most important because it will signal to the market the company's ability to get the job done. Should the first deal prove positive for share prices, WMIH will be able to sell additional equity at terms that are more advantageous. Using this next round of capital, it could then pursue a second acquisition, resulting in a positive feedback loop. Consequently, as shares in WaMu continue to climb, its ability to use its NOL assets increases proportionally, making them more valuable, in turn increasing WMIH's underlying value.

Such has been the case for NOL shell ALJ Regional Holdings (OTCPK:ALJJ), which began in March 2013 with only $30M in cash and $176M in NOLs, trading then in the low 80 cent range. Over a series of three acquisitions beginning in September 2013, shares have moved repeatedly higher, yielding nearly 500% to date. ALJ's first acquisition, health care processor Faneuil, added an immediate 50% to share price, a possible example of what WMIH shareholders could expect if the company is able to execute on a smart acquisition.

WMIH's Chief Executive Officer, William C. Gallagher and Chief Operating Officer, Thomas L. Fairfield each have 1.8M reasons to do right by the company. Much of their compensation is built into an executive share grant worth $4.3M to each at today's prices. Good deal or bad, they both will be impacted as much as shareholders would by their first acquisition, giving them every reason to only make a move that will increase share value. Both were involved in the Capmark Financial restructuring which produced sizable gains for those involved before acquiring and becoming Bluestem Group (OTCPK:BGRP) in 2015.

Final Thoughts:

For the past 33 months, WMIH has amply rewarded investors willing to overlook the uncertainty surrounding the company's prospects and dig into its true value. However, despite all the progress made to date, WMIH shares continue to remain undervalued. This presents an uncommon opportunity that may disappear once the company makes its first acquisition. As a KKR SPAC, WMIH is likely to engage in a series of acquisitions overseen by the parent firm to consume its NOL assets. Ultimately, WMIH may be absorbed by KKR much like it did with KKR Financial in 2014. This leaves WMIH a special situation KKR play, one that will likely outperform both the market and the parent once all the pieces come together. Will 2016 be the breakout year?

(0)

(0) (0)

(0)