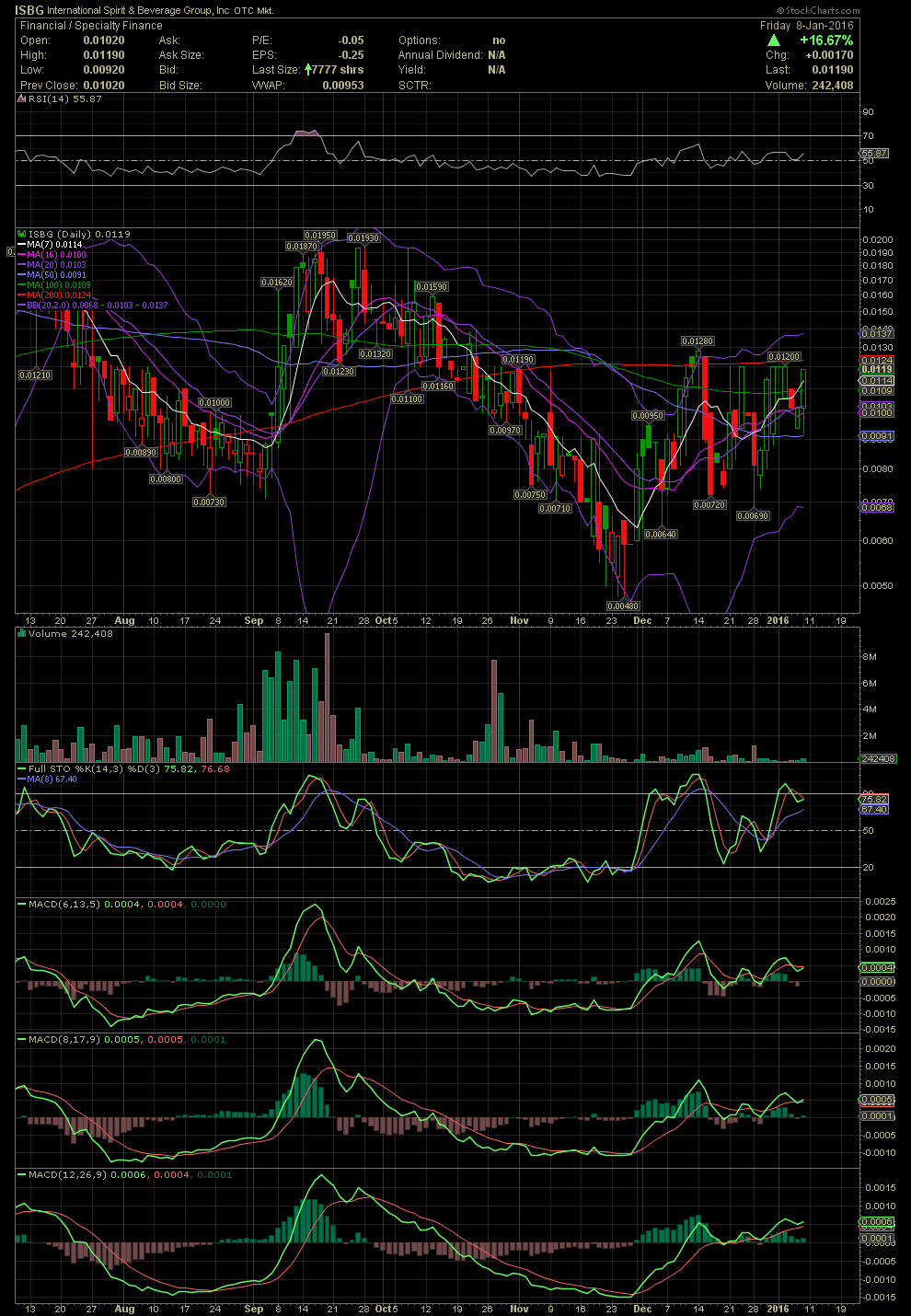

ISBG Daily Chart ~ Holding Just Under the MA200

Post# of 2561

My last post on ISBG was on Nov 22 when I believed the stock was not going to confirm a negative crossover of the 20 day MACD. As it turns out, that .007 live was the short term low (with the exception of a $18 trade at .0069 a week later. In the meantime, the stock has recovered to the .0119/.012 area which is just below the MA200 (red line). The company continues to execute, and despite the idiots on another board who have no clue what's going on with the company, my opinion is that ISBG will become a very profitable and exciting over time. Cavoda Vodka is into yet another production run, but the quantity is unknown to me. The first run was for 10,000 cases of six bottles per case and according to the company, that is almost sold out. The initial run of 5,000 cases of Besado was 100% sold out off the run.

Technically, there's not much to go by at the moment. I believe ISBG will be a fundamental play that will take time as management delivers. A break and close above .012 on volume would indicate the next leg is underway. The FullSto is near overbought levels, but the MACDs have plenty of room before entering their overbought territories. The lagging RSI indicator is gradually moving higher over the last three weeks. GLTA

http://investorshangout.com/post/view?id=3432756

(0)

(0) (0)

(0)